The India passive fire protection market is structurally driven by the strengthening and institutionalization of fire safety regulations anchored in the National Building Code (NBC) of India 2016, Part IV – Fire & Life Safety. Once a model guideline, NBC provisions are increasingly embedded into state fire acts, municipal building bye-laws, and approval processes for construction permits and occupancy certificates, transforming passive fire protection from a best practice into a compliance mandate. The April 2017 advisory by the Ministry of Housing & Urban Affairs urging states to adopt NBC 2016 reinforced its application during plan approvals and certifications. NBC Part IV prescribes minimum fire-resistance ratings, compartmentation norms, and structural fire protection requirements based on building height and occupancy. State legislations, such as the Maharashtra Fire Prevention and Life Safety Measures Act, explicitly mandate compliance with NBC standards, enhancing enforceability. As regulatory scrutiny intensifies, developers and asset owners are compelled to specify certified passive fire protection systems at both design and execution stages. This regulatory convergence ensures sustained, non-cyclical demand for compliant passive fire protection solutions across new construction and regulated retrofits.

Access Full Report @ https://www.databridgemarketresearch.com/reports/india-passive-fire-protection-market

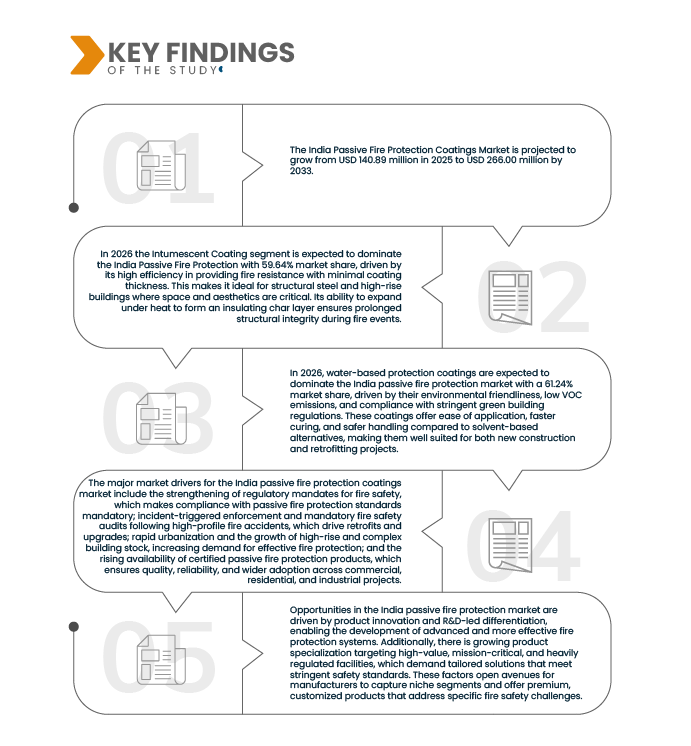

Data Bridge Market Research analyses that the India Passive Fire Protection Coatings Market is USD 266.00 Million by 2033 from USD 140.89 Million in 2025 growing at a CAGR of 8.4% during the forecast period of 2026 to 2033.

Key Findings of the Study

Incident-triggered enforcement drives and mandatory fire safety audits

A key driver of the India passive fire protection market is incident-triggered regulatory enforcement following high-profile fire accidents. Fatal fires in commercial, hospitality, and assembly occupancies routinely prompt swift responses from state governments and municipal authorities, including mass inspections, licence suspensions, temporary closures, and mandatory fire safety audits. These enforcement drives consistently expose deficiencies in fire compartmentation, protected exits, fire doors, and structural fire resistance, forcing owners to undertake rapid corrective measures. Recent actions in Goa, Delhi, Nagpur, and Kochi illustrate how post-incident scrutiny translates directly into compliance deadlines tied to continued operations. Such measures disproportionately stimulate retrofit demand, as existing buildings must be upgraded to meet prescribed fire and life safety norms. The recurring nature of these enforcement waves reinforces the importance of certified passive fire protection systems, making enforcement-led retrofits a sustained demand driver across urban India.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable from 2018-2024)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Product Type (Cementitious Material and Intumescent Coating), Technology (Water-Based Protection Coating and Solvent-Based Protection Coating), Price Range (Mass, Mid-Range and Premium), Application (Structural Steel Protection, Concrete Protection, Wood Substrates, HVAC/Ducts, Electric Cables, Storage Tanks & Vessels and Pipelines), Formulation (Epoxy, Acrylic, Cementitious, Alkyd and Polyurethane/Hybrid), End Use (Building & Construction, Oil and Gas, Automotive, Aerospace and Defense, Electrical and Electronics, Textile, Furniture, Infrastructure, Marine and Others), Distribution Channels (Indirect and Direct)

|

|

Market Players Covered

|

Kansai Nerolac Paints Limited, Akzo Nobel, NAVAIR International Pvt. Limited, Jotun, PPG Industries, Hempel, Carboline, SafeCoat Fire Solutions, The Sherwin-Williams Company, Etex Group, Feukem India Pvt. Ltd, Isolatek International (Newkem), Ugam Chemicals, Tremco CPG India (Nullifire), CharCoat

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The India Passive fire protection Market is segmented into seven notable segments based on the product type, technology, price range, application, formulation, end use and distribution channel.

On the basis of Product type, the India Passive fire protection Market is segmented into Intumescent Coating, Cementitious Material.

In 2026 The Intumescent Coating Segment Is Expected to Dominate the India Passive Fire Protection Market

In 2026 the intumescent coating segment is expected to dominate the India passive fire protection market with 59.64% market share, driven by its high efficiency in providing fire resistance with minimal coating thickness. This makes it ideal for structural steel and high-rise buildings where space and aesthetics are critical. Its ability to expand under heat to form an insulating char layer ensures prolonged structural integrity during fire events.

On the basis of Technology, the India passive fire protection market is segmented into Water-based Protection Coating, Solvent-based Protection Coating.

In 2026 Water-Based Protection Coating to Dominate the India Passive Fire Protection Market

In 2026, water-based protection coatings are expected to dominate the I passive fire protection market with a 61.24% market share, driven by their environmental friendliness, low VOC emissions, and compliance with stringent green building regulations. These coatings offer ease of application, faster curing, and safer handling compared to solvent-based alternatives, making them well suited for both new construction and retrofitting projects.

On the basis of Price Range, the India Passive fire protection Market is segmented into Mass, mid-range, Premium.

In 2026 The Mid-Range Segment Is Anticipated to Dominate The India Passive Fire Protection Market

In 2026, the mid-range segment is anticipated to dominate the India passive fire protection market with a 50.39% market share, as it offers an optimal balance between cost and performance, making it accessible across commercial, residential, and industrial projects. This segment delivers reliable fire-resistance performance and compliance with building codes without the high costs associated with premium solutions, while offering better quality and durability than mass-market options. Its affordability, combined with growing adoption in urban infrastructure and mid-tier construction projects, is driving strong demand and market penetration.

On the basis of Application, the India Passive fire protection Market is segmented Structural Steel Protection, Concrete Protection, Wood Substrates, HVAC/Ducts, Electric Cables, Storage Tanks & Vessels, Pipelines.

In 2026 The Structural Steel Protection Segment Is Anticipated to Dominate the India Passive Fire Protection Market

In 2026, the structural steel protection segment is anticipated to dominate the passive fire protection market with a 49.51% market share, driven by the widespread use of steel in high-rise buildings, industrial facilities, and infrastructure projects where maintaining structural integrity during fire incidents is critical. Intumescent and cementitious coatings for steel offer high fire-resistance ratings, prolonged structural stability, and minimal thickness requirements, making them ideal for space-constrained applications.

On the basis of Formulation, the India Passive fire protection Market is segmented into Epoxy, Acrylic, Cementitious, Alkyd, Polyurethane/Hybrid.

In 2026 The Epoxy Segment Is Anticipated to Dominate the India Passive Fire Protection Market

In 2026, the epoxy segment is anticipated to dominate the India passive fire protection market with a 39.46% market share, driven by its excellent adhesion, chemical resistance, and mechanical strength, which make it highly effective for protecting structural steel, concrete, and industrial surfaces against fire. Epoxy-based fire protection coatings deliver durable, long-lasting performance in harsh environments and can be combined with intumescent or cementitious formulations to enhance fire-resistance ratings. Their versatility, ease of application, and compatibility with multiple substrates are driving strong adoption across commercial, industrial, and infrastructure projects in India.

On the basis of End user, the India Passive fire protection Market is segmented into Building & Construction, Oil and Gas, Automotive, Aerospace and Defense, Electrical and Electronics, Textile, Furniture, Infrastructure, Marine, Others.

In 2026, The Building & Construction Segment Is Anticipated to Dominate the India Passive Fire Protection Market

In 2026, the building & construction segment is anticipated to dominate the India passive fire protection market with a 42.32% market share, driven by the rapid growth of office complexes, shopping malls, hotels, and mixed-use developments in urban areas. These structures require strict compliance with fire safety codes, high fire-resistance ratings for structural steel and concrete, and effective compartmentation to ensure occupant safety. Increasing awareness of life-safety regulations, combined with high-rise construction trends and the retrofitting of existing buildings, is driving strong adoption of passive fire protection solutions across the commercial sector.

On the basis of Distribution channel, the India Passive fire protection Market is segmented into Indirect and Direct.

In 2026 The Indirect Segment Is Anticipated To Dominate The India Passive Fire Protection Market

In 2026, the indirect segment is anticipated to dominate the India passive fire protection market with a 60.50% market share, as most projects rely on distributors, contractors, and system integrators to supply, install, and maintain fire protection solutions. This channel enables manufacturers to reach a wider customer base across diverse regions and project types without directly managing on-site operations. Additionally, indirect channels provide technical support, training, and compliance assistance, ensuring proper application and adherence to fire safety standards, which drives higher adoption and market penetration.

Major Players

Data Bridge Market Research analyzes Kansai Nerolac Paints Limited, Akzo Nobel, NAVAIR International Pvt. Limited, Jotun, PPG Industries, Hempel, Carboline, SafeCoat Fire Solutions, The Sherwin-Williams Company, Etex Group, Feukem India Pvt. Ltd, Isolatek International (Newkem), Ugam Chemicals, Tremco CPG India (Nullifire), CharCoat

Market Developments

- In December, 2025, AkzoNobel extended its marine coatings partnership with Winning Shipping in China to accelerate the industry’s transition to sustainable shipping. The expanded collaboration, ongoing since 2016, will supply international coatings for six drydocking projects in 2026, enhancing fleet efficiency and reducing environmental impact. Central to the agreement is Intersleek 1100SR, the world’s first biocide-free fouling control coating with “slime release” technology, reducing hull resistance, fuel use, and greenhouse gas emissions. The project will also use Intercept 8500 LPP antifouling coatings for deep-sea vessels. The partnership supports China’s “Dual Carbon” strategy and IMO emission reduction goals, advancing sustainable maritime operations.

- In November 2025, Akila announced a strategic partnership with Jotun Group to deploy a unified energy-intelligence layer across Jotun's production facilities worldwide. This program represents one of the most significant global energy-intelligence initiatives undertaken by Akila to date, establishing asset-level monitoring and portfolio-wide optimization from the outset — and positioning Jotun to unlock measurable savings across its global network. Akila announced a strategic partnership with Jotun Group to deploy a unified energy-intelligence layer across Jotun's production facilities worldwide. This program represents one of the most significant global energy-intelligence initiatives undertaken by Akila to date, establishing asset-level monitoring and portfolio-wide optimization from the outset — and positioning Jotun to unlock measurable savings across its global network.

- In January, 2020, Kansai Nerolac Paints Limited (KNPBL) announced its expansion into Bangladesh at a press conference held at the International Convention City Bashundhara (ICCB), attended by top officials including MD Harishchandra Bharuka, ED Anuj Jain, and CEO Vishal Mothreja. The company plans to launch a full range of Coil, Powder, Automotive, Marine, and Protective coatings, aiming to boost local employment and production efficiency. KNPBL offers products tailored to different customer budgets, with renowned cricketer Tamim Iqbal as its brand ambassador.

- In December 2024, Nullifire launched "A Guide to Specification and Design for Firestopping" to simplify passive fire protection processes amid evolving building regulations. This helps architects and contractors apply passive fire protection correctly, reducing errors and safety risks. This strengthens the company’s reputation, boosts customer confidence, and promotes wider adoption of its certified fire‑stopping products.

As per Data Bridge Market Research analysis:

For more detailed information about Passive fire protection Coatings Market click here – https://www.databridgemarketresearch.com/reports/india-passive-fire-protection-market