The pet population in Mexico has experienced significant growth, rising from 24.7 million in 2016 to 32.2 million in 2021. Within this period, the dog population reached 22.5 million, while the number of cats increased to 6.3 million. This surge in pet ownership is driving strong demand for a wide range of pet care products, including food, grooming supplies, healthcare solutions, toys, and accessories. The growth is especially noticeable in urban and semi-urban areas, where more pet owners are contributing to an expanding consumer base. As pet ownership continues to rise, the need for specialized, high-quality pet products has intensified, with an increasing number of pet owners becoming more aware of the importance of health, nutrition, and overall well-being for their pets.

This has led to a shift toward premium, organic, and innovative offerings, further propelling the growth of the pet care industry. The continuous rise in pet numbers serves as a primary driver for market expansion, prompting product diversification, technological innovations, and a greater emphasis on sustainable pet care solutions.

Access Full Report @ https://www.databridgemarketresearch.com/reports/mexico-pet-care-products-market

Data Bridge market research analyzes that The Mexico Pet Care Products Market is expected to reach USD 7.37 billion by 2032 from USD 4.58 billion in 2024, growing with a substantial CAGR of 6.2% in the forecast period of 2025 to 2032.

Key Findings of the Study

Expansion of Public Veterinary Clinics Enhancing Pet Care Accessibility

The establishment of public, free veterinary clinics across Mexico has significantly enhanced the pet care ecosystem by making veterinary services more accessible to a wider population. These clinics reduce the financial burden of pet healthcare, making it easier for families, particularly in lower- and middle-income groups, to adopt and care for pets. As a result, more households are bringing pets into their lives, fostering greater responsibility among owners regarding their pets' health and well-being. With veterinary services becoming more widely available, pet owners are increasingly focused on responsible care, including purchasing high-quality food, grooming products, hygiene supplies, and supplements. Regular interactions with veterinary professionals are not only addressing immediate health concerns but also raising awareness about proper nutrition, preventive care, and overall pet wellness. This shift in awareness is influencing consumer behavior, leading to a higher demand for premium and nutritionally balanced pet products.

Moreover, the integration of more pet owners into formal veterinary systems is strengthening Mexico's pet care infrastructure, creating more opportunities for brands and retailers. By encouraging responsible pet ownership and improving care standards, the growth of public veterinary clinics is directly contributing to the rising demand for pet care products and services, driving market expansion and product innovation in the country.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Product (Pet Food, Pet Services, Veterinary Care, Pet Shampoo, Pharmaceuticals, Mouth Care), Companion Animal (Dogs, Cats, Birds, Fishes, Horses, Rabbits, Others), Distribution Channel (Offline, Online)

|

|

Countries Covered

|

Mexico

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, porter’s five force analysis, brand outlook, consumer buying behavior, climate change scenario, innovation tracker and strategic analysis, patent analysis, raw material coverage, supply chain analysis, technological advancements, value chain analysis, vendor selection criteria, and pricing analysis.

|

Segment Analysis

The Mexico Pet Care Products Market is segmented into three notable segments based on product, companion animal, distribution channel.

- On the basis of product, the market is segmented into pet food, pet services, veterinary care, pet shampoo, pharmaceuticals, mouth care.

In 2025, the pet food segment is expected to dominate the market

In 2025, the pet food segment is expected to dominate the market with a market share of 76.33% due to their growing pet population, rising awareness about pet nutrition, and an increasing preference for premium and specialized pet foods. This demand is further fueled by changing consumer behavior, with more pet owners prioritizing health, quality, and tailored nutrition for their pets. The pet food segment’s dominance is also driven by the rising popularity of both dry and wet food options, catering to diverse pet needs.

Additionally, snacks and treats are gaining traction, as pet owners seek healthier and more indulgent options for their pets. The shift toward natural, organic, and functional pet foods is also contributing to the growth of the pet food segment. Pet owners are becoming more conscious of the ingredients in pet food, leading to a surge in demand for high-quality, nutritious options that cater to specific dietary needs, such as grain-free, hypoallergenic, or age-specific formulas. Moreover, innovations in pet food, such as freeze-dried, raw, and high-protein diets, are further driving consumer interest.

- On the basis of companion animal, the market is segmented into dogs, cats, birds, fishes, horses, rabbits, others.

In 2025, the dogs segment is expected to dominate the market

In 2025, dogs segment dominates the market with a market share of 51.71% due to their status as the most popular companion animal in the country. The increasing adoption of dogs in urban and semi-urban areas, along with the rising awareness among Mexican pet owners about proper pet care and nutrition, is driving this trend. Additionally, the availability of specialized products tailored for dogs, including premium food, grooming supplies, and healthcare solutions, contributes to the growing demand.

- On the basis of distribution channel, the market is segmented into offline and online.

In 2025, the offline segment is expected to dominate the market

In 2025, the offline segment is expected to dominate the market with a market share of 72.34% as traditional retail stores, pet specialty shops, and veterinary clinics continue to be the preferred shopping destinations for pet owners in Mexico. The physical presence of these stores allows consumers to interact with products directly, receive expert advice, and make immediate purchases. Additionally, the strong presence of established pet care retailers and brands in offline channels reinforces this dominance.

Major Players

Mars, Incorporated, Nestlé, Hill's Pet Nutrition, Inc., ADM, SESAJAL, among others.

Market Developments

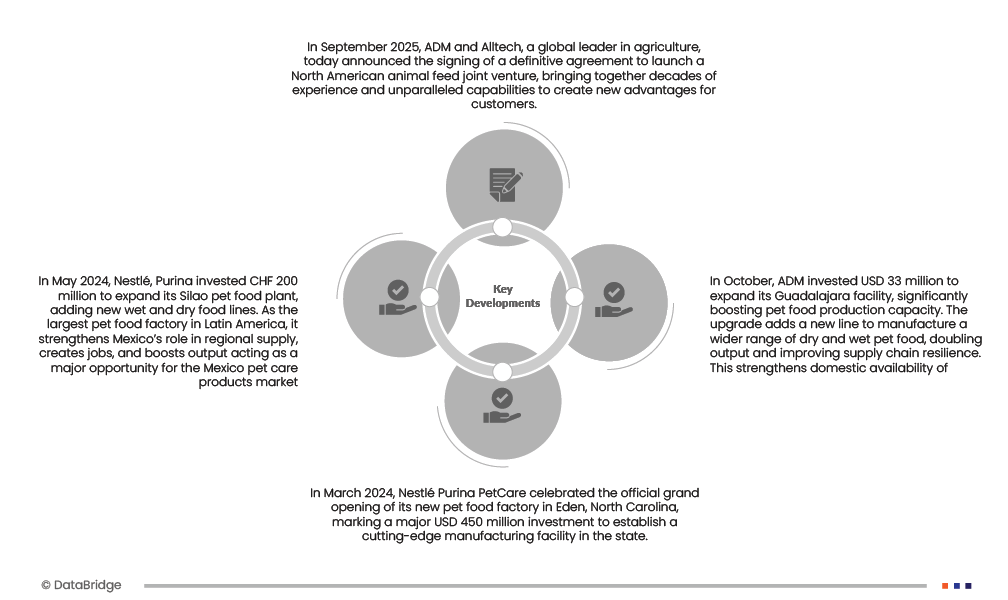

- In September 2025, ADM and Alltech, a global leader in agriculture, today announced the signing of a definitive agreement to launch a North American animal feed joint venture, bringing together decades of experience and unparalleled capabilities to create new advantages for customers.

- In May 2024, Nestlé, Purina invested CHF 200 million to expand its Silao pet food plant, adding new wet and dry food lines. As the largest pet food factory in Latin America, it strengthens Mexico’s role in regional supply, creates jobs, and boosts output acting as a major opportunity for the Mexico pet care products market

- In October 2023, ADM invested USD 33 million to expand its Guadalajara facility, significantly boosting pet food production capacity. The upgrade adds a new line to manufacture a wider range of dry and wet pet food, doubling output and improving supply chain resilience. This strengthens domestic availability of premium pet nutrition, acting as a key opportunity for the Mexico pet care products market.

For more detailed information about the Mexico Pet Care Products Market report, click here – https://www.databridgemarketresearch.com/reports/mexico-pet-care-products-market