As more individuals become aware of the importance of balanced diets, nutrient intake, and long-term health, they are actively seeking food options that support a healthy lifestyle. Frozen fruits and vegetables have emerged as a practical and reliable choice, offering high nutritional value, longer shelf life, and year-round availability without compromising on quality.

Consumers today are more informed about the benefits of vitamins, minerals, fiber, and antioxidants found in fruits and vegetables. With rising rates of lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions, the inclination toward healthier food choices has become stronger. Frozen produce, often harvested and flash-frozen at peak ripeness, retains essential nutrients and freshness, making it a valuable alternative to fresh produce, especially in urban areas where access to fresh fruits and vegetables may be limited or inconsistent. In addition, the perception of frozen fruits and vegetables as clean-label, additive-free, and minimally processed options supports their increasing popularity among health-conscious consumers. As plant-based and vegetarian diets continue to gain momentum, frozen produce becomes a staple in households aiming for healthier eating patterns.

Access Full Report @ https://www.databridgemarketresearch.com/reports/north-america-frozen-fruit-and-vegetables-mix-market

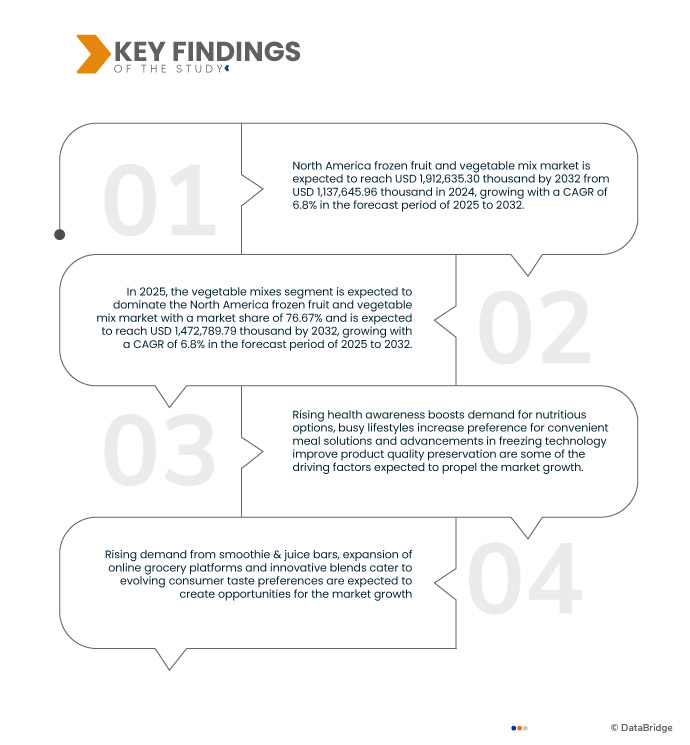

Data Bridge market research analyzes that North America Frozen Fruit and Vegetable Mix Market is expected to reach USD 1,912,635.30 thousand by 2032 from USD 1,137,645.96 thousand in 2024, growing with a CAGR of 6.8% in the forecast period of 2025 to 2032.

Key Findings of the Study

Busy Lifestyles Increase Preference for Convenient Meal Solutions

In today's fast-paced world, consumers are increasingly juggling demanding work schedules, family responsibilities, and social obligations, leaving limited time for meal planning and preparation. As a result, there is a rising preference for convenient, time-saving food options that do not compromise on nutrition or taste. Frozen fruits and vegetables fit perfectly into this lifestyle shift, offering a quick and easy solution to maintain healthy eating habits without the need for washing, peeling, chopping, or frequent grocery shopping.

Frozen produce helps consumers eliminate preparation time while ensuring year-round availability of seasonal fruits and vegetables. Whether added to smoothies, used in stir-fries, or incorporated into soups and salads, frozen options offer versatility, consistency, and minimal waste. This convenience factor is particularly appealing to urban dwellers, working professionals, college students, and young families who seek efficient meal solutions aligned with their health goals. Additionally, frozen fruits and vegetables are often flash-frozen at their peak ripeness, preserving nutrients andflavor, which appeals to health-conscious individuals seeking nutritious alternatives to processed or takeout foods. The growth of single-serve packs and pre-mixed blends further supports quick meal assembly and portion control, aligning with the demand for on-the-go and ready-to-use formats.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD thousand

|

|

Segments Covered

|

By Product Type (Fruit Mixes, Vegetable Mixes and Mixed Fruit & Vegetable Blends), By Technology (IQF, Blast Frozen, Cryogenic Frozen, Fluidized Bed, Isochoric Freezing and Others), By Product Category (Raw Frozen, Steam Blanched then IQF, Raw IQF, Grilled then IQF, Roasted then IQF, Marinated or Coated Frozen, Sauce Included Frozen Mixes, Parboiled then Frozen, Rehydrated then Frozen, Pre-Seasoned then IQF and Others), By Form (whole, sliced, diced, halves, pureed, minced, mashed, crumbled, spiralized, julienned, crushed, zested, granulated, coated, and others ), By Category (conventional and organic ), By Source (conventional, hydroponic, regenerative agriculture sourced, vertical farm based, biodynamic, and others ), By Labeling & Certification (Non-GMO Verified, Gluten Free, Kosher, Halal, Vegan, Fair Trade Certified, Clean Label, Pesticide Free, Allergen Free and Others), By Packaging Format (Pouch, Vacuum Sealed, Single Serve Cubes, Bulk Institutional Pack, Multi Compartment Tray, Bag in Box, Club Store Bulk Bag, Retail Brick Pack, Pouch with Window and Plastic Tubs), By Packaging Size (Retail Packaging Sizes and Foodservice/Institutional Packaging Sizes), By Shelf Life (≤6 Months, 6-9 Months, 9-12 Months, 12-15 Months, 15-24 Months and >24 Months), By Application (Retail Consumer Use, Foodservice (HORECA), Meal Kit Companies, Foodservice Industry, Baby Food Manufacturers, Nutritional Supplements Manufacturers, Institutional Kitchens, Retail Fresh Frozen Combo Packs and Others), By Distribution Channel (B2B, B2C (Store-Based, Non-Store-Based))

|

|

Countries Covered

|

U.S., Canada, Mexico

|

|

Market Players Covered

|

Ardo, Wawona Frozen Foods, Titan Frozen Fruit, Earthbound Farm, Dole Packaged Foods Llc, Nature’s Touch, Sunopta, Jr Simplot Company, Oregon Fruit Company, Greenyard, Scenic Fruit Company, Stahlbush Island Farms, Milne Fruit Products, Alasko, Fruit D'or.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

North America frozen fruit and vegetable mix market is categorized into twelve notable segments which are based on the product type, Technology, Product category, Form, Category, Source, Labelling and Certifications, Packaging format, Packaging size, Shelf life, Application, Distribution channel.

- On the basis of type, the North America frozen fruit and vegetable mix market is segmented into fruit mix and vegetable mix.

In 2025, the vegetable mixes segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the vegetable mixes segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 76.67%, due to their high demand in smoothies, desserts, and breakfast applications, growing consumer preference for convenient and healthy food options, and year-round availability across retail and foodservice channels. The extensive use of berry, tropical, and citrus blends continues to drive demand within North America’s evolving health-focused and convenience-driven food landscape.

- On the basis of technology, the North America frozen fruit and vegetable mix market is segmented into Individually Quick Frozen (IQF), Blast frozen, cryogenic frozen, fluidized bed, isochoric freezing, and others.

In 2025, the IQF segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the IQF segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 49.24%, due to its ability to preserve the nutritional quality, texture, and taste of fruits and vegetables while preventing clumping and enabling easy portioning. IQF technology is widely adopted across processing facilities and by manufacturers to ensure product consistency and extended shelf life, supporting its growing use in retail, foodservice, and industrial applications within North America’s evolving frozen food landscape.

- On the basis of product category, the North America frozen fruit and vegetable mix market is segmented into Raw IQF, Steam Blanched Then IQF, Roasted Then IQF, Grilled Then IQF, Marinated Or Coated Frozen, Raw Frozen, Pre Seasoned Then IQF, Sauce Included Frozen Mixes, Parboiled Then Frozen, Rehydrated Then Frozen, and Others.

In 2025, the raw IQF segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the raw IQF segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 27.19%. due to its minimal processing, preservation of nutritional content, and growing consumer preference for clean-label and additive-free products. The demand for raw frozen fruit and vegetable mixes continues to increase across retail and foodservice channels in North America, supporting convenient, healthy meal preparation within the evolving frozen food landscape.

- On the basis of form, the North America frozen fruit and vegetable mix market is segmented into whole, sliced, diced, halves, pureed, minced, mashed, crumbled, spiralized, julienned, crushed, zested, granulated, coated, and others.

In 2025, the whole segment is expected to dominate the North America frozen fruit and vegetable mix market with a market

In 2025, the whole segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 25.06%.

- On the basis of category, the North America frozen fruit and vegetable mix market is segmented into conventional and organic.

In 2025, the conventional segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the conventional segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 79.26%.

- On the basis of source, the North America frozen fruit and vegetable mix market is segmented into conventional, hydroponic, regenerative agriculture sourced, vertical farm based, biodynamic, and others.

In 2025, the conventional segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the conventional segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 50.98%.

- On the basis of labeling & certification, the North America frozen fruit and vegetable mix market is segmented into clean label, non-GMO verified, vegan, gluten free, pesticide free, allergen free, kosher, halal, fair trade certified, and others.

In 2025, the clean label segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the clean label segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 20.31%.

- On the basis of packaging format, the North America frozen fruit and vegetable mix market is segmented into pouch, vacuum sealed, bulk institutional pack, multi compartment tray, bag in box, single serve cubes, club store bulk bag, retail brick pack, pouch with window, and plastic tubs.

In 2025, the pouch segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the pouch segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 35.14%.

- On the basis of packaging size, the North America frozen fruit and vegetable mix market is segmented into retail packaging sizes and foodservice/institutional packaging sizes.

In 2025, the retail packaging sizes segment isexpected to dominate the North America frozen fruit and vegetable mix market

In 2025, the retail packaging sizes segment isexpected to dominate the North America frozen fruit and vegetable mix market with a market share of 74.51%.

- On the basis of shelf life, the North America frozen fruit and vegetable mix market is segmented into ≤ 6 months, 6–9 months, 9–12 months, 12–15 months, 15–24 months, and ≥ 24 months.

In 2025, the 9–12 months segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the 9–12 months segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 35.16%.

- On the basis of application, the North America frozen fruit and vegetable mix market is segmented into retail consumer use, Foodservice (HORECA), meal kit companies, foodservice industry, baby food manufacturers, nutritional supplements manufacturers, institutional kitchens, retail fresh frozen combo packs, and others.

In 2025, the retail consumer use segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the retail consumer use segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 54.32%,

- On the basis of distribution channel, the North America frozen fruit and vegetable mix market is segmented into B2B and B2C.

In 2025, the B2C segment is expected to dominate the North America frozen fruit and vegetable mix market

In 2025, the B2C segment is expected to dominate the North America frozen fruit and vegetable mix market with a market share of 69.67%.

Major Players

The Major Companies Providing Products In The North America Frozen Fruit And Vegetable Mix Market Are Ardo, Wawona Frozen Foods, Titan Frozen Fruit, Earthbound Farm, Dole Packaged Foods Llc, Nature’s Touch, Sunopta, Jr Simplot Company, Oregon Fruit Company, Greenyard, Scenic Fruit Company, Stahlbush Island Farms, Milne Fruit Products, Alasko, Fruit D'or, Among Others.

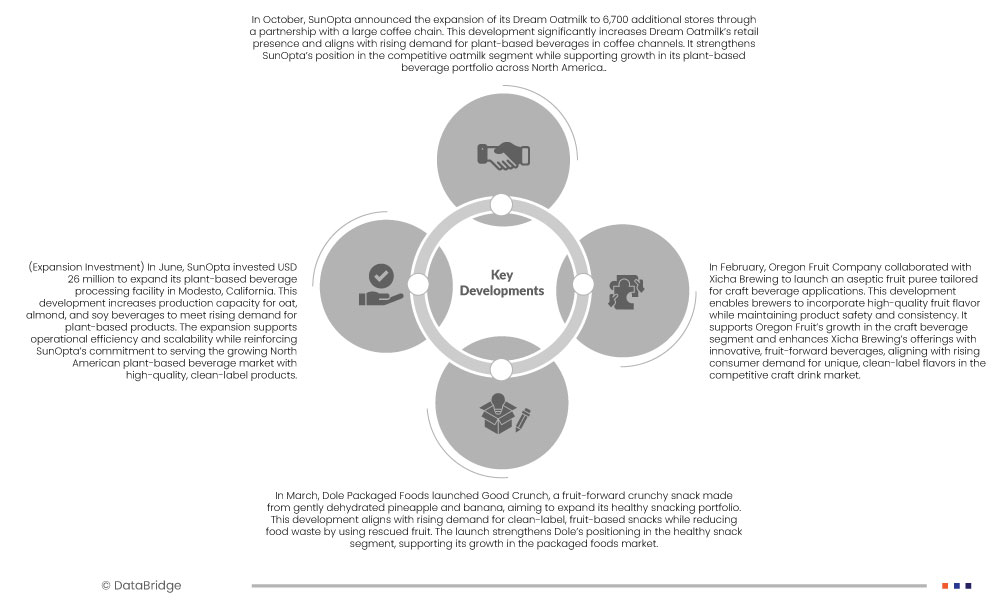

Market Developments

- In October 2024, SunOpta announced the expansion of its Dream Oatmilk to 6,700 additional stores through a partnership with a large coffee chain. This development significantly increases Dream Oatmilk’s retail presence and aligns with rising demand for plant-based beverages in coffee channels. It strengthens SunOpta’s position in the competitive oatmilk segment while supporting growth in its plant-based beverage portfolio across North America.

- In June 2024, SunOpta invested USD 26 million to expand its plant-based beverage processing facility in Modesto, California. This development increases production capacity for oat, almond, and soy beverages to meet rising demand for plant-based products. The expansion supports operational efficiency and scalability while reinforcing SunOpta’s commitment to serving the growing North American plant-based beverage market with high-quality, clean-label products.

- In March2023, Dole Packaged Foods launched Good Crunch, a fruit-forward crunchy snack made from gently dehydrated pineapple and banana, aiming to expand its healthy snacking portfolio. This development aligns with rising demand for clean-label, fruit-based snacks while reducing food waste by using rescued fruit. The launch strengthens Dole’s positioning in the healthy snack segment, supporting its growth in the packaged foods market.

- In February2024, Oregon Fruit Company collaborated with Xicha Brewing to launch an aseptic fruit puree tailored for craft beverage applications. This development enables brewers to incorporate high-quality fruit flavor while maintaining product safety and consistency. It supports Oregon Fruit’s growth in the craft beverage segment and enhances Xicha Brewing’s offerings with innovative, fruit-forward beverages, aligning with rising consumer demand for unique, clean-label flavors in the competitive craft drink market.

- In May 2025, Dot Foods Announces New All-In-One Product Content Solution that helps suppliers author and enhance data to comply with GDSN standards and serve their customers. Dot Data Services also provides distributors and operators access to product content and tools to maintain it. ew solution is part of Dot’s ongoing commitment to meeting the needs of our business partners and our evolving industry.

As per Data Bridge Market Research analysis:

For more detailed information about the North America Frozen Fruit and Vegetable Mix Market report, click here – https://www.databridgemarketresearch.com/reports/north-america-frozen-fruit-and-vegetables-mix-market