Urbanization and population growth are major forces shaping the demand for architectural coatings in the Philippines. The rapid increase in housing requirements, expansion of urban centers, and surge in commercial infrastructure projects have created sustained demand for decorative and protective coatings across both residential and non-residential segments. Rising disposable incomes, government infrastructure programs, and private sector investments have further accelerated construction activities—driving consistent market expansion for paints and coatings manufacturers.

Access Full Report @ https://www.databridgemarketresearch.com/reports/philippines-architectural-coatings-market

For instance,

- In February 2024, Crown Asia – A Vista Land Company cited data from the Philippine Statistics Authority (PSA) indicating that the country’s construction industry expanded by 8.5% year-on-year, driven by strong growth in private residential developments and public infrastructure projects under ongoing government programs.

- In February 2025, the Philippine Institute for Development Studies (PIDS) highlighted data from the Department of Human Settlements and Urban Development (DHSUD) showing that the Philippines currently faces a housing deficit of over 6.5 million units, which could rise to nearly 10 million by 2030 if interventions remain limited. This persistent housing gap underscores a sustained growth opportunity for residential construction materials, particularly architectural paints and coatings.

- In May 2024, according to RIDERS DIGEST PHILIPPINES 2024, The “Build Better More” infrastructure program launched by the government covers over 194 priority projects, including transport terminals, bridges, airports, and government facilities, all of which require protective and decorative coatings.

- In August 2025, Colliers Philippines reported a steady increase in commercial real estate developments—particularly in Metro Manila, Cebu, and Davao—with over 1.5 million square meters of office space projected for completion between 2024 and 2026.

- In July 2022, according to Building Resilience of the urban poor in the Philippines report of the Asian Development Bank (ADB) highlighted that urbanization in the Philippines has reached nearly 52% of the total population, and this figure continues to rise as rural populations migrate to cities for better economic opportunities.

The rising housing demand and growing urban population have not only increased the consumption of coatings for new construction but also for repainting and renovation of existing structures. Moreover, the boom in mixed-use developments and eco-friendly construction is driving demand for low-VOC, weather-resistant, and sustainable coating formulations.

Thus, the combined momentum of urbanization, housing development, and a robust commercial construction pipeline is a critical factor propelling the growth of the Philippines architectural coatings market, fostering opportunities for both local and international manufacturers to expand their production and distribution capacities across the country.

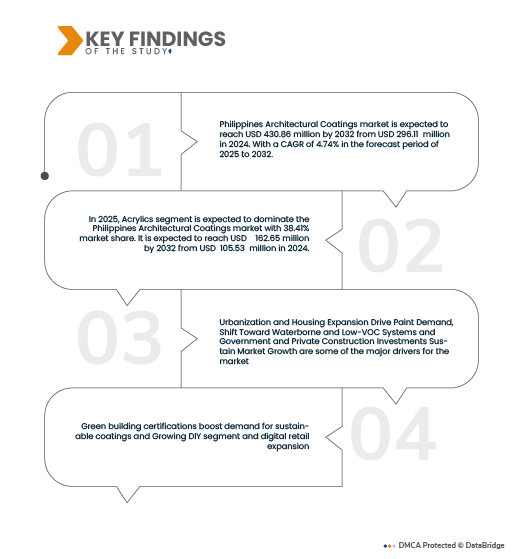

Key Findings of the Study

Shift Toward Waterborne and Low-Voc Systems

The architectural coatings market in the Philippines is undergoing a significant transition toward waterborne, low-odor, and low-VOC (volatile organic compound) paint systems. This shift is driven by stricter environmental regulations, increased health awareness among consumers, and a growing commitment from the construction sector toward sustainable development. Both residential and commercial end-users are prioritizing coatings that promote better indoor air quality, offer faster drying times, and minimize environmental impact. These evolving preferences are influencing product innovation and shaping new market standards across the industry.

For instance,

- In October 2024, according to the World Health Organization (WHO), poor indoor air quality contributes significantly to urban health risks in Southeast Asia, prompting stricter guidelines for indoor environments.

- In November 2023, according to The Asian Development Bank (ADB) has highlighted air quality improvement and pollution reduction as key priorities in Philippine cities like Metro Manila and Cebu, influencing green material choices across the building sector.

Environmental regulations and green building policies are also strengthening the market shift. The Department of Environment and Natural Resources (DENR), through the Philippine Clean Air Act (RA 8749), promotes the reduction of VOC emissions from paints and coatings. At the same time, green building certification programs like BERDE (Building for Ecologically Responsive Design Excellence) and EDGE (Excellence in Design for Greater Efficiencies) reward projects using low-VOC materials to improve indoor air quality and sustainability.

For instance,

- In July 2023, according to upropertyph, the Philippine Green Building Council (PhilGBC) reported that over 65% of BERDE-certified projects now specify water-based and low-VOC coatings in their materials list.

- In August 2024, Major developers like Ayala Land, SM Prime Holdings, and Megaworld have publicly committed to ESG-driven construction standards that Favor eco-labeled paints for compliance and brand differentiation.

Industry players are responding with innovation by expanding eco-friendly product lines and investing in new water-based resin technologies.

For instance,

- In May 2021, according to Boysen, its KNOxOUT recognized by the Philippine Green Building Council (2024) as the first air-purifying paint reducing NOx gases by up to 20% in high-traffic areas like EDSA.

- In June 2025, Nippon Paint Odour-less AirCare certified by Singapore Green Label and marketed in the Philippines for indoor health-conscious consumers.

Rapid urbanization and institutional demand further accelerate this trend, as developers and organizations specify low-VOC coatings to reduce disruption and comply with health and safety standards.

For instance,

- In in August 2025, Colliers Philippines reported that commercial property developers increasingly specify eco-labeled paints to align with LEED and BERDE certifications for upcoming office towers and mixed-use developments.

- Educational institutions and healthcare facilities, such as St. Luke’s Medical Center and Ateneo de Manila University, have transitioned to low-odor, water-based interior paints to ensure safe indoor air quality during renovation projects.

On a global scale, Philippine manufacturers are aligning with international chemical and environmental standards to enhance export competitiveness and environmental safety.

For instance,

- In June 2024, the ISO 11890-2:2020/Amd.1:2024 revision standardized determination of VOC content in paints and varnishes, prompting many Asian manufacturers—including Philippine producers—to update laboratory testing and formulation protocols for export markets.

The shift toward waterborne, low-odor, and low-VOC coatings is transforming the Philippines architectural coatings market from a niche segment into a mainstream movement. Regulatory pressure, sustainability goals, and health-conscious consumers are jointly accelerating this change. Manufacturers focusing on green chemistry, certification compliance, and ongoing innovation will secure a competitive advantage as eco-efficiency and safety become essential to brand credibility and market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2035

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

By Resin Type (Acrylics, Vinyl Acrylics and VAE, Alkyds, Polyurethanes, Epoxies, Silicone and Siloxane, Others), Technology (Solventborne, Waterborne, UV-Curable, Powder Coatings (Architectural), High-Solids/Other Emerging), Application (Interior, Exterior), End Use (Roads And Highways, Railways And Ballast Stabilization, Retaining Walls and Steep Slopes, Airport Runways and Aprons, Landfill And Waste Containment, Ports, Marine, And Coastal, Mining Haul Roads and Yards and Others), End Use (Residential, Commercial, Institutional, Industrial Building (Light Industrial and Warehouses), Others), Finish & Sheen (Flat and Matte, Eggshell, Satin, Semi-Gloss, Textured and Stone-Finish, High-Gloss, Metallic and Effects, Others), Distribution Channel(Indirect and Direct)

|

|

Countries Covered

|

Philippines

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include Porter’s five forces analysis, Rand Outlook, Pestle analysis, Technological Advancements, Profit Margin Scenario, , Value Chain Analysis, Pricing Analysis.

|

Segment Analysis

The Philippines Architectural Coatings market is segmented into six notable segments based on the Resin Type, technology, application, End Use, Finish and Sheen and Distribution Channel.

- On the basis of Resin Type, the market is segmented into Acrylics, Vinyl Acrylics and VAE, Alkyds, Polyurethanes, Epoxies, Silicone and Siloxane and Others.

In 2025, the Acrylics segment is expected to dominate the market

In 2025, the Acrylics segment is expected to dominate the Philippines Architectural Coatings market with the market share of 38.41%, due to its excellent durability, color retention, and weather resistance, making it ideal for both interior and exterior applications. Additionally, the growing demand for low-VOC and waterborne formulations, along with cost-effectiveness and ease of application, further strengthens its dominance in the Philippines architectural coatings market.

- On the basis of technology, the Philippines architectural coatings market is segmented into Solventborne, Waterborne, UV-Curable, Powder Coatings (Architectural), and High-Solids/Other Emerging technologies.

In 2025, the Solventborne segment is expected to dominate the market

In 2025, the Solventborne segment is expected to dominate the Philippines Architectural Coatings market with the market share of 47.87%, due to its superior adhesion, durability, and resistance to harsh weather conditions compared to waterborne and powder coatings. Its ability to provide a smooth, high-gloss finish and quick drying time makes it ideal for industrial and automotive applications.

- On the basis of application, the Philippines Architectural Coatings market is segmented into Interior and Exterior

In 2025, the Interior segment is expected to dominate the market

In 2025, the Interior is expected to dominate the Philippines Architectural Coatings market with the market share of 60.20 due to rising demand for decorative and protective coatings in residential and commercial buildings. Increasing renovation activities, aesthetic preferences, and the need for moisture, stain, and abrasion-resistant coatings are driving the adoption of high-performance interior coating solutions.

- On the basis of End Use, the Philippines Architectural Coatings market is segmented into Residential, Commercial, Institutional, Industrial Building (Light Industrial and Warehouses) and Others

In 2025, the Residential segment is expected to dominate the market

In 2025, the Residential segment is expected to dominate the Philippines Architectural Coatings market with the market share of 47.75%, due to the rapid growth in housing development, increasing urbanization.

- On the basis of Finish and Sheen, the Philippines Architectural Coatings market is segmented into Flat and Matte, Eggshell, Satin, Semi-Gloss, Textured and Stone-Finish, High-Gloss, Metallic and Effects and Others.

In 2025, the Flat and Matte is expected to dominate the market

In 2025, the Flat and Matte Flute segment is expected to dominate the Philippines Architectural Coatings market with the market share of 27.74%, due to its superior ability to hide surface imperfections, smooth finish, and increasing preference in modern interior designs for its elegant and non-reflective appearance.

- On the basis of Distribution Channel, the Philippines Architectural Coatings market is segmented into Indirect and Direct.

In 2025, the Indirect segment is expected to dominate the market

In 2025, the Indirect segment is expected to dominate the Philippines Architectural Coatings market with the market share of 59.20%, due to its superior ability to hide surface imperfections, smooth finish, and increasing preference in modern interior designs for its elegant and non-reflective appearance.

Major Players

Pacific Paint (Boysen) Philippines, Inc. ( Philippines), NIPPONPAINT Co., Ltd. ( Japan), PPG Industries (U.S.), Inc., AkzoNobel Paints (Netherlands), Jotun (Norway) and others.

Latest Developments in Philippines Architectural Coatings market

- In February 2024, Crown Asia – A Vista Land Company cited data from the Philippine Statistics Authority (PSA) indicating that the country’s construction industry expanded by 8.5% year-on-year, driven by strong growth in private residential developments and public infrastructure projects under ongoing government programs.

- In May 2024, according to RIDERS DIGEST PHILIPPINES 2024, The “Build Better More” infrastructure program launched by the government covers over 194 priority projects, including transport terminals, bridges, airports, and government facilities, all of which require protective and decorative coatings.

- The shift toward waterborne, low-odor, and low-VOC coatings is transforming the Philippines architectural coatings market from a niche segment into a mainstream movement. Regulatory pressure, sustainability goals, and health-conscious consumers are jointly accelerating this change. Manufacturers focusing on green chemistry, certification compliance, and ongoing innovation will secure a competitive advantage as eco-efficiency and safety become essential to brand credibility and market growth.

- In September 2023, the Department of Budget and Management (DBM) announced a record PHP 1.42 trillion allocation for infrastructure spending under the “Build Better More” program, representing 5.3% of GDP, covering 194 priority projects nationwide including bridges, airports, and housing complexes that directly contribute to coatings consumption.

As per Data Bridge Market Research analysis:

Geographically, the country covered in the Philippines Architectural Coatings market report is Philippines.

Luzon is the dominating region in Philippines Architectural Coatings market

Luzon is the leading region in the Philippines Architectural Coatings market, driven by rapid urbanization, robust construction activities, and strong demand from residential, commercial, and infrastructure projects. The region benefits from a high concentration of industrial zones, expanding real estate developments, and a growing middle-class population, which collectively boost consumption of decorative and protective coatings.

Makati, Taguig, Pasigis expected to be the fastest growing city in Philippines Architectural Coatings market

Architectural Coatings market during the forecast period, supported by increasing construction and renovation activities, rapid commercial expansion, and rising adoption of sustainable and high-performance coatings. These key urban centers within Metro Manila continue to experience strong demand driven by high-density residential developments, premium office spaces, mixed-use projects, and ongoing infrastructure upgrades.

For more detailed information about the Philippines Architectural Coatings market report, click here – https://www.databridgemarketresearch.com/reports/philippines-architectural-coatings-market