The growth of the Mexico tractor market is being significantly influenced by government-backed farm mechanization initiatives aimed at enhancing agricultural productivity and efficiency. Various programs and policy frameworks, including Producción para el Bienestar and rural credit support schemes, have been implemented to promote the adoption of modern farming equipment. Through these initiatives, subsidies, financial assistance, and training programs are being extended to farmers to encourage the transition from traditional manual practices to mechanized operations. As a result, tractor penetration across medium and large-scale farms in Mexico is being steadily increased, fostering greater modernization within the country’s agricultural sector.

For Instance,

- As announced by the Secretaría de Agricultura y Desarrollo Rural (SADER) in March 2024, the government allocated over MXN 16 billion under the Producción para el Bienestar program to support small and medium farmers through direct subsidies and equipment financing, thereby promoting tractor adoption and farm mechanization across rural Mexico.

- As stated by the Government of Jalisco in October 2024, the state launched its Programa de Apoyo a la Mecanización Agrícola, providing partial subsidies for the purchase of new tractors and implements, reflecting regional efforts to modernize farming and strengthen agricultural output through mechanized cultivation.

- As reported by the Mexican Ministry of Agriculture in August 2023, the expansion of the MasAgro initiative introduced localized mechanization service hubs across eight agricultural states, providing access to two- and four-wheel tractors for smallholder farmers and enhancing productivity in staple crop production

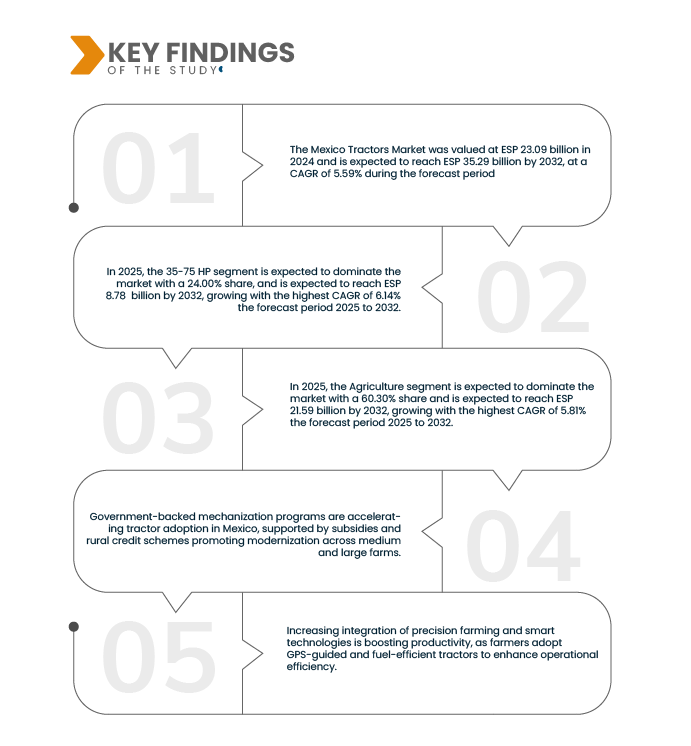

Government-backed mechanization programs are playing a crucial role in accelerating tractor adoption across Mexico. By offering subsidies, credit support, and state-level assistance, these initiatives are enabling farmers to modernize operations and improve productivity. Continued policy support is expected to sustain tractor demand and strengthen Mexico’s transition toward efficient, technology-driven agriculture.

Access Full Report @ https://www.databridgemarketresearch.com/reports/mexico-tractors-market

Data Bridge market research analyzes that The Mexico Tractors Market is expected to reach ESP 35.28 billion by 2032 from ESP 23.09 billion in 2024, growing with a substantial CAGR of 5.59% in the forecast period of 2025 to 2032.

Key Findings of the Study

Rising demand for higher yields and export orientation

The growing emphasis on improving crop yields and strengthening Mexico’s agricultural export competitiveness is significantly driving tractor demand. As the country expands its production of high-value crops such as fruits, vegetables, and grains for export to the United States, Canada, and Europe, farmers are increasingly adopting modern tractors to enhance productivity and operational efficiency. Mechanized farming practices are being prioritized to meet international quality standards, reduce labor dependency, and maximize output per hectare, positioning Mexico as a key player in global agri-trade.

For instance,

- As reported by Secretaría de Agricultura y Desarrollo Rural (SADER) in November 2023, Mexico’s agri-food exports reached USD 39.7 billion in the first nine months of 2023—marking the highest export value in 31 years thereby driving farmers to adopt more mechanised equipment, including tractors, to meet rising export-scale production.

- As cited in an August 2023 report by the U.S. Department of Agriculture’s Economic Research Service (ERS), Mexico’s horticultural exports particularly tomatoes, strawberries, and cucumbers from major producing states accounted for 63.5% of total U.S. vegetable imports in 2021. This strong export orientation highlights Mexico’s growing focus on large-scale, mechanized cultivation to enhance productivity and meet international demand, thereby supporting increased tractor adoption.

- As cited by the U.S. Department of Commerce’s Country Commercial Guide in November 2023, U.S. exports of agricultural equipment to Mexico — including high-horsepower tractors and harvesting machinery — rose to around USD 1.5 billion in 2021, supporting the surge in export-oriented crop production and thereby driving tractor demand

The rising emphasis on achieving higher crop yields and strengthening Mexico’s agricultural export competitiveness has intensified the need for efficient and modern farming practices. This trend is fostering greater reliance on tractors and other mechanized equipment to enhance productivity, ensure timely cultivation, and meet international quality standards. Consequently, the pursuit of export-oriented growth continues to act as a pivotal driver for tractor demand across Mexico’s agricultural landscape.

The increasing adoption of precision agriculture and advanced tractor technologies is reshaping Mexico’s agricultural landscape by enhancing efficiency, productivity, and resource optimization. Farmers are increasingly leveraging GPS-enabled tractors, telematics, and data-driven solutions to achieve precise field operations, reduce input wastage, and improve overall yield quality. Supported by technological innovation and government initiatives promoting digital transformation in agriculture, the integration of smart farming practices is driving a steady shift toward modern, technology-equipped tractors across the country

For instance,

- As reported by International Journal of Horticulture in June 2024, Mexican farms are increasingly deploying GPS-enabled tractors, unmanned aerial vehicles (UAVs) and sensor-based monitoring systems for crop health and soil mapping, reflecting a shift toward precision agriculture-driven operations and thereby boosting demand for advanced tractors.

- As noted on the tech news site TecScience in September 2024, México’s agricultural sector has seen a rise in adoption of telematics-equipped tractors and variable-rate application systems—especially for irrigation and fertilizer use on high-value crops—signalling that advanced tractor technology is increasingly being embraced across key production regions.

The increasing adoption of precision agriculture and advanced tractor technologies in Mexico underscores the nation’s gradual transition toward data-driven, efficient, and sustainable farming. As farmers face mounting pressure to enhance productivity and optimize resource use, the integration of GPS-guided tractors, telematics, and smart implements is reshaping field operations. Supported by both private sector innovation and regional government initiatives promoting digitalization in agriculture, this technological shift is expected to significantly elevate operational efficiency and strengthen Mexico’s position in modern mechanized farming.

High purchase costs combined with limited access to affordable credit and financing options remain major barriers to tractor adoption in Mexico. A large share of small and medium-scale farmers continue to operate under tight financial constraints, making it difficult to invest in new machinery despite the clear benefits of mechanization. While government-backed credit programs and agricultural banks exist, their reach is often limited, especially in rural and remote regions. This financial gap continues to restrict fleet modernization and slows the overall pace of mechanization in the Mexican agricultural sector.

For instance,

- As noted by the digital-finance platform Verqor in March 2025, more than 90 % of Mexican farmers lack access to formal financing, constraining their ability to purchase tractors and mechanized equipment.

- According to the credit-line transaction signed by Inter‑American Development Bank (IDB) for Mexico’s rural agricultural sector in October 2024, only 2.5 % of small-scale producers secured any type of bank loan in 2022, reflecting severely limited financing for equipment purchases.

High tractor costs and limited financing access remain key barriers to mechanization in Mexico. Many small farmers struggle to secure affordable loans, restricting equipment upgrades. Expanding rural credit access and subsidy programs will be essential to accelerate tractor adoption and boost agricultural productivity.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2033

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

By Horse Power Category (20-35HP, 35-75HP, 75-100HP, 100-140HP, 140 and over), By Drive Mechanism (Two-Wheel-Drive, Four-Wheel-Drive, All-Wheel-Drive), By Application (Agriculture, Construction and infrastructure, Mg and Quarry, Utility & Urban Maintenance, Railway Maintenance, Waste Management & Landfills), By Engine Type (internal Combustion Engine (ICE), Electric, Hybrid), By Operating Weight (Light Duty, Medium Duty, Heavy Duty)

|

|

Countries Covered

|

Mexico

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include Porter’s five forces analysis, Pestle analysis, Supply Chain Analysis, Brand outlook, Raw Material Coverage, Pricing Analysis.

|

Segment Analysis

The Mexico Tractors Market is segmented into five notable segments based horse power category, drive mechanism, application, engine type, operating weight.

- On the basis of horse power category, the Mexico Tractor Market is segmented into 20–35 HP, 35–75 HP, 75–100 HP, 100–140 HP, and 140 HP & Above.

In 2025, the 35–75 HP segment is expected to dominate the market

In 2025, the 35-75 HP segment is expected to dominate the market with a 24.00% share, supported by affordability, ease of operation, and high suitability for small and medium-sized farms. This segment is favored by farmers for light-duty agricultural tasks, offering efficient performance and lower maintenance costs across Mexico’s diverse agricultural landscape.

- On the basis of Application, the Mexico Tractors Market is categorized Agriculture, Construction and Infrastructure, Mining and Quarring, Utility & Urban Maintenance, Railway Maintenance, and Waste Management & Landfills.

In 2025, the Agriculture segment is expected to dominate the market

. In 2025, the Agriculture segment is expected to dominate the market with a 60.30% share, supported by widespread use of tractors for plowing, tilling, planting, and harvesting activities. The segment’s leadership is further supported by the affordability and accessibility of agricultural tractors, along with government programs promoting farm mechanization and improved credit availability for small and medium farmers.

- On the basis of engine type, the Mexico Tractors Market is segmented into Internal Combustion Engine (ICE), Electric, and Hybrid

In 2025, the Internal Combustion Engine (ICE) segment is expected to dominate the market

In 2025, the Internal Combustion Engine (ICE) segment is projected to dominate the market with a 93.11% share, driven by proven reliability, high power output, and cost-effectiveness compared to emerging alternatives. The widespread availability of diesel and gasoline infrastructure, coupled with lower upfront costs and strong aftermarket service networks, continues to support the dominance of ICE tractors across both agricultural and non-agricultural applications.

- On the basis of drive mechanism, the Mexico Tractors Market is segmented into Two-Wheel-Drive, Four-Wheel-Drive, All-Wheel-Drive

In 2025, the Two-Wheel-Drive segment is expected to dominate the market

In 2025, the Two-Wheel-Drive segment is expected to dominate the market with a 93.16% share, primarily due to its affordability, ease of maintenance, and suitability for light to medium agricultural operations. These tractors are widely preferred by small and medium-scale farmers for routine field tasks such as tilling, hauling, and plowing, especially in regions with relatively flat terrains. Their lower ownership costs, fuel efficiency, and availability of local service networks further strengthen their adoption across rural areas of Mexico.

- On the basis of operating weight, the Mexico Tractors Market is segmented into Light Duty, Medium Duty, and Heavy Duty.

In 2025, the Light Duty is expected to dominate the market

In 2025, the Light Duty segment is expected to dominate the market with a 78.63% share, primarily due to its affordability, versatility, and suitability for small- to mid-scale agricultural operations. Light duty tractors are widely used for tasks such as plowing, tilling, mowing, and material transport on small farms and orchards. Their compact design, fuel efficiency, and ease of maneuverability make them particularly attractive for regions with limited landholding sizes and narrow field layouts. The segment also benefits from increasing mechanization among smallholder farmers, availability of financing options, and growing adoption of entry-level tractors across rural Mexico.

Major Players

Deere & Company (U.S.), CNH Industrial N.V. (U.K.), KUBOTA Corporation (Japan), Farmtrac (India), LOVOL Corporation (China), AGCO Corporation (Massey Ferguson) (U.S.), Tractors and Farm Equipment Limited (India), McCormick (Parent Company- Argo Tractors S.p.A.) (Italy), Mahindra&Mahindra (India), Solis (China), Sonalika (India), Zoomlion (China),YTO Group (China) and others.

Latest Developments in Mexico Tractors Market

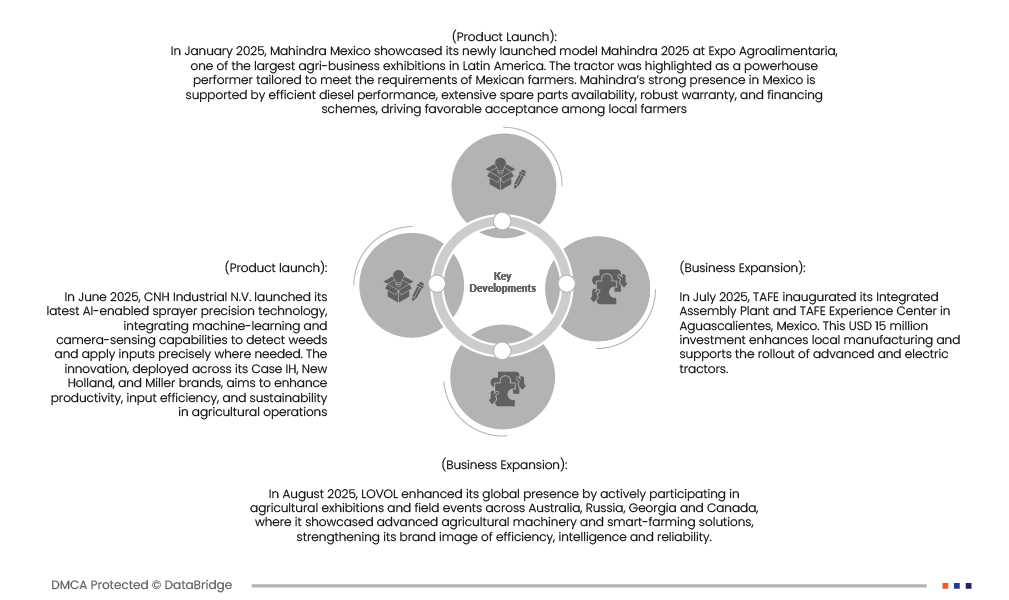

- In October 2025, Lovol showcased its new-energy tractor series and China’s first smart-agriculture AI-model at the China International Agricultural Machinery Exhibition (CIAME) in Wuhan, demonstrating its commitment to intelligence, electrification, and full-chain smart-agriculture solutions.

- In September 2025, the McCormick X8.634 VT-Drive, introduced, is the flagship tractor model delivering 340 HP with advanced VT-Drive transmission and the innovative Clever Cab for enhanced operator comfort and visibility. This model combines power, cutting-edge technology, and comfort, positioning it as a leading contender for the Tractor of the Year 2026 award.

- In September 2025, AGCO announced a €54 million investment at its AGCO Power plant to expand production of low-emission engines, reinforcing its commitment to sustainable, high-efficiency powertrains.

- In August 2025, TAFE opened a MXD 280 million tractor assembly plant in Aguascalientes aimed at boosting assembly capacity, creating 300+ jobs, and producing electric tractors aligned with Mexico’s sustainable mobility goals.

- In January 2025, Mahindra Mexico showcased its newly launched model Mahindra 2025 at Expo Agroalimentaria, one of the largest agri-business exhibitions in Latin America. The tractor was highlighted as a powerhouse performer tailored to meet the requirements of Mexican farmers. Mahindra’s strong presence in Mexico is supported by efficient diesel performance, extensive spare parts availability, robust warranty, and financing schemes, driving favorable acceptance among local farmers.

As per Data Bridge Market Research analysis:

Geographically, the country covered in the Mexico Tractors Market report is Mexico.

Mexico (Estado de México) is the dominating region in Mexico Tractors Market

Mexico (Estado de México) is expected to dominate the Mexico Tractors Market, accounting for the largest revenue share of 10.35% in 2025. This dominance is attributed to rapid urban development, large-scale infrastructure projects, and strong residential and commercial construction activity across the region. The presence of major industrial zones, expanding retail hubs, and sustained government investment in infrastructure modernization further strengthens Estado de México’s position as the key growth center in the country’s tractors market

Chihuahua is expected to be the fastest growing region in Mexico Tractors Market

The Chihuahua Tractor Market is anticipated to witness steady growth, underpinned by expanding agricultural activities, increasing investment in irrigation infrastructure, and rising adoption of advanced farming equipment. The region’s strong focus on crop diversification, particularly in grains and horticulture, along with government incentives promoting farm mechanization, is driving consistent demand for tractors. Additionally, improvements in rural logistics, access to financing options, and the growing presence of local dealerships and service networks are expected to further support market expansion in Chihuahua over the forecast period.

For more detailed information about the Mexico Tractors Market report, click here – https://www.databridgemarketresearch.com/reports/mexico-tractors-market