The dental aligners market refers to orthodontic treatment solutions that use a series of clear, removable aligners to gradually correct tooth misalignment, spacing, crowding, and bite-related issues. These aligners are custom-fabricated using digital scanning, 3D imaging, and computer-aided design technologies to ensure precise fit and controlled tooth movement. Treatment services typically include digital impression taking, treatment planning, aligner manufacturing, periodic monitoring, and post-treatment retention, delivered through dental clinics, orthodontic practices, and increasingly via direct-to-consumer platforms under professional supervision. The market for dental aligners encompasses product-based and service-oriented offerings that provide access to clear aligner therapy across aesthetic and functional orthodontic applications. Market growth is driven by rising demand for discreet and comfortable orthodontic solutions, increasing awareness of dental aesthetics, technological advancements in digital dentistry, and growing adult orthodontic adoption. Key participants include established orthodontic companies, dental service organizations, and emerging direct-to-consumer brands operating across private clinics, hospitals, and specialized dental centers.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-dental-aligners-market

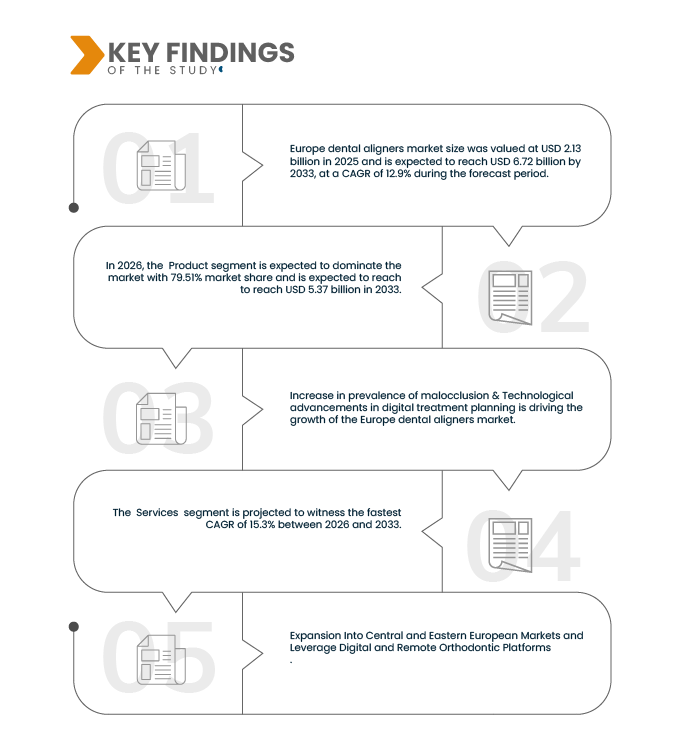

Data Bridge Market Research analyzes that the Europe Dental Aligners Market is expected to reach 6.72 billion by 2033 from USD 2.137 billion in 2025, growing at a substantial CAGR of 12.9% in the forecast period of 2026 to 2033.

Key Findings of the Study

Increase in Prevalence of Malocclusion

Occlusion refers to the alignment and contact relationship between the upper and lower teeth. Any deviation from normal alignment is termed malocclusion, a condition characterized by improper positioning of teeth and an incorrect relationship between the maxillary and mandibular dental arches. Common forms of malocclusion include overcrowding, spacing issues, overbites, underbites, and crossbites, which often lead to functional bite problems. In European patients, misalignment of upper teeth may result in cheek or lip biting, while lower dental misalignment frequently causes tongue irritation and discomfort.

Malocclusion is widely recognized as one of the most prevalent oral conditions, following dental caries and periodontal disease. Across Europe, malocclusion is often regarded as a natural biological variation rather than a disease, with treatment decisions influenced by functional needs, long-term oral health considerations, and psychosocial factors such as facial aesthetics and self-confidence. Evidence from European studies highlights notable geographic and ethnic variations in malocclusion prevalence, reflecting differences in genetics, dietary patterns, and access to orthodontic care, which collectively support sustained demand for orthodontic and clear aligner treatments across the region.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Year

|

2024 (Customizable 2018-2024)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

By Product and Services (Product, Services), By Design (Attachments, Trimline, Power Ridges, Cut-outs, Bite Ramps, Others), By Application (Crowded Teeth, Overbite, Underbite, Diastema, Open Bite, Misaligned Primary Teeth, Others), By Population Type (Pediatrics, Adults), By End User (Stand Alone Practices, Group Practices, Hospitals, Home Care Settings, Others), By Distribution Channel (Direct, Indirect, Others), By Country (Germany, U.K., France, Italy, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, Denmark, Norway, Finland, Sweden, Rest of Europe).

|

|

Region Covered

|

Europe

|

|

Market Players Covered

|

Align Technology, Inc., Institut Straumann AG, Envista, Solventum, Dentsply Sirona, SMILE2IMPRESS SL, DENTAURAM GmbH & Co. KG, Straight Teeth Direct, ODS Aligners, DB Orthodontics Limited, Wondersmile, Clear Moves Aligners, TP Orthodontics, Inc., Orthocaps, Angel Aligner, ALIGNERCO, Alliance-HNI Health Care Services, K Line Europe GmbH, Shanghai Smartee Denti-Technology Co., Ltd., ALS Dental and, among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

Europe Dental Aligners market is categorized into six notable segments which are based on Product and Services, Design, Application, Population Type, End User, Distribution Channel.

- On the basis of Product and Services, Europe Dental Aligners market is segmented into Product, Services, the Product segment is further sub segmented into Clear Aligners, Ceramic Braces, Clear Retainers, Lingual Braces, the Clear Aligners segment is further sub segmented into Polyurethane (PU), Polyethylene Terephthalate Glycol-Modified (PET-G), Polycarbonate (PC), Polypropylene (PP), Others, the Ceramic Braces segment is further sub segmented into Polycrystalline Alumina, Monocrystalline Alumina (Sapphire), Zirconia-Reinforced Ceramic, Ceramic-Metal Composite, the Clear Retainers segment is further sub segmented into Polyurethane (PU), Polyethylene Terephthalate Glycol-Modified (PET-G), Polypropylene (PP), Polycarbonate (PC), Multilayer Thermoplastic Sheets, the Lingual Braces is further sub segmented into Stainless Steel, Titanium Alloy, Cobalt-Chromium Alloy, Gold Alloy.

In 2026, the Product segment is expected to dominate the market

In 2026, the Product segment is expected to dominate with 79.51% due to strong patient preference for clear aligner systems over traditional orthodontic appliances and their widespread availability across dental and orthodontic clinics. Advanced aligner products offer improved comfort, aesthetics, and predictable treatment outcomes, driving higher adoption among both adults and adolescents. European dental professionals increasingly favor technologically advanced aligner solutions supported by digital treatment planning and efficient manufacturing capabilities.

- On the basis of Design, the Europe Dental Aligners market is segmented into Attachments, Trimline, Power Ridges, Cut-outs, Bite Ramps, Others.

In 2026, the Attachments segment is expected to dominate the market

In 2026, the Attachments segment is expected to dominate with 45.63% market share due to its essential role in enabling precise and controlled tooth movements across a wide range of orthodontic cases. Attachments enhance aligner grip and force application, allowing effective correction of complex malocclusions, rotations, and vertical movements that cannot be achieved with aligners alone.

- On the basis of Applications, the Europe Dental Aligners market is segmented into Crowded Teeth, Overbite, Underbite, Diastema, Open Bite, Misaligned Primary Teeth, Others. In 2026, the Crowded Teeth segment is expected to dominate with 35.91% market share

- On the basis of Population Type, the Europe Dental Aligners market is segmented into Pediatrics, Adults, the Adults segment is further sub segmented into At-Home Aligners, In-Office Aligners. In 2026, Pediatrics segment is expected to dominate with 35.48% market share.

- On the basis of end user, the Europe Dental Aligners market is segmented into Stand Alone Practices, Group Practices, Hospitals, Home Care Settings, Others. In 2026, Stand Alone Practices segment is expected to dominate with 63.78% market share

- On the basis of distribution channel, the Europe Dental Aligners market is segmented into direct, indirect, Others. In 2026, the direct segment is expected to dominate the with 45.13% market share

Major Players

Data Bridge Market Research analyzes Align Technology, Inc., Institut Straumann AG, Envista, Solventum, Dentsply Sirona as the major market players of the market.

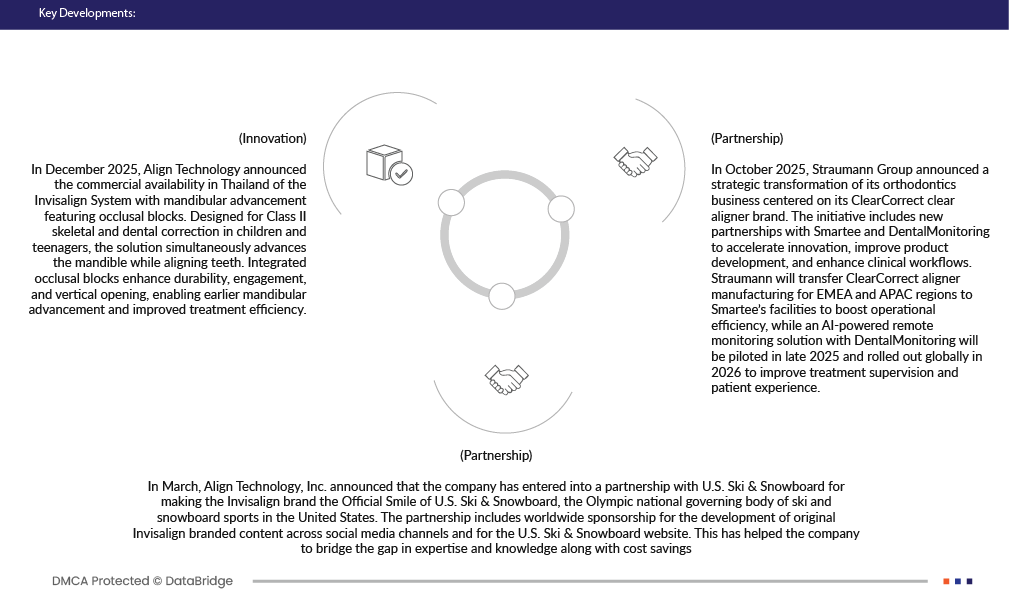

Market Development

- In December 2025, Align Technology announced the commercial availability in Thailand of the Invisalign System with mandibular advancement featuring occlusal blocks. Designed for Class II skeletal and dental correction in children and teenagers, the solution simultaneously advances the mandible while aligning teeth. Integrated occlusal blocks enhance durability, engagement, and vertical opening, enabling earlier mandibular advancement and improved treatment efficiency.

- In October 2025, Straumann Group announced a strategic transformation of its orthodontics business centered on its ClearCorrect clear aligner brand. The initiative includes new partnerships with Smartee and DentalMonitoring to accelerate innovation, improve product development, and enhance clinical workflows. Straumann will transfer ClearCorrect aligner manufacturing for EMEA and APAC regions to Smartee’s facilities to boost operational efficiency, while an AI-powered remote monitoring solution with DentalMonitoring will be piloted in late 2025 and rolled out Europely in 2026 to improve treatment supervision and patient experience.

- In November 2022, Ormco has launched Spark Clear Aligners Release 13, introducing significant clinical and software enhancements designed to improve orthodontic diagnosis, treatment planning, and workflow efficiency. Release 13 incorporates three major innovations: Integrated Hooks, which are built directly into the aligners to provide a durable alternative to traditional elastic cutouts for Class II, Class III, and gummy smile corrections; the CBCT TruRoot™ Feature, enabling clinicians to replace generic library root models with a patient’s actual root anatomy from cone beam computed tomography (CBCT) scans for more precise visualization and movement planning; and Real Time Approval in the Spark Approver software, allowing orthodontists to add, modify, or delete aligner features such as attachments, ramps, and hooks without needing change requests, thereby streamlining the approval process and reducing turnaround time. These enhancements collectively provide clinicians with greater control, flexibility, and efficiency throughout the aligner treatment process.

- On March 8, 2024, 3M’s Board of Directors formally approved the planned spin-off of its Health Care business into a newly independent public company, Solventum Corporation, marking a strategic milestone in the company’s ongoing portfolio transformation. Under the approved plan, 3M shareholders of record as of March 18, 2024 will receive one share of Solventum common stock for every four shares of 3M common stock held, with the distribution scheduled to occur prior to the opening of trading on April 1, 2024.

- In October 2023, Dentsply Sirona announced the launch of the SureSmile Simulator, a new application within its DS Core digital platform designed to help dental professionals show patients a 3D visualization of their potential smile outcome with SureSmile® Aligner treatment before therapy begins. This tool uses AI-driven modeling and intraoral scans (e.g., from Primescan) to create visual simulations in just minutes, enabling clearer communication about treatment expectations and helping patients make more confident, informed decisions about starting aligner therapy.

For more detailed information about the Europe Dental Aligners Market report, click here – https://www.databridgemarketresearch.com/reports/europe-dental-aligners-market