Bangladesh’s industrial landscape has expanded rapidly over the past decade, driving significant growth in trucking demand as rising manufacturing output, large-scale construction, and expanding regional trade increase the movement of raw materials, intermediate goods, and finished products across key economic corridors. The development of economic zones, industrial parks, and logistics hubs—along with growing clusters of factories in Gazipur, Narayanganj, Chattogram, Cumilla, and Rajshahi—has sharply increased inter-district cargo flows, prompting fleet owners to diversify and scale capacity. This momentum is reinforced by major infrastructure improvements such as the Padma Bridge and upgraded national highways, which have enhanced connectivity, reduced travel time, and enabled manufacturers to widen distribution networks. At the same time, rapid urbanization in cities like Dhaka, Chattogram, Gazipur, and Sylhet continues to fuel domestic consumption, boosting demand for frequent deliveries of consumer goods, construction materials, and essentials. Recent briefings—from the Bangladesh Planning Commission (March 2024), Ministry of Industries (August 2024), and BAFFA (January 2025)—collectively highlight rising freight movement, growing investment in manufacturing, and improved logistics efficiency. Together, these structural shifts make growing domestic trade and industrialization a powerful force shaping Bangladesh’s trucking market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/bangladesh-trucking-market

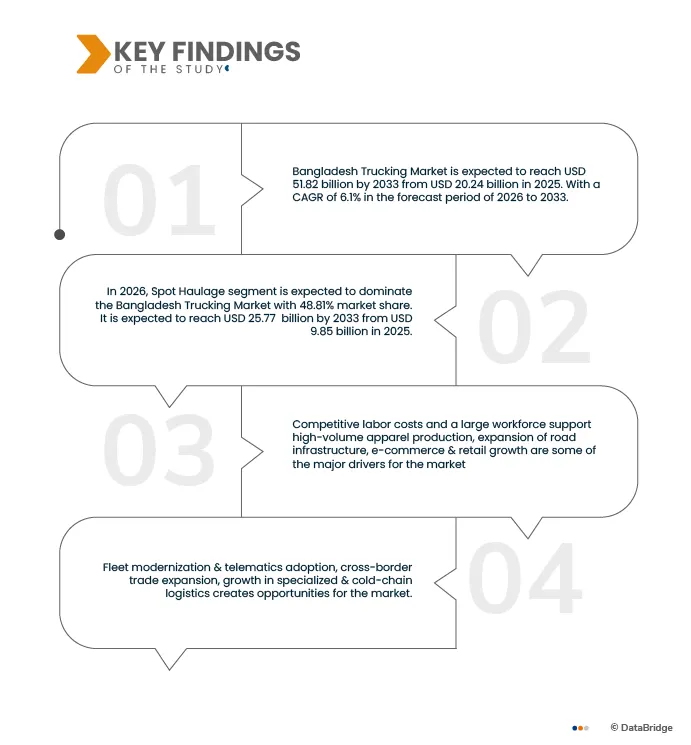

Data Bridge Market Research analyses that the Bangladesh Trucking Market is USD 51.82 billion in 2033 from USD 20.24 billion in 2025, growing with a substantial CAGR of 6.1% in the forecast period of 2026 to 2033.

Key Findings of the Study

Expansion of Road Infrastructure

Bangladesh’s road infrastructure has undergone significant improvement over the past decade, fundamentally enhancing the efficiency, reliability, and performance of the trucking sector. Major highways, expressways, and bridge networks—most notably the Padma Bridge—have reduced travel times, minimized congestion, and enabled uninterrupted freight movement across key industrial corridors linking Dhaka, Chattogram, Khulna, Sylhet, and Rajshahi. These enhancements allow trucking operators to complete more trips in shorter periods, lower operating costs, optimize route planning, and increase fleet utilization. Improved access between the central and southwestern regions has accelerated distribution of agricultural, industrial, and construction goods, while the modernization of regional and feeder roads strengthens connectivity for agro-based industries by enabling faster delivery of perishables. Government-led development of economic corridors and improved linkages to major seaports have further supported export and import logistics. Recent updates underscore the impact: in July 2024, the RHD reported that upgrades to the Dhaka–Chattogram Highway cut freight transit time by nearly one-third; in October 2024, new expressway and regional connectivity projects were highlighted as key to reducing trade-route bottlenecks; and in January 2025, the BBA noted that the Padma Bridge had significantly increased freight movement and trucking demand across 21 southwestern districts. Collectively, these sustained advancements position road infrastructure expansion as a central driver of Bangladesh’s trucking market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable from 2018-2024)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By service type (Spot Haulage, Multi-drop Distribution, Expedited Delivery, Intermodal Feeder, Others), vehicle (Medium-Duty Commercial Trucks, Light-Duty Commercial Trucks, Heavy-Duty Commercial Trucks), truck type (Box Trucks, Tanker Trucks, Refrigerated Trucks, Semi-Trailer Trucks, Flatbeds Truck, Liftgate Trucks, Others), load type (Full Truckload (FTL), Less‑Than‑Truckload (LTL), Partial Truckload (PTL)), drive train (Diesel, CNG, Electric (BEV), Hybrid, Alt‑Fuel, Others), payload (12–20 tonnes, Above 20 tonnes, 7–12 tonnes, 3–7 tonnes, 1–3 tonnes, Up to 1 tonne), distance (100–200 miles, 200–500 miles, Less than 50 miles, 50–100 miles, More than 500 miles), ownership (Owner-Operators, 3PL Providers, Aggregator Platforms, Captive Fleets, 4PL Providers, Others), fleet size (Small Fleets, Medium Fleets, Large Fleets), cargo type (Containerized, Dry Cargo, Perishables, Bulk Liquids, Bulk Solids, High-Value, Oversized Cargo, Hazardous, Others), operation type (Domestic, International), pricing model (Distance-Based, Weight-Based, Trip-Based, Time-Based, Subscription, Others), application (RMGs & Textiles, FMCG, Food & Beverages, Manufacturing, Retail, E-Commerce, Mining, Energy & Utility Oil & Gas, Automotive, Chemicals, Transportation, Healthcare, Electronics, Apparels & Footwear, IT & Telecom, Defense, Others), contract type (Private Fleet Trucking, For-Hire Trucking, Dedicated Contract Carriage (DCC)), end use (B2B (Business-to-Business), B2C (Business-to-Consumer))

|

|

Market Players Covered

|

DHL (Germany), Kuehne+Nagel (Switzerland), DSV (Denmark), Nippon Express Holdings (Japan), Pathao Ltd. (Bangladesh), Truck Lagbe (Bangladesh), Obhai Solutions Limited (Bangladesh), Titas Transport Agency (Bangladesh), Loop (Bangladesh), Homebound (Bangladesh), Reliable Logistics Service (Bangladesh), Fleet Freight (Bangladesh), A H Khan & Company Limited (Bangladesh), Faraji Logistics (Bangladesh), WAC Bangladesh Limited (Bangladesh)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

|

Segment Analysis

The Bangladesh Trucking Market is categorized into fifteen notable segments based on Service Type, Vehicle, Truck Type, Load Type, Drive Train, Payload, Distance, Ownership, Fleet Size, Cargo Type, Operation Type, Pricing Model, Application, Contract Type, End Use

- Based on service type, the Bangladesh trucking market is segmented into Spot Haulage, Multi-drop Distribution, Expedited Delivery, Intermodal Feeder, Others.

In 2026, the Service Type segment is expected to dominate the Bangladesh Trucking Market

In 2026, Spot Haulage segment is expected to dominate the Bangladesh Trucking Market with 48.81% market share and is expected to reach 25.77 billion by 2033, growing with the CAGR of 6.4% in the forecast period 2026 to 2033.

- Based on vehicle, the Bangladesh trucking market is segmented into Medium-Duty Commercial Trucks, Light-Duty Commercial Trucks, Heavy-Duty Commercial Trucks.

In 2026, the vehicle segment dominates the Trucking Market

. In 2026, Medium-Duty Commercial Trucks segment is expected to dominate the Bangladesh Trucking Market with 52.67% market share and is expected to reach 27.72 thousand by 2033, growing with the CAGR of 6.3% in the forecast period 2026 to 2033.

- Based on Truck Type, the Bangladesh trucking market is segmented into Box Trucks, Tanker Trucks, Refrigerated Trucks, Semi-Trailer Trucks, Flatbeds Truck, Liftgate Trucks, Others.

In 2026, Box Trucks segment dominates the Trucking Market

In 2026, Box Trucks segment is expected to dominate the Bangladesh Trucking Market with 32.33% market share and is expected to reach 17.41 thousand by 2033, growing with the CAGR of 6.7% in the forecast period 2026 to 2033.

- Based on Load Type, the Bangladesh trucking market is segmented into Full Truckload (FTL), Less‑Than‑Truckload (LTL), Partial Truckload (PTL).

In 2026, the Full Truckload (FTL) cloud segment dominates the Trucking Market

In 2026, Full Truckload (FTL) segment is expected to dominate the Bangladesh Trucking Market with 56.49% market share and is expected to reach 28.47 thousand by 2033, growing with the CAGR of 7.8% in the forecast period 2026 to 2033.

- Based on Drive Train, the Bangladesh trucking market is segmented into Diesel, CNG, Electric (BEV), Hybrid, Alt‑Fuel, Others.

In 2026, the Standard Malt segment dominates the Trucking Market

In 2026, Above 20 tonnes segment is expected to dominate the Bangladesh Trucking Market with 74.18% market share and is expected to reach 38.67 thousand by 2033, growing with the CAGR of 6.2% in the forecast period 2026 to 2033.

- Based on Payload, the Bangladesh trucking market is segmented into 12–20 tonnes, Above 20 tonnes, 7–12 tonnes, 3–7 tonnes, 1–3 tonnes, Up to 1 tonne.

In 2026, the Service Type segment is expected to dominate the Bangladesh Trucking Market

In 2026, 12–20 tonnes segment is expected to dominate the Bangladesh Trucking Market with 25.76% market share and is expected to reach 13.98 thousand by 2033, growing with the CAGR of 6.8% in the forecast period 2026 to 2033.

- Based on Payload, the Bangladesh trucking market is segmented into 100–200 miles, 200–500 miles, Less than 50 miles, 50–100 miles, More than 500 miles.

In 2026, the 100–200 miles segment is expected to dominate the Bangladesh Trucking Market

In 2026, 100–200 miles segment is expected to dominate the Bangladesh Trucking Market with 28.24% market share and is expected to reach 15.07 thousand by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033.

- Based on Ownership, the Bangladesh trucking market is segmented into Owner-Operators, 3PL Providers, Aggregator Platforms, Captive Fleets, 4PL Providers, Others.

In 2026, the Owner-Operators segment is expected to dominate the Bangladesh Trucking Market

In 2026, Owner-Operators segment is expected to dominate the Bangladesh Trucking Market with 45.26% market share and is expected to reach 23.56 thousand by 2033, growing with the CAGR of 6.2% in the forecast period 2026 to 2033.

- Based on fleet size, the Bangladesh trucking market is segmented into Small Fleets, Medium Fleets, Large Fleets.

In 2026, the Small Fleets segment is expected to dominate the Bangladesh Trucking Market

In 2026, Small Fleets segment is expected to dominate the Bangladesh Trucking Market with 52.87% market share and is expected to reach 28.11 thousand by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033.

- Based on Cargo Type, the Bangladesh trucking market is segmented into Containerized, Dry Cargo, Perishables, Bulk Liquids, Bulk Solids, High-Value, Oversized Cargo, Hazardous, Others.

In 2026, the Small Fleets segment is expected to dominate the Bangladesh Trucking Market

In 2026, Containerized segment is expected to dominate the Bangladesh Trucking Market with 39.30% market share and is expected to reach 21.05 thousand by 2033, growing with the CAGR of 6.6% in the forecast period 2026 to 2033.

- Based on Operation Type, the Bangladesh trucking market is segmented into Domestic, International.

In 2026, the Domestic segment is expected to dominate the Bangladesh Trucking Market

In 2026, Domestic segment is expected to dominate the Bangladesh Trucking Market with 85.64% market share and is expected to reach 44.28 thousand by 2033, growing with the CAGR of 6.0% in the forecast period 2026 to 2033.

- Based on Pricing Model, the Bangladesh trucking market is segmented into Distance-Based, Weight-Based, Trip-Based, Time-Based, Subscription, Others.

In 2026, the Distance-Based segment is expected to dominate the Bangladesh Trucking Market

In 2026, Distance-Based segment is expected to dominate the Bangladesh Trucking Market with 55.10% market share and is expected to reach 28.45 thousand by 2033, growing with the CAGR of 6.0% in the forecast period 2026 to 2033.

- Based on Application, the Bangladesh trucking market is segmented into RMGs & Textiles, FMCG, Food & Beverages, Manufacturing, Retail, E-Commerce, Mining, Energy & Utility Oil & Gas, Automotive, Chemicals, Transportation, Healthcare, Electronics, Apparels & Footwear, IT & Telecom, Defense, Others.

In 2026, the RMGs & Textiles segment is expected to dominate the Bangladesh Trucking Market

In 2026, RMGs & Textiles segment is expected to dominate the Bangladesh Trucking Market with 22.27% market share and is expected to reach 11.67 thousand by 2033, growing with the CAGR of 6.3% in the forecast period 2026 to 2033.

- Based on Contract Type, the Bangladesh trucking market is segmented into Private Fleet Trucking, For-Hire Trucking, Dedicated Contract Carriage (DCC).

In 2026, the Private Fleet Trucking segment is expected to dominate the Bangladesh Trucking Market

In 2026, Private Fleet Trucking segment is expected to dominate the Bangladesh Trucking Market with 52.87% market share and is expected to reach 9.58 thousand by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033

- Based on End Use, the Bangladesh trucking market is segmented into B2B (Business-to-Business), B2C (Business-to-Consumer).

In 2026, the B2B (Business-to-Business) Trucking segment is expected to dominate the Bangladesh Trucking Market

In 2026, B2B (Business-to-Business) segment is expected to dominate the Bangladesh Trucking Market with 85.73% market share and is expected to reach 28.09 thousand by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033

Major Players

Data Bridge Market Research analyzes DHL (Germany), Kuehne+Nagel (Switzerland), DSV (Denmark), Nippon Express Holdings (Japan), Pathao Ltd. (Bangladesh), Truck Lagbe (Bangladesh), Obhai Solutions Limited (Bangladesh), Titas Transport Agency (Bangladesh), Loop (Bangladesh), Homebound (Bangladesh), Reliable Logistics Service (Bangladesh), Fleet Freight (Bangladesh), A H Khan & Company Limited (Bangladesh), Faraji Logistics (Bangladesh), WAC Bangladesh Limited (Bangladesh)

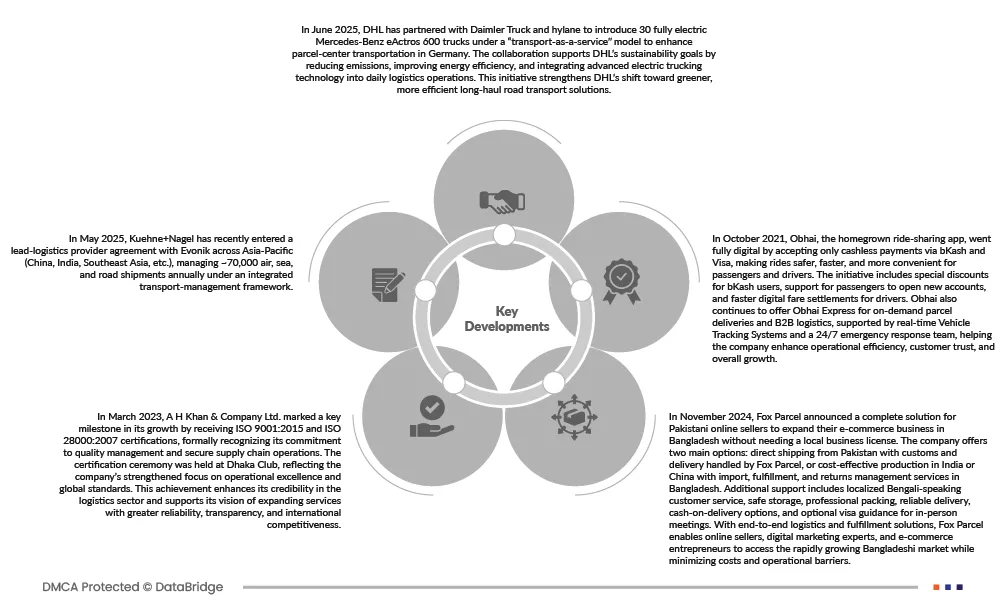

Market Developments

- In June 2025, DHL has partnered with Daimler Truck and hylane to introduce 30 fully electric Mercedes-Benz eActros 600 trucks under a “transport-as-a-service” model to enhance parcel-center transportation in Germany. The collaboration supports DHL’s sustainability goals by reducing emissions, improving energy efficiency, and integrating advanced electric trucking technology into daily logistics operations. This initiative strengthens DHL’s shift toward greener, more efficient long-haul road transport solutions.

- In May 2025, Kuehne+Nagel has recently entered a lead-logistics provider agreement with Evonik across Asia-Pacific (China, India, Southeast Asia, etc.), managing ~70,000 air, sea, and road shipments annually under an integrated transport-management framework.

- In March 2023, A H Khan & Company Ltd. marked a key milestone in its growth by receiving ISO 9001:2015 and ISO 28000:2007 certifications, formally recognizing its commitment to quality management and secure supply chain operations. The certification ceremony was held at Dhaka Club, reflecting the company’s strengthened focus on operational excellence and global standards. This achievement enhances its credibility in the logistics sector and supports its vision of expanding services with greater reliability, transparency, and international competitiveness.

- In November 2024, Fox Parcel announced a complete solution for Pakistani online sellers to expand their e-commerce business in Bangladesh without needing a local business license. The company offers two main options: direct shipping from Pakistan with customs and delivery handled by Fox Parcel, or cost-effective production in India or China with import, fulfillment, and returns management services in Bangladesh. Additional support includes localized Bengali-speaking customer service, safe storage, professional packing, reliable delivery, cash-on-delivery options, and optional visa guidance for in-person meetings. With end-to-end logistics and fulfillment solutions, Fox Parcel enables online sellers, digital marketing experts, and e-commerce entrepreneurs to access the rapidly growing Bangladeshi market while minimizing costs and operational barriers.

As per Data Bridge Market Research analysis:

For more detailed information about Trucking Market click here – https://www.databridgemarketresearch.com/reports/bangladesh-trucking-market