Cordless tools, powered by advanced lithium-ion and brushless motor technologies, offer enhanced convenience, portability, and efficiency, highly valued in professional and DIY applications. The construction, automotive, and manufacturing industries across Europe are increasingly shifting toward cordless models due to their improved ergonomics and ability to operate without external power sources, reducing downtime and improving productivity.

Additionally, countries such as Germany, France, and the UK are seeing rising demand for sustainable, energy-efficient tools, further encouraging the adoption of rechargeable battery systems. The integration of smart features such as Bluetooth connectivity, battery health indicators, and power control modes enhances the user experience and operational precision. The expansion of residential renovation projects and DIY culture, particularly post-pandemic, has also boosted sales of compact and lightweight cordless devices.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-power-tools-market

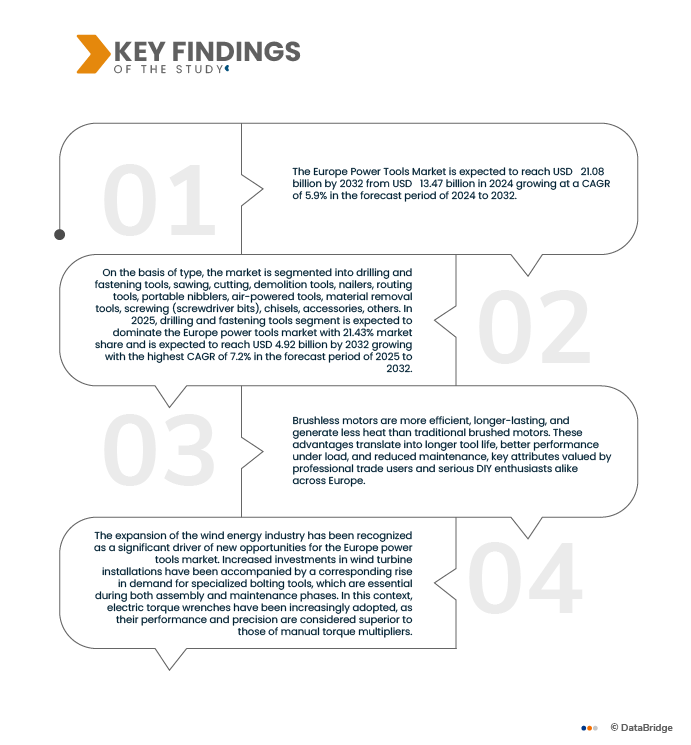

Data Bridge market research analyzes that The Europe Power Tools Market is expected to reach USD 21.08 billion by 2032 from USD 13.47 billion in 2024 growing at a CAGR of 5.9% in the forecast period of 2024 to 2032.

Key Findings of the Study

Integration of Brushless Motors in Power Tools

Brushless motors are more efficient, longer-lasting, and generate less heat than traditional brushed motors. These advantages translate into longer tool life, better performance under load, and reduced maintenance, key attributes valued by professional trade users and serious DIY enthusiasts alike across Europe.

Moreover, the adoption of brushless motors aligns with evolving expectations for energy efficiency and sustainability in European regulatory environments. Tools equipped with such motors consume less power, offering lower lifecycle costs and supporting compliance with energy standards. The reduction in mechanical friction also lowers component wear, leading to fewer replacements and less waste.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD thousand

|

|

Segments Covered

|

By Type (Drilling And Fastening Tools, Sawing, Cutting, Demolition Tools, Nailers, Routing Tools, Portable Nibblers, Air-Powered Tools, Material Removal Tools, Screwing (Screwdriver Bits), Chisels, Accessories), By Mode Of Operation (Electric, Liquid Fuel Tool, Hydraulic, Pneumatic, Powder-Actuated Tools), By Application (Concrete And Construction, Woodworking, Metalworking, Welding), By End User (Industrial/Professional, Residential), By (Online, Offline)

|

|

Countries Covered

|

Europe

|

|

Market Players Covered

|

Robert Bosch Power Tools GmbH, Stanley Black & Decker, Inc., Hilti Aktiengesellschaft , Apex Tool Group, LLC, Atlas Copco AB, Delta Power Equipment Corporation, Ferm International B.V. Makita Corporation, Emerson Electric Co, Husqvarna Group, Ingersoll Rand, KYOCERA Corporation, Panasonic Corporation, Snap-on Incorporated.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand..

|

Segment Analysis

The power tools market is segmented into five notable segments which are based on type, mode of operation, application, end user, and sales channel.

- On the basis of type, the market is segmented into drilling and fastening tools, sawing, cutting, demolition tools, nailers, routing tools, portable nibblers, air-powered tools, material removal tools, screwing (screwdriver bits), chisels, accessories, others.

In 2025, the drilling and fastening tools segment is expected to dominate the market

In 2025, drilling and fastening tools segment is expected to dominate with the largest share 21.43%. The drilling and fastening tools segment is driven by growing construction and manufacturing activities across Europe, where precision, durability, and efficiency are critical. Increasing adoption of cordless and brushless motor technologies enhances portability and performance. Demand from the automotive and aerospace sectors for high-torque fastening tools supports market expansion. Additionally, rising home improvement and DIY trends, coupled with industrial refurbishment projects, boost product penetration. Innovations such as smart connectivity, quick-change chucks, and lightweight ergonomic designs further strengthen market growth across commercial and residential applications.

- On the basis of mode of operation, the market is segmented into electric, liquid fuel tool, hydraulic, pneumatic, and powder-actuated tools. Electric segment is further segmented into corded tool, cordless tool.

In 2025 the electric segment is expected to dominate the market

In 2025, electric segment is expected to dominate market share 35.98%. Electric power tools dominate the European market due to rising infrastructure development and industrial automation. The shift from manual to powered equipment enhances productivity and safety, reducing project timelines. Growth in energy-efficient and battery-operated solutions supports sustainability initiatives. Cordless electric models are increasingly preferred for flexibility and mobility in professional and DIY applications. Major manufacturers focus on integrating brushless motors and smart controls for better performance and energy optimization. The surge in construction, automotive repair, and renovation activities further propels electric power tool demand.

- On the basis of application, the market is segmented into concrete and construction, woodworking, metalworking, welding, and others.

In 2025, the concrete and construction segment is expected to dominate the market

In 2025, concrete and construction segment is expected to dominate market share 35.89%. Concrete and construction power tools experience strong demand across Europe, supported by large-scale urbanization, smart city projects, and public infrastructure investments. Increased usage in road, bridge, and housing development fuels sales of concrete cutters, demolition hammers, and rotary hammers. Advancements in vibration-control technologies and durable materials improve user safety and efficiency. Cordless innovations and integrated dust-management systems enhance worksite productivity and compliance with EU safety standards. Additionally, demand for lightweight, high-performance tools from contractors and builders continues to drive this segment’s growth.

- On the basis of end user, the market is segmented into industrial/professional and residential.

In 2025, the industrial/professional segment is expected to dominate the market

In 2025, industrial/professional segment is expected to dominate market share 72.20%. The industrial and professional power tools segment is driven by expanding manufacturing, automotive, and aerospace industries across Europe. Growing automation, coupled with the demand for high-precision assembly tools, fuels market growth. Professionals increasingly prefer ergonomic, high-torque, and low-maintenance devices for efficiency and reliability. Manufacturers are integrating IoT-enabled systems for predictive maintenance and operational monitoring. Additionally, rising investments in renewable energy projects and offshore construction increase tool utilization. The focus on safety compliance, energy efficiency, and productivity improvement continues to strengthen professional tool adoption.

- On the basis of sales channel, the market is segmented into online and offline.

In 2025, the offline segment is expected to dominate the market

In 2025, offline segment is expected to dominate market share 64.42%. Offline sales dominate the European power tools market due to strong customer preference for physical inspection, after-sales services, and brand trust. Hardware stores, authorized distributors, and retail chains like Leroy Merlin and Würth play key roles in product accessibility. Demonstration facilities, bulk discounts, and immediate product availability attract professional users. Additionally, offline channels provide personalized assistance, which is crucial for industrial and construction buyers. Increasing partnerships between manufacturers and regional dealers enhance distribution efficiency, driving the steady performance of this sales channel across Europe.

Major Players

Robert Bosch Power Tools GmbH, Stanley Black & Decker, Inc., Hilti Aktiengesellschaft , Apex Tool Group, LLC, Atlas Copco AB, Delta Power Equipment Corporation, Ferm International B.V. Makita Corporation, Emerson Electric Co, Husqvarna Group, Ingersoll Rand, KYOCERA Corporation, Panasonic Corporation, Snap-on Incorporated and among others.

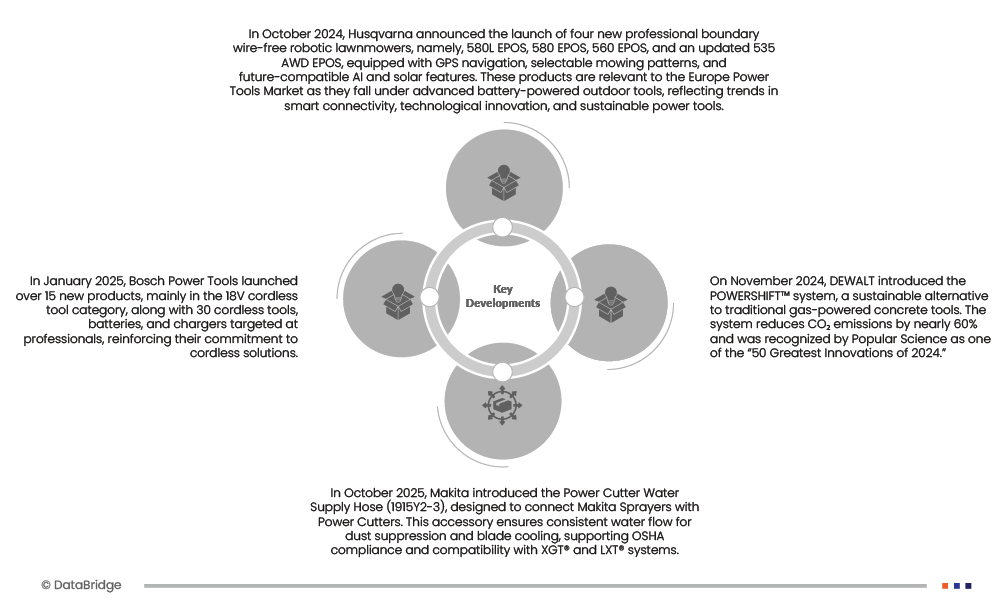

Market Developments

- In October 2024, Husqvarna announced the launch of four new professional boundary wire-free robotic lawnmowers, namely, 580L EPOS, 580 EPOS, 560 EPOS, and an updated 535 AWD EPOS, equipped with GPS navigation, selectable mowing patterns, and future-compatible AI and solar features. These products are relevant to the Europe Power Tools Market as they fall under advanced battery-powered outdoor tools, reflecting trends in smart connectivity, technological innovation, and sustainable power tools.

- In January 2025, Bosch Power Tools launched over 15 new products, mainly in the 18V cordless tool category, along with 30 cordless tools, batteries, and chargers targeted at professionals, reinforcing their commitment to cordless solutions.

- In October 2025, Makita introduced the Power Cutter Water Supply Hose (1915Y2-3), designed to connect Makita Sprayers with Power Cutters. This accessory ensures consistent water flow for dust suppression and blade cooling, supporting OSHA compliance and compatibility with XGT® and LXT® systems.

- In November, DEWALT introduced the POWERSHIFT™ system, a sustainable alternative to traditional gas-powered concrete tools. The system reduces CO₂ emissions by nearly 60% and was recognized by Popular Science as one of the “50 Greatest Innovations of 2024.

As per Data Bridge Market Research analysis:

For more detailed information about the Europe Power Tools Market report, click here – https://www.databridgemarketresearch.com/reports/europe-power-tools-market