Достижения в области сенсорных технологий являются убедительным драйвером, продвигающим глобальный рынок датчиков уровня и расхода на новые высоты. Непрерывное развитие возможностей датчиков, начиная от повышенной точности и прецизионности и заканчивая повышенной прочностью и миниатюризацией, произвело революцию в способах мониторинга и управления уровнями и расходами жидкости в промышленности. Эти технологические прорывы позволили датчикам предоставлять информацию в режиме реального времени, позволяя отраслям оптимизировать процессы, минимизировать отходы и повысить общую эффективность работы. Кроме того, интеграция передовых функций, таких как беспроводное подключение , удаленный мониторинг и прогнозная аналитика , открыла для отраслей возможности перехода к стратегиям проактивного обслуживания, сокращая время простоя и еще больше повышая производительность.

В эту эпоху цифровой трансформации быстрый прогресс сенсорных технологий органично сочетается с требованиями современных отраслей. Компании стремятся достичь более высоких уровней автоматизации и принятия решений на основе данных, передовые датчики играют ключевую роль, предоставляя важный поток точных и своевременных данных. Будь то производство, энергетика, здравоохранение или мониторинг окружающей среды , применение инновационных сенсорных технологий позволяет отраслям раскрывать скрытые идеи, делать обоснованный выбор и в конечном итоге направлять свою деятельность к повышенной эффективности, устойчивости и конкурентоспособности. Эта сенсорная технология продолжает развиваться, глобальный рынок датчиков уровня и расхода будет процветать, открывая новую эру интеллектуальных и отзывчивых промышленных процессов.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/global-level-and-flow-sensor-market

По данным исследования рынка Data Bridge, ожидается, что среднегодовой темп роста мирового рынка датчиков уровня и расхода составит 5,8% в прогнозируемый период с 2023 по 2030 год, а к 2030 году он, как ожидается, достигнет 24 175 765,05 тыс. долларов США.

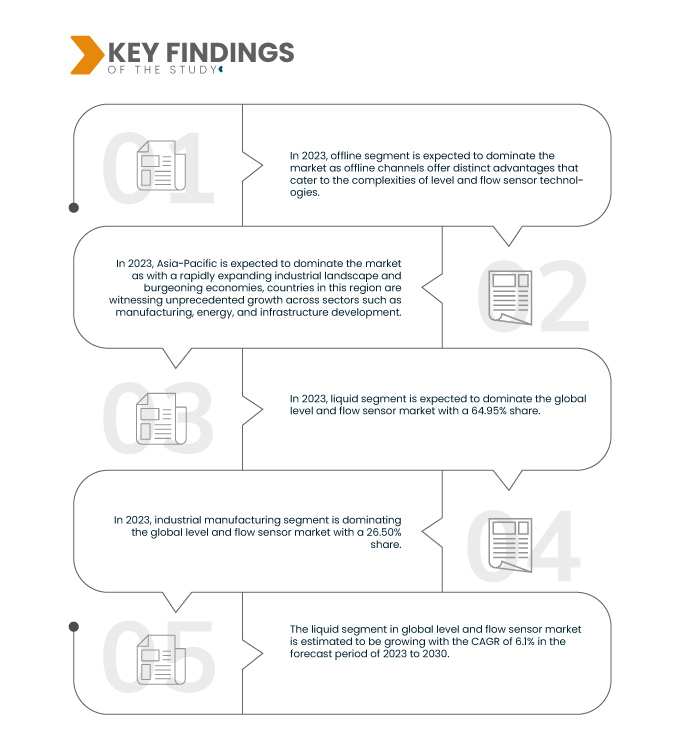

Основные выводы исследования

Растущее внедрение промышленной автоматизации и возникновение Индустрии 4.0

Растущее внедрение промышленной автоматизации и появление Industry 4.0 являются значительными драйверами и, как ожидается, будут продвигать вперед мировой рынок датчиков уровня и расхода. Интеграция передовых сенсорных технологий стала необходимой, поскольку отрасли стремятся повысить эффективность работы, сократить расходы и улучшить общую производительность. Промышленная автоматизация, характеризующаяся использованием робототехники, ИИ и Интернета вещей, требует точных и актуальных данных для эффективного принятия решений и оптимизации процессов. Датчики уровня и расхода играют решающую роль в этой экосистеме, обеспечивая точные измерения уровней жидкости и газа, а также расхода жидкости.

Эти датчики позволяют системам автоматизации оперативно реагировать на изменения, предотвращая сбои, минимизируя потери и оптимизируя распределение ресурсов. Более того, акцент промышленности 4.0 на взаимосвязанности и данных, подпитывает спрос на интеллектуальные датчики , которые могут беспрепятственно взаимодействовать с другими устройствами и системами, способствуя созданию оптимизированного и взаимосвязанного промышленного ландшафта.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2021-2030

|

Базовый год

|

2022

|

Исторические годы

|

2021 (Можно настроить на 2015-2020)

|

Количественные единицы

|

Доход в тыс. долл. США

|

Охваченные сегменты

|

Тип (датчик расхода и датчик уровня), Технология (бесконтактный датчик уровня и расхода и контактный датчик уровня и расхода), Среда применения (твердые вещества, жидкости и газ), Конечный пользователь (промышленное производство, нефть и газ, химическая промышленность , потребительские товары, автомобилестроение, энергетика, правительство и оборона, сточные воды, здравоохранение и другие)

|

Страны, охваченные

|

США, Канада, Мексика, Германия, Великобритания, Франция, Италия, Испания, Россия, Польша, Нидерланды, Бельгия, Швейцария, Дания, Финляндия, Швеция, Норвегия, Турция, остальные страны Европы, Китай, Япония, Южная Корея, Индия, Тайвань, Австралия, Таиланд, Индонезия, Малайзия, Сингапур, Новая Зеландия, Филиппины, Вьетнам, остальные страны Азиатско-Тихоокеанского региона, Бразилия, Аргентина и остальные страны Южной Америки, Саудовская Аравия, ОАЭ, Южная Африка, Кувейт, Катар, Египет, Израиль, Оман, Бахрейн и остальные страны Ближнего Востока и Африки

|

Охваченные участники рынка

|

TE Connectivity (Япония), Temposonics (дочерняя компания Amphenol Corporation) (США), AMETEK Inc. (США), Emerson Electric Co. (США), KEYENCE CORPORATION (Япония), ABB (США), Fortive (США), SICK AG (Франция), OMRON Corporation (Япония), Azbil Corporation (Япония), Honeywell International Inc. (США), Endress+Hauser Group Services AG (Франция), SSI Technologies, LLC (Великобритания) и Balluff Automation India Pvt. Ltd (Индия) и другие

|

Данные, отраженные в отчете

|

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, анализ воронки продаж, анализ ценообразования и нормативную базу.

|

Анализ сегмента:

Глобальный рынок датчиков уровня и расхода разделен на пять основных сегментов, которые различаются по типу, технологии, среде применения, конечному пользователю и каналу сбыта.

- По типу рынок сегментирован на датчики расхода и датчики уровня.

Ожидается, что в 2023 году сегмент датчиков расхода будет доминировать на мировом рынке датчиков уровня и расхода.

Ожидается, что в 2023 году сегмент датчиков расхода будет доминировать на рынке с долей рынка 63,43%, поскольку он играет ключевую роль в широком спектре промышленных процессов, начиная от производства и производства энергии и заканчивая управлением водными ресурсами. Их критическая функция в мониторинге движения жидкости подчеркивает необходимость специализированной экспертизы как на этапах выбора, так и на этапах развертывания.

- На основе технологии рынок был сегментирован на бесконтактный датчик уровня и расхода и контактный датчик уровня и расхода. Ожидается, что в 2023 году бесконтактный датчик уровня и расхода будет доминировать на рынке с долей рынка 64,76%.

- На основе среды применения глобальный рынок датчиков уровня и расхода был сегментирован на жидкие, газовые и твердые. Ожидается, что в 2023 году сегмент жидкостей будет доминировать на рынке с долей рынка 64,95%.

- На основе конечного пользователя рынок был сегментирован на промышленное производство, нефть и газ, химию, потребительские товары, автомобилестроение, энергетику, правительство и оборону, сточные воды, здравоохранение и др. Ожидается, что в 2023 году промышленное производство будет доминировать на рынке с долей рынка 26,50%.

- На основе канала сбыта мировой рынок датчиков уровня и расхода сегментирован на офлайн и онлайн.

Ожидается, что в 2023 году автономный сегмент будет доминировать на мировом рынке датчиков уровня и расхода.

Ожидается, что в 2023 году офлайн-сегмент будет доминировать на рынке с долей рынка 72,75%, поскольку офлайн-каналы предлагают особые преимущества, которые учитывают сложность технологий датчиков уровня и расхода. Эти датчики часто требуют специализированных знаний и индивидуальных консультаций для оптимального выбора и интеграции, особенно в отраслях с разнообразными потребностями в применении. Офлайн-каналы предоставляют бесценную платформу для личного взаимодействия, позволяя производителям датчиков и экспертам напрямую взаимодействовать с клиентами, понимать их уникальные требования и предлагать индивидуальные решения.

Основные игроки

Компания Data Bridge Market Research выделяет следующие компании в качестве основных игроков на мировом рынке датчиков уровня и расхода, в том числе Emerson Electric Co. (США), KEYENCE CORPORATION (Япония), ABB (США), Honeywell International Inc. (США), Endress+Hauser Group Services AG (Франция) и другие.

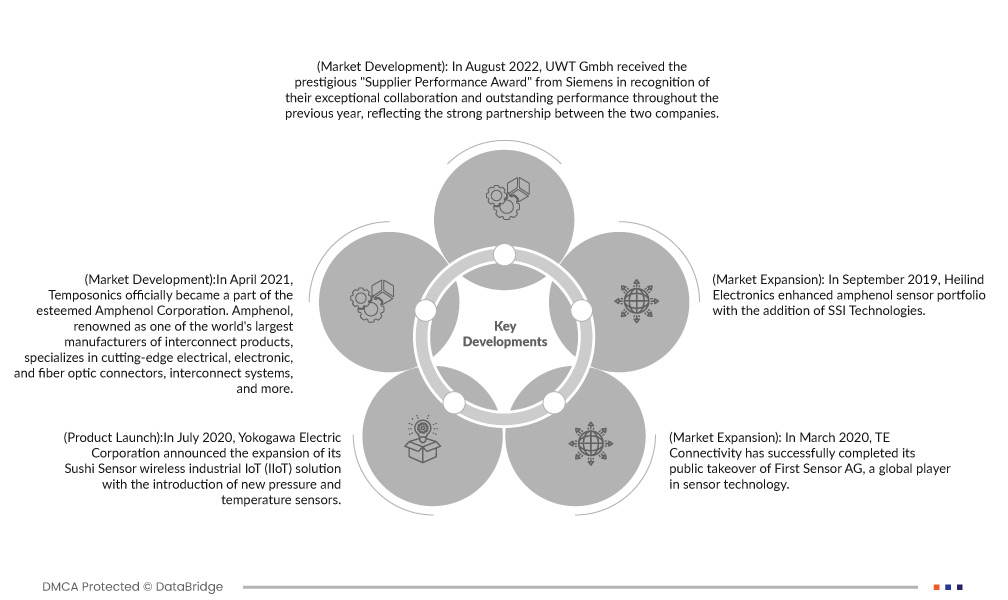

Развитие рынка

- В августе 2022 года компания UWT Gmbh получила престижную премию «Supplier Performance Award» от Siemens в знак признания исключительного сотрудничества и выдающихся результатов в течение предыдущего года, что отражает прочное партнерство между двумя компаниями. Эта награда подчеркивает приверженность UWT предоставлению надежных решений и подчеркивает эффективную командную работу, которая способствовала этому признанию, демонстрируя их приверженность совершенству и удовлетворенности клиентов.

- В апреле 2021 года Temposonics официально стала частью уважаемой корпорации Amphenol. Amphenol, известная как один из крупнейших в мире производителей соединительных продуктов, специализируется на передовых электрических, электронных и оптоволоконных разъемах, соединительных системах и многом другом. Стратегическая интеграция позиционирует Temposonics в мощной сети компаний под эгидой Amphenol, объединяя ее портфель сенсорных решений с широким спектром предложений. Это сотрудничество позволяет Temposonics использовать обширные ресурсы и опыт Amphenol, тем самым укрепляя ее глобальный охват и возможности на рынке датчиков расхода. Теперь клиенты могут получить доступ к расширенному и гармоничному ассортименту продукции для удовлетворения разнообразных потребностей.

- В июле 2020 года Yokogawa Electric Corporation объявила о расширении своего беспроводного промышленного решения IoT (IIoT) Sushi Sensor с введением новых датчиков давления и температуры . Первоначально запущенные в Японии в июле 2019 года, эти датчики теперь доступны в Европе, Северной Америке и на некоторых рынках Юго-Восточной Азии, а более широкий выпуск запланирован для других регионов. Решение Sushi Sensor от Yokogawa соответствует ее приверженности «интеллектуальному» аспекту производства за счет использования технологии IoT для повышения производительности и эффективности завода. Демонстрируемые продукты еще больше укрепляют роль Yokogawa как комплексного поставщика, предоставляющего комплексное решение для беспроводных потребностей IIoT.

- В марте 2020 года TE Connectivity успешно завершила публичное поглощение First Sensor AG, глобального игрока в области сенсорных технологий. Теперь, когда TE владеет 71,87% акций First Sensor, этот стратегический шаг позволяет TE Connectivity значительно расширить свой портфель датчиков. Приобретение соответствует стремлению TE быть лидером в области датчиков, предоставляя клиентам инновационные и высококачественные продукты. TE может предложить широкий ассортимент датчиков, разъемов и систем, улучшая свою стратегию роста и общие возможности на рынке датчиков расхода и за его пределами за счет объединения сильных сторон обеих компаний.

- В сентябре 2019 года Heilind Electronics расширила портфолио датчиков Amphenol, добавив SSI Technologies. В стратегическом шаге по диверсификации своего ассортимента промышленных, коммерческих и автомобильных датчиков Heilind Electronics расширила свое сотрудничество с SSI Technologies, тем самым обогатив портфолио датчиков Amphenol. Это расширение предлагает клиентам Heilind еще более широкий выбор высококачественных сенсорных решений, укрепляя позиции компании как комплексного поставщика электронных компонентов и повышая ценность для ее клиентов.

Региональный анализ

Глобальный рынок датчиков уровня и расхода разделен на пять основных сегментов, которые различаются по типу, технологии, среде применения, конечному пользователю и каналу сбыта.

Страны, охваченные данным отчетом о рынке: США, Канада, Мексика, Германия, Великобритания, Франция, Италия, Испания, Россия, Польша, Нидерланды, Бельгия, Швейцария, Дания, Финляндия, Швеция, Норвегия, Турция, остальные страны Европы, Китай, Япония, Южная Корея, Индия, Тайвань, Австралия, Таиланд, Индонезия, Малайзия, Сингапур, Новая Зеландия, Филиппины, Вьетнам, остальные страны Азиатско-Тихоокеанского региона, Бразилия, Аргентина и остальные страны Южной Америки, Саудовская Аравия, ОАЭ, Южная Африка, Кувейт, Катар, Египет, Израиль, Оман, Бахрейн и остальные страны Ближнего Востока и Африки.

Азиатско-Тихоокеанский регион является доминирующим и самым быстрорастущим на мировом рынке датчиков уровня и расхода.

Ожидается, что Азиатско-Тихоокеанский регион будет доминировать, поскольку регион зарекомендовал себя как глобальный производственный центр, а такие страны, как Китай, Япония, Южная Корея и Тайвань, находятся на переднем крае производственной деятельности. В этих странах есть надежные электронные, автомобильные и машиностроительные отрасли, которые в значительной степени зависят от процессов, основанных на жидкостях. Датчики расхода являются неотъемлемой частью этих процессов, обеспечивая точный контроль над потоком жидкостей и газов. Ожидается, что спрос на точное измерение и контроль расхода будет расти, что приведет к росту рынка датчиков расхода.

Азиатско-Тихоокеанский регион является самым быстрорастущим регионом, поскольку в регионе происходит обширное развитие инфраструктуры, включая строительство энергетических объектов, водоочистных сооружений и транспортных сетей. Эти проекты часто требуют сложных систем управления жидкостями для обеспечения эффективности и надежности. Датчики расхода помогают контролировать распределение жидкости, потребление и обнаружение утечек, способствуя общей эффективности этих инфраструктурных разработок. Более высокие инвестиции в инфраструктуру, вероятно, повысят спрос на различные устройства и датчики расхода.

Согласно анализу Data Bridge Market Research:

Для получения более подробной информации об отчете о мировом рынке датчиков уровня и расхода нажмите здесь – https://www.databridgemarketresearch.com/reports/global-level-and-flow-sensor-market