Ускорение развития технологий в секторе здравоохранения значительно возросло за последние несколько лет. Прогресс в технологиях медицинских устройств поддерживает безболезненное и несложное лечение во время управления заболеваниями. Более того, инновации и модернизация медицинских устройств способствуют точным и быстрым результатам диагностики заболеваний. Кроме того, инновации в медицинских устройствах обеспечивают экономическую эффективность терапевтических инструментов на основе технологий во время лечения заболеваний.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/global-medical-device-testing-market

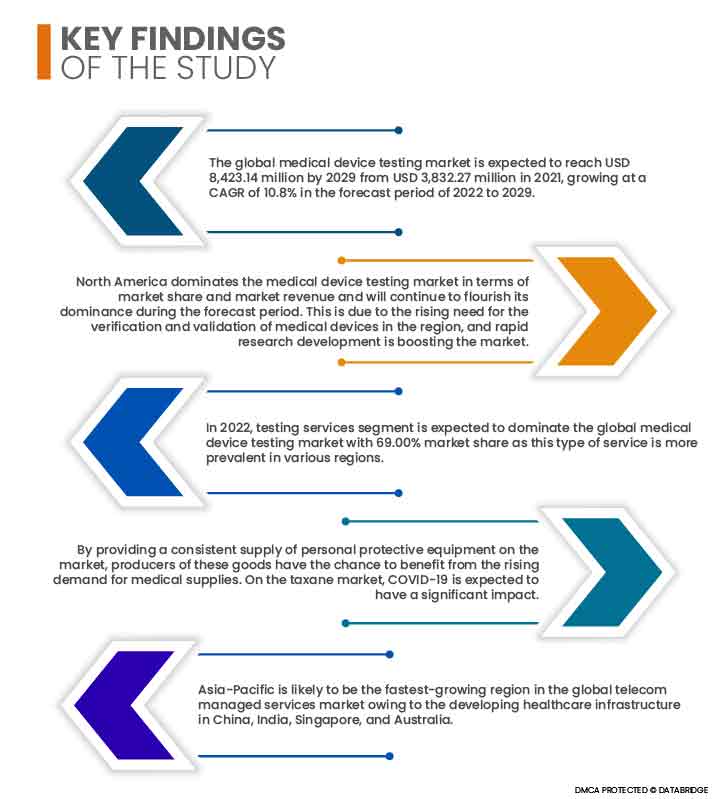

Ожидается, что мировой рынок тестирования медицинских устройств достигнет 8 423,14 млн долларов США к 2029 году с 3 832,27 млн долларов США в 2021 году, увеличившись в среднем на 10,8% в прогнозируемый период с 2022 по 2029 год. Растущая потребность в глобальной проверке и валидации медицинских устройств усилила рост рынка. Растущие расходы на здравоохранение для улучшения медицинских услуг также способствуют росту рынка. Некоторые из основных игроков рынка сосредоточены на различных запусках и одобрениях услуг в этот решающий период.

Растущая потребность в проверке и валидации медицинских изделий во всем мире будет способствовать темпам роста рынка.

Медицинские устройства также становятся меньше и сложнее в конструкции с использованием передовых, инженерных пластиков. Это делает процесс валидации и верификации (V&V) еще более важным. Это приводит к лучшей повторяемости, меньшему количеству ошибок, меньшему количеству переделок и перепроектирования, более быстрому времени выхода на рынок, повышению конкурентоспособности и снижению производственных затрат. Кроме того, ожидается, что повышение стандартов и правил в отношении услуг по валидации и верификации медицинских устройств будет способствовать росту рынка тестирования медицинских устройств.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2022-2029

|

Базовый год

|

2021

|

Исторические годы

|

2020 (Можно настроить на 2014 - 2019)

|

Количественные единицы

|

Доход в млн. долл. США, объемы в единицах, цены в долл. США

|

Охваченные сегменты

|

Тип услуги (услуги по тестированию, инспекционные услуги и услуги по сертификации), тип тестирования (физические испытания, химические/биологические испытания, испытания кибербезопасности, микробиологические испытания и испытания на стерильность и другие), фаза (доклинические и клинические), тип источника (внутренние и внешние), класс устройства (класс I, класс II и класс III), продукт (активное имплантируемое медицинское устройство, активное медицинское устройство, неактивное медицинское устройство, медицинское устройство для диагностики in vitro, офтальмологическое медицинское устройство, ортопедическое и стоматологическое медицинское устройство, сосудистое медицинское устройство и другие)

|

Страны, охваченные

|

США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки.

|

Охваченные участники рынка

|

SGS (Швейцария), Eurofins Scientific (Великобритания), Bureau Veritas (Великобритания), Intertek (Великобритания), TÜV SÜD (Великобритания), DEKRA (Великобритания), BSI (Великобритания), TÜV Rheinland (Великобритания), Elements Material Technology (Великобритания), Envigo (США), Avomeen Analytical Services (США), Gateway Analytical (США), Medistri SA (Швейцария), North American Science Associates (США), Pace Analytical Services (США), Wuxi Apptec (Китай), Toxikon (США), Charles River Laboratories (США), Medical Device Testing services (США), Source Bioscience (Великобритания), NSF International (США), BDC laboratorys (США) и Surpass (США) и другие.

|

Данные, отраженные в отчете

|

Помимо таких рыночных данных, как рыночная стоимость, темпы роста, сегменты рынка, географический охват, участники рынка и рыночный сценарий, рыночный отчет, подготовленный командой Data Bridge Market Research, включает в себя углубленный экспертный анализ, эпидемиологию пациентов, анализ воронки продаж, анализ цен и нормативную базу.

|

Анализ сегмента:

Глобальный рынок тестирования медицинских устройств подразделяется на шесть основных сегментов, таких как тип услуги, тип тестирования, фаза, тип источника, класс устройства и продукт.

- На основе типа услуг глобальный рынок тестирования медицинских устройств сегментируется на услуги тестирования, услуги инспекции и услуги сертификации. Ожидается, что в 2022 году сегмент услуг тестирования будет доминировать на мировом рынке тестирования медицинских устройств с долей рынка 69,00%, поскольку этот тип услуг более распространен в различных регионах

- На основе типа тестирования глобальный рынок тестирования медицинских устройств сегментируется на физическое тестирование, химико-биологическое тестирование, тестирование кибербезопасности, микробиологическое тестирование и тестирование стерильности и другие. Ожидается, что в 2022 году сегмент химико-биологического тестирования будет доминировать на мировом рынке тестирования медицинских устройств с долей рынка 36,10%. Этот тип тестирования очень важен для медицинских устройств, которые будут продаваться.

- На основе фазы глобальный рынок тестирования медицинских устройств сегментируется на доклинический и клинический. Ожидается, что в 2022 году доклинический сегмент будет доминировать на мировом рынке тестирования медицинских устройств с долей рынка 79,52%, поскольку эта фаза крайне важна для тестирования медицинских устройств.

- На основе типа источника мировой рынок тестирования медицинских устройств сегментируется на внутренний и аутсорсинговый. Ожидается, что в 2022 году аутсорсинговый сегмент будет доминировать на мировом рынке тестирования медицинских устройств с долей рынка 73,53%, поскольку это менее дорогой тип источника, присутствующий на рынке, который производители очень предпочитают.

- На основе класса устройства глобальный рынок тестирования медицинских устройств сегментируется на класс I, класс II и класс III. Ожидается, что в 2022 году сегмент класса I будет доминировать на мировом рынке тестирования медицинских устройств с долей рынка 42,54% за счет увеличения активности НИОКР для медицинских устройств класса I.

Сегмент класса I будет доминировать в сегменте классов устройств на рынке тестирования медицинских приборов.

Сегмент класса I станет доминирующим сегментом класса устройств. Это связано с растущей осведомленностью о системах на рынке, особенно в развивающихся экономиках. Кроме того, рост и расширение услуг по научно-исследовательским разработкам в глобальном масштабе еще больше поддержит рост этого сегмента.

- На основе продукта глобальный рынок тестирования медицинских устройств сегментирован на активные имплантируемые медицинские устройства, активные медицинские устройства, неактивные медицинские устройства, диагностические медицинские устройства in vitro, офтальмологические медицинские устройства, ортопедические и стоматологические медицинские устройства, сосудистые медицинские устройства и другие. Ожидается, что в 2022 году сегмент неактивных медицинских устройств будет доминировать на мировом рынке тестирования медицинских устройств с долей рынка 29,02%. Этот тип медицинских устройств широко используется на рынке; следовательно, эти продукты необходимо тестировать перед выходом на рынок.

Сегмент неактивных медицинских устройств будет доминировать в продуктовом сегменте рынка тестирования медицинских устройств.

Сегмент неактивных медицинских устройств станет доминирующим сегментом по продукту с долей рынка около 29,00%. Это связано с растущим числом мероприятий по развитию инфраструктуры на рынке, особенно в развивающихся экономиках. Кроме того, рост и расширение ИТ-индустрии по всему миру еще больше поддержит рост этого сегмента.

Основные игроки

Data Bridge Market Research признает следующие компании в качестве игроков рынка тестирования медицинских устройств: SGS (Швейцария), Eurofins Scientific (Великобритания), Bureau Veritas (Великобритания), Intertek (Великобритания), TÜV SÜD (Великобритания), DEKRA (Великобритания), BSI (Великобритания), TÜV Rheinland (Великобритания), Elements Material Technology (Великобритания), Envigo (США), Avomeen Analytical Services (США), Gateway Analytical (США), Medistri SA (Швейцария), North American Science Associates (США), Pace Analytical Services (США), Wuxi Apptec (Китай), Toxikon (США), Charles River Laboratories (США), Medical Device Testing services (США), Source Bioscience (Великобритания), NSF International (США), BDC laboratorys (США) и Surpass (США).

Развитие рынка

- В апреле 2021 года TÜV SÜD объявила, что она представила себя на Medtec LIVE, чтобы продемонстрировать свою способность быть универсальным магазином для тестирования медицинских устройств. Услуги компании охватывали тестирование электрической и функциональной безопасности, кибербезопасность и программное обеспечение, ЭМС и биосовместимость. Эксперты из TÜV SÜD были представлены в программе онлайн-выставки и конгресса с различными докладами, живым хаком и презентацией в лифте

- В июне 2020 года Intertek объявила о расширении своих услуг по средствам индивидуальной защиты, включая предсертификационные испытания респираторов N95 в соответствии с требованиями Национального института охраны труда и здоровья (NIOSH). Новые услуги являются результатом успешной аккредитации по стандартным протоколам испытаний NIOSH в соответствии с ISO 17025. С помощью этих новых услуг Intertek также расширяет свои решения и ресурсы для поддержки клиентов и мирового сообщества во время пандемии COVID-19.

Региональный анализ

Географически в отчете о рынке тестирования медицинских устройств рассматриваются следующие страны: США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, остальные страны Европы в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, остальные страны Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, остальные страны Ближнего Востока и Африки (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и остальные страны Южной Америки как часть Южной Америки.

Согласно анализу Data Bridge Market Research:

Северная Америка будет доминирующим регионом на рынке тестирования медицинских устройств в прогнозируемый период 2022–2029 гг.

Северная Америка доминирует на рынке тестирования медицинских устройств с точки зрения доли рынка и рыночного дохода и продолжит процветать в течение прогнозируемого периода. Это связано с растущей потребностью в проверке и валидации медицинских устройств в регионе, а быстрое развитие исследований стимулирует рынок.

По оценкам, Азиатско-Тихоокеанский регион станет самым быстрорастущим регионом на рынке тестирования медицинских устройств в прогнозируемый период 2022–2029 гг.

Азиатско-Тихоокеанский регион, вероятно, станет самым быстрорастущим регионом на мировом рынке благодаря развивающейся инфраструктуре здравоохранения.

Влияние COVID -19

COVID-19 оказал положительное влияние на рынок. Медицинские приборы, такие как МРТ-сканеры, аппараты искусственной вентиляции легких и другие, увеличились за эти годы. Следовательно, использование различных приборов значительно возросло среди населения мира. Таким образом, пандемия оказала положительное влияние на этот рынок тестирования.

Для получения более подробной информации об отчете по тестированию рынка медицинских устройств нажмите здесь – https://www.databridgemarketresearch.com/reports/global-medical-device-testing-market