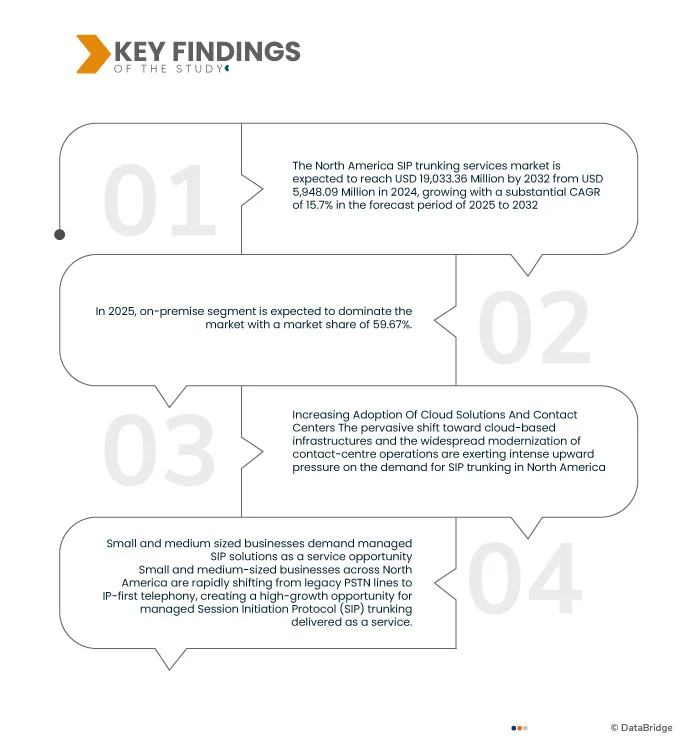

The pervasive shift toward cloud-based infrastructures and the widespread modernization of contact-centre operations are exerting intense upward pressure on the demand for SIP trunking in North America. As organizations migrate away from on-premises Private Branch Exchanges (PBXs) and legacy telephony, they require SIP trunks to bridge voice traffic into cloud Unified Communications (UC) platforms and Cloud Contact-Centre as a Service (CCaaS). Regulatory mandates for enhanced interoperability and public safety (notably for emergency call services), combined with enterprise expectations for scalability, redundancy, and omnichannel support, render SIP trunks an essential component in any cloud-first contact-centre strategy.

The ongoing expansion of cloud-based communication platforms and the regulatory shift toward IP-enabled emergency services clearly demonstrate that SIP trunking has become a critical enabler of enterprise voice transformation in North America. Government directives mandating SIP/IP delivery for public safety systems, combined with rapid innovation by leading technology providers such as AWS, Google, and Cisco in cloud contact-centre solutions, reinforce the indispensability of SIP trunks for modern communications. These developments confirm that SIP trunking is not only a transitional bridge from legacy telephony but also a foundational element for scalable, resilient, and intelligent cloud-first communication strategies across industries.

Access Full Report @ https://www.databridgemarketresearch.com/reports/north-america-sip-trunking-services-market

Data Bridge Market Research analyses that the North America SIP Trunking Services Market is expected to reach USD 19,033.36 Million by 2032 from USD 5,948.09 Million in 2024, growing with a substantial CAGR of 15.7% in the forecast period of 2025 to 2032.

Key Findings of the Study

The Rise of Hybrid Work Models is Creating Greater Need for Scalable and Flexible Sip Trunking

The rise of hybrid work models, where employees routinely split time between remote locations and central offices, has materially increased demand for scalable, resilient, and flexible SIP trunking across North America. Organizations implementing hybrid work require unified communications and cloud contact-centre capabilities that deliver consistent voice quality, device mobility, and seamless call routing regardless of worker location; SIP trunks provide the logical and operational bridge that links cloud UC/CCaaS platforms to the public switched telephone network and enterprise telephony. Public-sector telework guidance and procurement strategies, together with major cloud-communications product updates from leading vendors, underscore that hybrid workforce policies are driving both procurement of cloud voice services and investments in SIP-based interconnection and session-border control infrastructure.

The institutionalization of hybrid work across North America has elevated SIP trunking from a technical option to a strategic necessity for enterprises and public agencies. Government telework frameworks and state-level procurement contracts validate SIP trunking as integral to hybrid workforce continuity. At the same time, technology vendors such as Cisco and Zoom continue to embed SIP-enabled connectivity into their cloud communications portfolios. Together, these developments affirm that scalable and flexible SIP trunking is indispensable in enabling resilient, location-agnostic communications infrastructures for the evolving hybrid work environment.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable from 2018-2023)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Deployment Type (On-Premise, Cloud and Hybrid), Organization Size (Large Enterprise, Small and Medium Enterprises (SMEs)), Connectivity (Dedicated SIP Trunks and Shared/Over-the-internet sip trunks), Service Type (Voice, Video, Web Conferencing, SMS Text Messaging, Desktop Sharing, Streaming Media, and Others), Application (Enterprise Telephony, Unified Communications (UC), Call Centers / Contact Centers, Mobile & Remote Workforce Enablement, Cost Optimization & Network Convergence, Disaster Recovery & Business Continuity, Global/International Communication, IOT & Smart Devices Integration and Others), Pricing (Channelized SIP Trunks and Metered SIP Trunks), Operating Model (Windows, Ios, Android, MAC OS and Linux), End-User (Banking, Financial Service & Insurance, IT And Telecommunication, Healthcare And Life Sciences, Government And Public Sector, Retail And E-commerce, Manufacturing, Media And Entertainment, Education And Research, Hotels And Hospitality, Logistics and Transportation and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico

|

|

Market Players Covered

|

Lumen Technologies (U.S.), 8x8, Inc. (U.S.), Rogers Communications (Canada), Verizon (U.S.), Twilio Inc. (U.S.), GTT Communications, Inc. (U.S.), net2phone (U.S.), Vonage America, LLC (U.S.), Telstra (Australia), and Intrado Life & Safety, Inc. (U.S.). Other notable participants are Nextiva (U.S.), Sinch AB (Sweden), Mitel Networks Corp. (Canada), Colt Technology Services Group Limited (U.K.), Fusion Connect (U.S.), BT (U.K.), Orange (France), IntelePeer Cloud Communications LLC (U.S.), Wildix Inc. (Italy), AVOXI, Inc. (U.S.), 3CX (Cyprus), SIP.US (U.S.), and G12 Communications LLC (U.S.).

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

|

Segment Analysis

The North America SIP trunking services market is segmented into eight notable segments based on deployment type, organization size, connectivity, service type, application, pricing, operating model, and end-user.

- On the basis of deployment type, the North America SIP trunking services market is segmented into on-premise, cloud, and hybrid.

In 2025, on-premise segment is expected to dominate the market with a market share of 59.67%.

In 2025, the on-premise server segment is expected to dominate the market due to the continued reliance of large enterprises and regulated industries on in-house infrastructure for greater control, compliance, and security. Many organizations in sectors such as healthcare, finance, and government prefer on-premise SIP trunking integrated with existing PBX and UC systems to maintain data sovereignty and reduce external dependency.

- On the basis of organization size, the North America SIP trunking services market is segmented into large enterprises and Small and Medium Enterprises (SMEs).

In 2025, the large enterprises segment is expected to dominate the market with a market share of 65.20%.

In 2025, the large enterprises segment is expected to dominate the market due to the high demand for scalable, secure, and reliable communication solutions, integration with existing PBX and UC systems, and the need to support complex, high-volume enterprise communication workloads across industries such as finance, healthcare, and government.

- On the basis of connectivity, the North America SIP trunking services market is segmented into dedicated SIP trunks and shared/over-the-internet SIP trunks. In 2025, the dedicated SIP trunks segment Is expected to dominate the market with a market share of 58.46%.

- On the basis of service type, the North America sip trunking services market is segmented into voice, video, web conferencing, sms/text messaging, desktop sharing, streaming media, and others. In 2025, the voice segment is expected to dominate the market with a market share of 49.96%.

- On the basis of application, the North America sip trunking services market is segmented into enterprise telephony, Unified Communications (UC), call centers / contact centers, mobile & remote workforce enablement, cost optimization & network convergence, disaster recovery & business continuity, global/international communication, IoT & smart devices integration, and others. In 2025, the enterprise telephony segment is expected to dominate the market with a market share of 29.70%

- On the basis of pricing, the North America SIP trunking services market is segmented into channelized SIP trunks and metered SIP trunks. In 2025, the enterprise telephony segment is expected to dominate the market with a market share of 66.97%.

- On the basis of operating model, the North America SIP trunking services market is segmented into windows, iOS, android, mac OS, and linux. In 2025, the windows segment is expected to dominate the market with a market share of 51.90%.

- On the basis of end-user, the North America sip trunking services market is segmented into Banking, Financial Services & Insurance (BFSI), it and telecommunication, healthcare and life sciences, government and public sector, retail and e-commerce, manufacturing, media and entertainment, education and research, hotels and hospitality, logistics and transportation, and others. In 2025, Banking, Financial Services & Insurance (BFSI) segment is expected to dominate the market with a market share of 23.81%.

Major Players

Data Bridge Market Research analyzes Orange (France), 8x8, Inc. (U.S.), Fusion Connect (U.S.), GTT Communications, Inc. (U.S.) and 3CX (U.S.) among others.

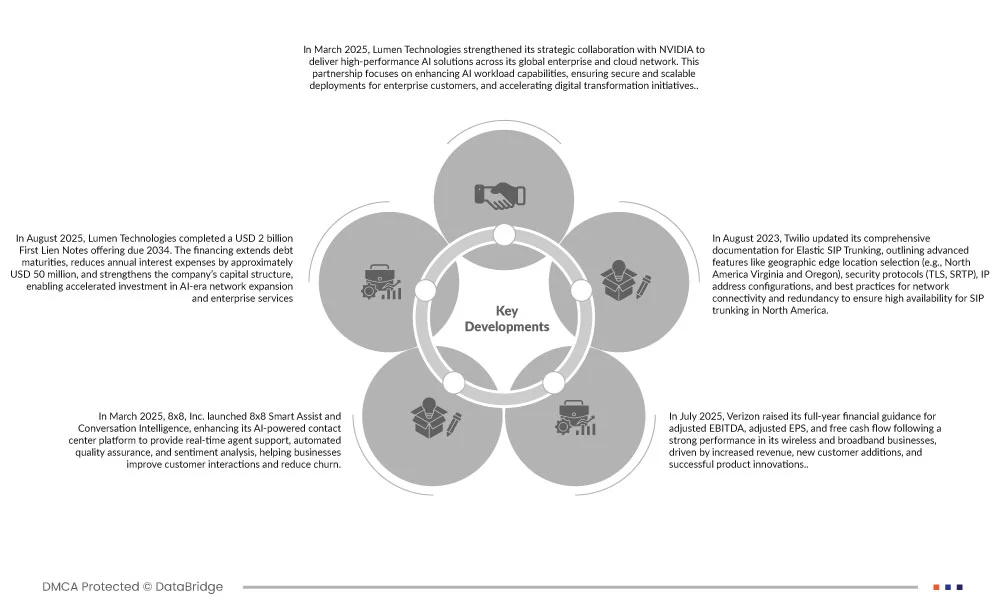

Market Developments

- In March 2025, Lumen Technologies strengthened its strategic collaboration with NVIDIA to deliver high-performance AI solutions across its global enterprise and cloud network. This partnership focuses on enhancing AI workload capabilities, ensuring secure and scalable deployments for enterprise customers, and accelerating digital transformation initiatives.

- In August 2025, Lumen Technologies expanded its network infrastructure by introducing up to 400Gbps Ethernet and IP services across 16 major metro markets and more than 70 third-party data centers. This expansion supports AI, multi-cloud, and high-bandwidth applications, providing enterprises with faster, reliable, and low-latency connectivity for critical workloads.

- In March 2025, 8x8, Inc. launched 8x8 Smart Assist and Conversation Intelligence, enhancing its AI-powered contact center platform to provide real-time agent support, automated quality assurance, and sentiment analysis, helping businesses improve customer interactions and reduce churn.

- In July 2025, Verizon raised its full-year financial guidance for adjusted EBITDA, adjusted EPS, and free cash flow following a strong performance in its wireless and broadband businesses, driven by increased revenue, new customer additions, and successful product innovations. In July, Verizon raised its full-year financial guidance for adjusted EBITDA, adjusted EPS, and free cash flow following a strong performance in its wireless and broadband businesses, driven by increased revenue, new customer additions, and successful product innovations.

- In August 2023, Twilio updated its comprehensive documentation for Elastic SIP Trunking, outlining advanced features like geographic edge location selection (e.g., North America Virginia and Oregon), security protocols (TLS, SRTP), IP address configurations, and best practices for network connectivity and redundancy to ensure high availability for SIP trunking in North America.

Regional Analysis

Geographically, the countries covered in the SIP trunking services market report are U.S., Canada, Mexico.

As per Data Bridge Market Research analysis:

For more detailed information about SIP trunking services market click here – https://www.databridgemarketresearch.com/reports/north-america-sip-trunking-services-market