Der spanische Markt für Emissionsüberwachungssysteme verzeichnet in verschiedenen Branchen wie Petrochemie, Öl und Gas, Energieerzeugung und Chemie ein starkes Wachstum. Der Einsatz von Software für Emissionsüberwachungssysteme ist weit verbreitet und ermöglicht eine präzise Messung der Emissionen gemäß den geltenden Normen. Das Wachstum dieses Marktes wird durch strenge Umweltvorschriften, den Fokus auf Nachhaltigkeit und die Notwendigkeit der Einhaltung von Emissionsgrenzwerten vorangetrieben. Die Marktentwicklung in Spanien spiegelt die zunehmende Bedeutung der Überwachung und Kontrolle von Emissionen in allen Branchen wider.

Den vollständigen Bericht finden Sie unter https://www.databridgemarketresearch.com/reports/spain-emission-monitoring-system-market

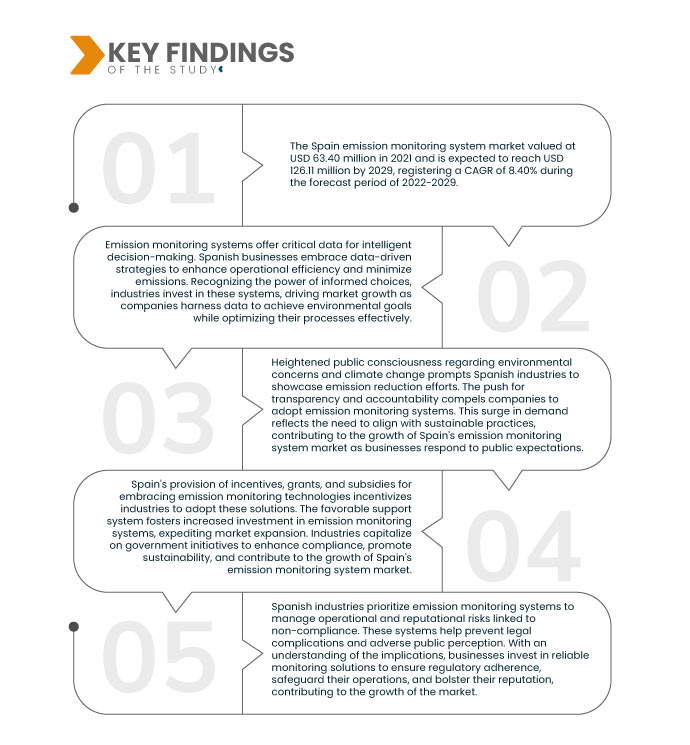

Data Bridge Market Research analysiert, dass der spanische Markt für Emissionsüberwachungssysteme im Jahr 2021 einen Wert von 63,40 Millionen US-Dollar hatte und bis 2029 voraussichtlich 126,11 Millionen US-Dollar erreichen wird. Dies entspricht einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,40 % im Prognosezeitraum 2022–2029. Unternehmen in Spanien, die Emissionsüberwachungssysteme nutzen, um umweltfreundliche Praktiken zu demonstrieren, verschaffen sich einen Wettbewerbsvorteil. Dies motiviert Wettbewerber, ähnliche Maßnahmen zu ergreifen und das Marktwachstum anzukurbeln, da die Industrie die Vorteile einer Ausrichtung auf nachhaltige Trends erkennt.

Wichtigste Ergebnisse der Studie

Die Weiterentwicklung der Softwaretechnologien zur Emissionsüberwachung in Spanien dürfte das Marktwachstum ankurbeln

Die Weiterentwicklung der Softwaretechnologien zur Emissionsüberwachung in Spanien bietet verbesserte Genauigkeit, Effizienz und Benutzerfreundlichkeit. Spanische Unternehmen nutzen diese Innovationen, um ihre Überwachungskompetenz zu verbessern und Compliance-Verfahren zu vereinfachen. Da die Industrie nach effektiven Lösungen sucht, um Vorschriften einzuhalten und Betriebsabläufe zu optimieren, fördert die Einführung fortschrittlicher Emissionsüberwachungssysteme das Marktwachstum, da sie verbesserte Überwachungsmöglichkeiten und optimierte Prozesse ermöglicht.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2022 bis 2029

|

Basisjahr

|

2021

|

Historische Jahre

|

2020 (Anpassbar auf 2014–2019)

|

Quantitative Einheiten

|

Umsatz in Millionen USD, Mengen in Einheiten, Preise in USD

|

Abgedeckte Segmente

|

Systemtyp (Kontinuierliches Emissionsüberwachungssystem (CEMS), Prädiktives Emissionsüberwachungssystem (PEMS)), Emissionsart (Kohlendioxid, Kohlenmonoxid, Stickoxide, Schwefeldioxid, Ammoniak , Schwefelwasserstoff, Kohlenwasserstoffe , Flusssäure , Sauerstoff, Sonstige), Stromart (Weniger als 200 V, 200 bis 300 V, Mehr als 300 V), Installationsart (Neu, Nachrüstung), Vertriebskanal (Direkt an Kunden, Direkt an Händler), Anwendung (Kraftkessel, Rückgewinnungskessel, Kraft-Wärme-Kopplung, Turbine, Zementofen, Müllverbrennungsanlage), Angebot (Hardware, Software, Dienstleistungen), Branche (Pharmazie, Metallverarbeitung, Kraftwerke und Verbrennung, Öl und Gas, Chemie, Petrochemie und Raffinerien, Baustoffe, Marine und Schifffahrt, Bergbau, Müllverbrennung, Zellstoff und Papier)

|

Abgedeckte Marktteilnehmer

|

Ems Security Group Ltd (Großbritannien), Electro Detectors Ltd (Großbritannien), Sterling Safety Systems (Großbritannien), Honeywell International, Inc. (USA), Siemens AG (Deutschland), Wagner Group GmbH (Deutschland), Hochiki Corporation (Japan), Halma Plc. (Großbritannien), Apollo Fire Detectors Limited (Großbritannien), Robert Bosch GmbH (Deutschland), EUROFYRE LTD. (Großbritannien), Detectomat GmbH (Deutschland), Ceasefire Industries Pvt. Ltd (Indien), Johnson Controls (Irland), Napco Security technologies, Inc. (USA), Def Nederland, Zeta Alarm ltd (Großbritannien), Libelium Comunicaciones Distribuidas SL (Spanien), Attentis (Australien) und Vigilys, Inc (USA), um nur einige zu nennen.

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage.

|

Segmentanalyse:

Der spanische Markt für Emissionsüberwachungssysteme ist nach Systemtyp, Emissionstyp, Leistungstyp, Installationstyp, Vertriebskanal, Anwendung, Angebot und Branche segmentiert.

- Auf der Grundlage des Systemtyps ist der Markt für Emissionsüberwachungssysteme in kontinuierliche Emissionsüberwachungssysteme (CEMS) und prädiktive Emissionsüberwachungssysteme (PEMS) unterteilt.

- Auf der Grundlage der Emissionsart ist der Markt für Emissionsüberwachungssysteme in Kohlendioxid, Kohlenmonoxid, Stickoxide, Schwefeldioxid, Ammoniak, Schwefelwasserstoff, Kohlenwasserstoffe, Flusssäure, Sauerstoff und andere unterteilt.

- Auf der Grundlage der Stromart ist der Markt für Emissionsüberwachungssysteme in weniger als 200 V, 200 bis 300 V und mehr als 300 V unterteilt.

- Auf der Grundlage der Installationsart ist der Markt für Emissionsüberwachungssysteme in Neu- und Nachrüstsysteme unterteilt.

- Auf der Grundlage der Vertriebskanäle ist der Markt für Emissionsüberwachungssysteme in Direktverkäufe an Kunden und Direktverkäufe an Händler segmentiert.

- Auf der Grundlage der Anwendung ist der Markt für Emissionsüberwachungssysteme in Kraftkessel, Rückgewinnungskessel, Kraft-Wärme-Kopplung, Turbinen, Zementöfen und Müllverbrennungsanlagen unterteilt.

- Auf der Grundlage des Angebots ist der Markt für Emissionsüberwachungssysteme in Hardware, Software und Dienstleistungen segmentiert.

- Auf Branchenbasis ist der Markt für Emissionsüberwachungssysteme in die Branchen Pharmazeutik, Metallverarbeitung, Kraftwerke und Verbrennung, Öl und Gas, Chemie, Petrochemie und Raffinerien, Baustoffe, Seefahrt und Schifffahrt, Bergbau, Müllverbrennung, Zellstoff und Papier unterteilt.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die wichtigsten Akteure auf dem spanischen Markt für Emissionsüberwachungssysteme an: Ems Security Group Ltd (UK), Electro Detectors Ltd (UK), Sterling Safety Systems (UK), Honeywell International, Inc. (USA), Siemens AG (Deutschland), Wagner Group GmbH (Deutschland), Hochiki Corporation (Japan), Halma Plc. (UK),

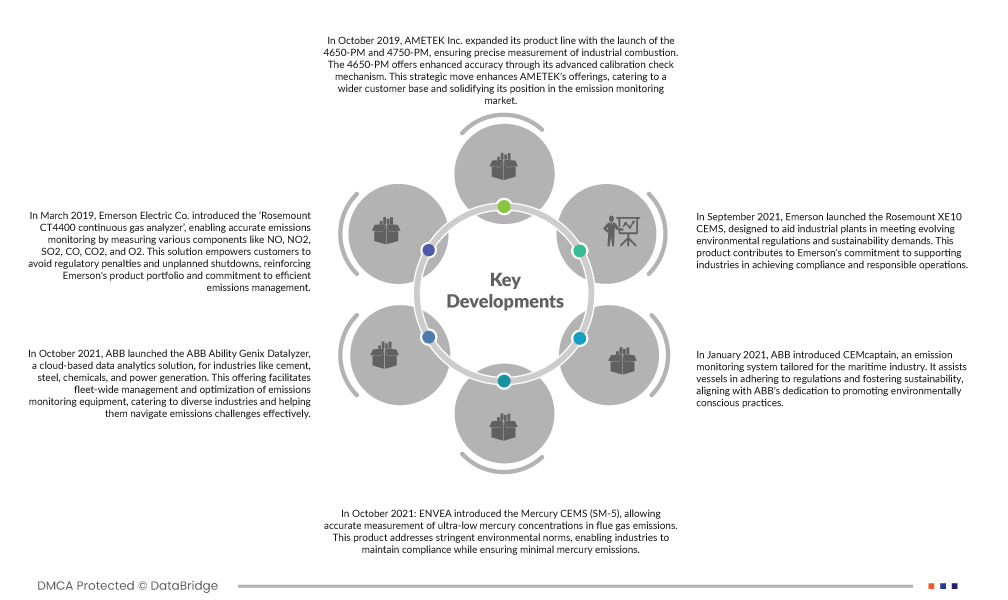

Marktentwicklungen

- Im Oktober 2019 erweiterte AMETEK Inc. seine Produktlinie mit der Einführung der Modelle 4650-PM und 4750-PM, die eine präzise Messung industrieller Verbrennungen gewährleisten. Das 4650-PM bietet dank seines fortschrittlichen Kalibrierungsprüfmechanismus eine höhere Genauigkeit. Dieser strategische Schritt erweitert das Angebot von AMETEK, spricht einen breiteren Kundenstamm an und festigt seine Position im Markt für Emissionsüberwachung.

- Im März 2019 stellte Emerson Electric Co. den kontinuierlichen Gasanalysator „Rosemount CT4400“ vor, der eine präzise Emissionsüberwachung durch die Messung verschiedener Komponenten wie NO, NO2, SO2, CO, CO2 und O2 ermöglicht. Diese Lösung ermöglicht es Kunden, behördliche Sanktionen und ungeplante Abschaltungen zu vermeiden und stärkt damit Emersons Produktportfolio und sein Engagement für effizientes Emissionsmanagement.

- Im Oktober 2021 brachte ABB den ABB Ability Genix Datalyzer auf den Markt, eine cloudbasierte Datenanalyselösung für Branchen wie Zement, Stahl, Chemie und Energieerzeugung. Dieses Angebot erleichtert die flottenweite Verwaltung und Optimierung von Emissionsüberwachungsgeräten, richtet sich an verschiedene Branchen und hilft ihnen, Emissionsprobleme effektiv zu bewältigen.

- Im Oktober 2021 stellte ENVEA das Mercury CEMS (SM-5) vor, das eine genaue Messung extrem niedriger Quecksilberkonzentrationen in Rauchgasemissionen ermöglicht. Dieses Produkt erfüllt strenge Umweltnormen und ermöglicht es der Industrie, die Vorschriften einzuhalten und gleichzeitig minimale Quecksilberemissionen zu gewährleisten.

- Im September 2021 brachte Emerson das Rosemount XE10 CEMS auf den Markt. Es unterstützt Industrieanlagen bei der Einhaltung neuer Umweltvorschriften und Nachhaltigkeitsanforderungen. Dieses Produkt unterstreicht Emersons Engagement, Branchen bei der Einhaltung von Vorschriften und einem verantwortungsvollen Betrieb zu unterstützen.

- Im Januar 2021 führte ABB CEMcaptain ein, ein speziell auf die Schifffahrtsindustrie zugeschnittenes Emissionsüberwachungssystem. Es unterstützt Schiffe bei der Einhaltung von Vorschriften und der Förderung der Nachhaltigkeit und steht im Einklang mit dem Engagement von ABB für umweltbewusstes Handeln.

- Im Februar 2020 stellte Baker Hughes das System 1 Predictive Emission Monitoring System (PEMS) vor, das die Schornsteinemissionen anhand von Umgebungsbedingungen, Kraftstoffzusammensetzung und Maschinenbetrieb vorhersagt. Dieser prädiktive Ansatz steht im Einklang mit dem Engagement von Baker Hughes für innovative Emissionsmanagementlösungen und trägt zu einem effizienteren und umweltfreundlicheren Betrieb bei.

Für detailliertere Informationen zum Marktbericht zum Emissionsüberwachungssystem in Spanien klicken Sie hier – https://www.databridgemarketresearch.com/reports/spain-emission-monitoring-system-market