Cat Litter is an essential supply for all indoor cats. It is used instinctively by a cat to bury its urine and feces, but some owners prefer what type of litter they'd like their cats to use. The most common type of litter is clay-based, which is absorbent and has natural odor control, and the other two main types of clay cat litter are clumping and non-clumping.

For instance,

- According to the data provided in US Imports All rights reserved, there are almost 2663 imports of cat litter products in the U.S. and 331 exports of cat litter products.

- As per Volza's United States Import data, Cat litter import shipments in the United States stood at 18.1K, imported by 32 United States Importers from 20 Suppliers.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-and-mexico-cat-litter-market

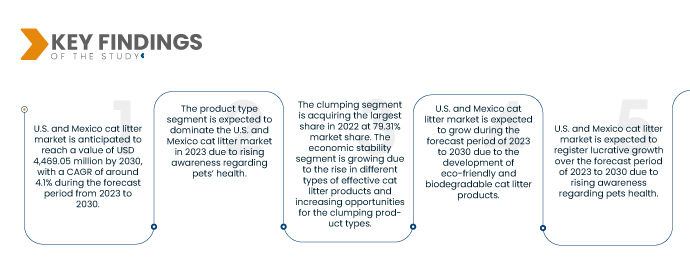

Data Bridge Market Research analyzes that the U.S. and Mexico Cat Litter Market is expected to grow with a CAGR of 4.1% in the forecast period of 2023 to 2030 and is expected to reach USD 4,469.05 million by 2030 for U.S. and Mexico respectively. The clumping segment is projected to propel the market growth as the development of litter products is rising worldwide.

Key Findings of the Study

Surging level of investment in development of cat litter products

The market players operating their business in transfection are continuously investing their money to achieve the best outcome. These companies are also getting funding from third party sources, boosting their activities. Several types of investments are accelerating the research and developmental activities of the transfection products and by time-to-time, new products are adding on to the existing established market.

For instance,

- In February 2023, Nestlé Purina PetCare (Subsidiary of nestle) announced plans to acquire Red Collar Pet Foods' Miami, Oklahoma pet treats factory from Arbor Investments, with an anticipated closing in March. The addition of the Miami factory to Purina's North American production footprint will mark the 22nd Purina owned and operated facility nationwide and expand in-house capabilities for dog and cat treats innovation and production. This has helped the company to expand globally.

The investments done by several companies allowed the development and introduction of new and innovative litter products in the market. These innovative products have enhanced the product efficiency and boosted the manufacturer's credibility in the market. This thus signifies that the surging level of investment is acting as an opportunity for the U.S. and Mexico cat litter market growth

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

By Product Type (Clumping, Non-clumping, Crystals, Deodorant Litters, Conventional, Others), By Raw Material (Clay, Silica, Plant Fibers), By Type (Scented and Non-Scented), By Form (Coarse Litter, Fine Litter), By Distribution Channel (Specialized Pet Shops, E-Commerce, Hypermarkets/Supermarkets, Other), By End User (Adult Cats, Kittens),

|

|

Countries Covered

|

U.S. and Mexico

|

|

Market Players Covered

|

The Clorox Company (California), Nestlé Purina Petcare (Subsidiary of Nestle) (Wiscosin), Oil-Dri Corporation of America.(Illinois), Pettex Limited (Essex), Dr. Elsey's (Wyoming), Sinchem Silica Gel Co., Ltd.(Shandong), Weihai Pearl Silica Gel CO., Ltd (Shandong), Mars, Incorporated and its Affiliates (Washington), Healthy Pet (Washington), Pestell Pet Products (Canada), Church & Dwight Co., Inc.(New York), sWheat Scoop (Minnesota), and Bentaş (Turkey), among others.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The U.S. and Mexico cat litter market is categorized into nine notable segments which are based on product type, raw material, type, form, end user, and distribution channel.

On the basis of product type, the U.S. and Mexico cat litter market is segmented into clumping, non-clumping, crystals, deodorant litters, conventional, and others. In 2023, the clumping segment is expected to dominate the U.S. and Mexico cat litter market with a 79.51% and 79.71% market share and is expected to reach USD 3,235.63 million and USD 378.11 million by 2030, growing with a CAGR of 4.4% and 3.8% for U.S. and Mexico respectively in the forecast period of 2023 to 2030.

In 2023, the clumping segment dominated in the U.S. and Mexico cat litter market due to the rise in different types of effective cat litter products.

- On the basis of raw material, the U.S. and Mexico cat litter market is segmented into clay, silica and plant fibers. In 2023, the clay segment is expected to dominate the U.S. and Mexico cat litter market with a 59.94% and 60.44% market share and is expected to reach USD 2,441.77 million and USD 286.94 million by 2030, growing with a CAGR of 4.4% and 3.8% for U.S. and Mexico respectively in the forecast period of 2023 to 2030.

- On the basis of type, the U.S. and Mexico cat litter market is segmented into scented and non-scented. In 2023, the non-scented segment is expected to dominate the U.S. and Mexico cat litter market with a 66.95% and 67.34% market share and is expected to reach USD 2,714.22 million and USD 320.45 million by 2030, growing with a CAGR of 4.4% and 3.9% for U.S. and Mexico respectively in the forecast period of 2023 to 2030.

- On the basis of form, the U.S. and Mexico cat litter market is segmented into coarse and fine litter. In 2023, the fine litter segment is expected to dominate the U.S. and Mexico cat litter market with a 58.99% and 59.40% market share and is expected to reach USD 2,418.71 million and USD 283.85 million by 2030, growing with a CAGR of 4.5% and 3.9% for U.S. and Mexico respectively in the forecast period of 2023 to 2030.

- On the basis of end user, the U.S. and Mexico cat litter market is segmented into adult cats, kittens. In 2023, the adult cats segment is expected to dominate the U.S. and Mexico cat litter market with a 78.09% and 78.31% market share and is expected to reach USD 3,156.44 million and USD 368.94 million by 2030, growing with a CAGR of 4.3% and 3.7% for U.S. and Mexico respectively in the forecast period of 2023 to 2030.

- On the basis of distribution channel, the U.S. and Mexico cat litter market is segmented into specialized pet shops, e-commerce, hypermarkets/supermarkets, and others. In 2023, the hypermarkets/supermarkets segment is expected to dominate the U.S. and Mexico cat litter market with a 51.63% and 52.10% market share and is expected to reach USD 2,171.81 million and USD 254.98 million by 2030, growing with a CAGR of 4.9% and 4.3% for U.S. and Mexico respectively in the forecast period of 2023 to 2030.

Major Players

Data Bridge Market Research recognizes the following companies as the market players in the U.S. and Mexico cat litter market that include The Clorox Company (California), Nestlé Purina Petcare (Subsidiary of Nestle) (Wiscosin), Oil-Dri Corporation of America.(Illinois), Pettex Limited (Essex), Dr. Elsey's (Wyoming), Sinchem Silica Gel Co., Ltd.(Shandong), Weihai Pearl Silica Gel CO.,Ltd (Shandong), Mars, Incorporated and its Affiliates (Washington), Healthy Pet (Washington), Pestell Pet Products (Canada), Church & Dwight Co., Inc.(New York), sWheat Scoop (Minnesota), Bentaş (Turkey), among others.

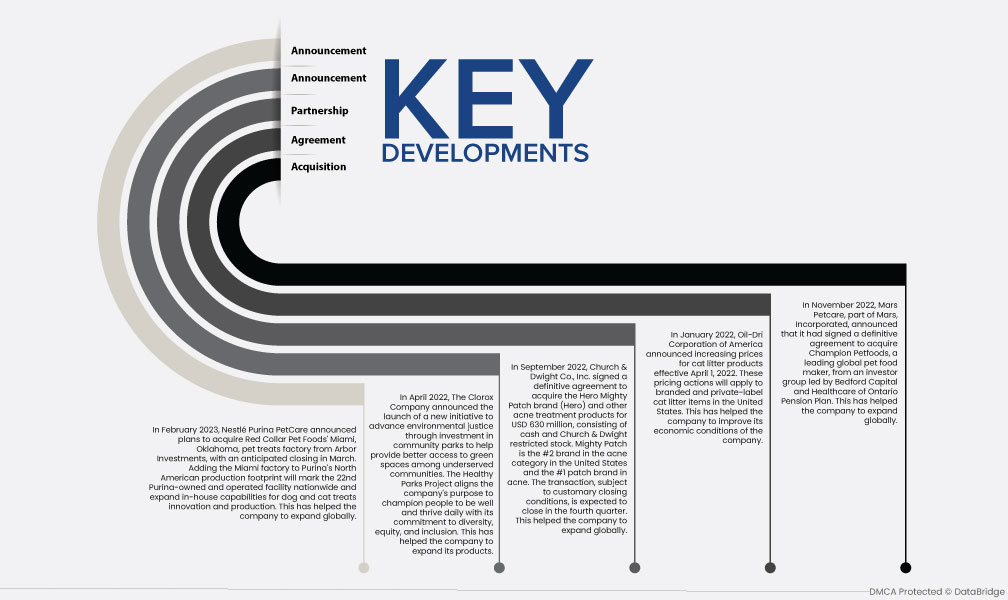

Market Development

- In February 2023, Nestlé Purina PetCare announced plans to acquire Red Collar Pet Foods' Miami, Oklahoma pet treats factory from Arbor Investments, with an anticipated closing in March. The addition of the Miami factory to Purina's North American production footprint will mark the 22nd Purina owned and operated facility nationwide and expand in-house capabilities for dog and cat treats innovation and production. This has helped the company to expand globally.

- In April 2022, The Clorox Company announced the launch of a new initiative to advance environmental justice through investment in community parks to help provide better access to green spaces among underserved communities. The Healthy Parks Project aligns the company's purpose to champion people to be well and thrive every single day with its commitment to diversity, equity and inclusion. This has helped the company to expand their products.

- In September, 2022 Church & Dwight Co., Inc. has signed a definitive agreement to acquire the Hero Mighty Patch brand (Hero) and other acne treatment products for $630 million, consisting of cash and Church & Dwight restricted stock. Mighty Patch is the #2 brand in the acne category in the United States and the #1 patch brand in acne. The transaction, which is subject to customary closing conditions, is expected to close in the fourth quarter. This had helped the company to expand globally.

- In January Oil-Dri Corporation of America announced increasing prices for cat litter products effective April 1, 2022. These pricing actions will apply to branded and private-label cat litter items in the United States. This has helped the company to improve the economic conditions of the company.

- In November 2022, Mars Petcare, part of Mars, Incorporated, announced that it has signed a definitive agreement to acquire Champion Petfoods, a leading global pet food maker, from an investor group led by Bedford Capital and Healthcare of Ontario Pension Plan. This has helped the company to expand globally.

Regional Analysis

Geographically, the countries covered in the cat litter market report are U.S. and Mexico

As per Data Bridge Market Research Analysis:

U.S is the dominant country in the cat litter market during the forecast period 2023-2030

- In 2023, U.S. dominated the cat litter market owing to the higher level of investments by U.S. manufacturers and the increasing prevalence of cat litter products in the U.S. The U.S. will continue to dominate the cat litter market regarding market share and revenue and flourish its dominance during the forecast period. This is due to the growing adoption of advanced technology and the launch of new products in this region. Additionally, the increasing number of cases of pet-owning home and the rising development of litter products are expected further to enhance the market's growth rate in this region.

For more detailed information about the cat litter market report, click here – https://www.databridgemarketresearch.com/reports/us-and-mexico-cat-litter-market