Europe Functional Flour Market

Market Size in USD Billion

CAGR :

%

USD

37.39 Billion

USD

51.65 Billion

2024

2032

USD

37.39 Billion

USD

51.65 Billion

2024

2032

| 2025 –2032 | |

| USD 37.39 Billion | |

| USD 51.65 Billion | |

|

|

|

|

What is the Europe Functional Flour Market Size and Growth Rate?

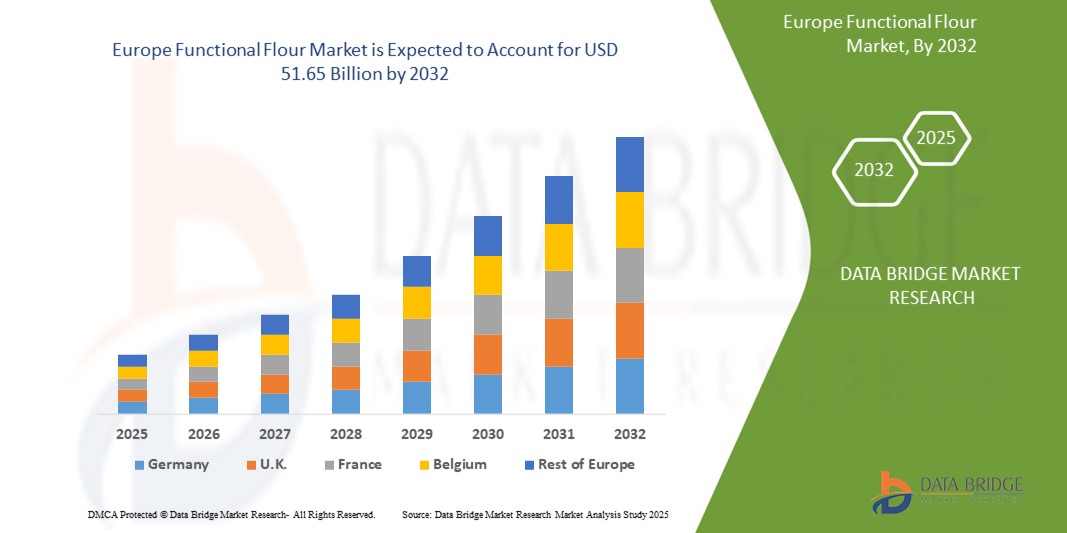

- The Europe functional flour market size was valued at USD 37.39 billion in 2024 and is expected to reach USD 51.65 billion bsy 2032, at a CAGR of 4.12% during the forecast period

- Functional flour market is witnessing significant advancements, fueled by the integration of the latest methods and technologies. This innovation is driving its widespread use across various industries, including food and beverage

- With a focus on health-conscious consumers, the market is experiencing remarkable growth, as functional flours cater to diverse dietary needs while offering enhanced nutritional benefits and improved product quality

What are the Major Takeaways of Functional Flour Market?

- The rise in health consciousness among consumers is fueling demand for functional flours enriched with nutrients such as protein, fiber, vitamins, and minerals. These flours offer healthier alternatives to traditional options, aligning with individuals' dietary preferences and wellness goals

- For instance, almond flour, rich in protein and low in carbohydrates, is gaining popularity among health-conscious consumers seeking gluten-free and nutrient-dense alternatives for baking and cooking needs

- Germany dominated the European functional flour market with the highest revenue share of 56.36% in 2024 with the largest revenue share, driven by the country’s strong bakery and processed food sectors

- U.K. functional flour market is projected to grow at a fastest CAGR through 2032, bolstered by the rising trend of health-forward eating habits and demand for high-protein and allergen-free food solutions

- The Specialty Flour segment dominated the market with the largest revenue share of 57.3% in 2024, driven by rising consumer preference for nutritionally enriched, gluten-free, and fortified flour types

Report Scope and Functional Flour Market Segmentation

|

Attributes |

Functional Flour Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Functional Flour Market?

“Rising Demand for Clean-Label, Nutrient-Rich Flour Alternatives”

- A major and accelerating trend in the functional flour market is the rising consumer demand for clean-label, nutrient-dense alternatives to conventional flour. As health-consciousness grows, both food manufacturers and consumers are prioritizing flours that offer enhanced functional and nutritional benefits without artificial additives

- Functional flours derived from legumes, pulses, quinoa, sorghum, and chia are gaining momentum due to their high protein, fiber, and micronutrient content, making them suitable for gluten-free and plant-based product formulations

- For instance, in May 2024, Epi Ingredients launched an additive-free butter powder, aligning with this clean-label movement and illustrating the growing preference for natural, functional ingredients in food processing

- The trend is also driven by regulatory backing and labeling transparency, encouraging food companies to reformulate their products with clean-label ingredients, including functional flours that support digestive health, sustained energy, and improved texture

- Furthermore, demand from sectors such as sports nutrition, infant formula, and bakery is reinforcing the need for flours that provide functional benefits such as enhanced viscosity, water-binding, and shelf stability

- As a result, manufacturers are increasingly investing in R&D for minimally processed, clean-label functional flours, positioning these ingredients as a crucial component of the evolving health and wellness-driven food landscape

What are the Key Drivers of Functional Flour Market?

- The growing consumer focus on health and wellness, particularly regarding digestive health, blood sugar control, and weight management, is a major driver for the increased adoption of Functional Flour in food applications

- For instance, in May 2025, Danone's Oikos brand launched a protein shake targeting users of GLP-1 medications such as Ozempic and Wegovy, signaling the demand for high-protein, fiber-rich products that support portion control and nutrient absorption

- In addition, the rising prevalence of gluten intolerance and celiac disease, along with a broader consumer shift toward gluten-free diets, is spurring the demand for flours made from alternative grains and pulses, which offer nutritional superiority and improved functional performance in recipes

- Functional flours are increasingly being incorporated into baked goods, snacks, RTE meals, and baby food, driven by their superior texturizing, binding, and nutritional properties compared to conventional wheat flour

- The market is also benefitting from growing product innovation, including high-protein, fiber-rich, and low-GI formulations aimed at athletes, elderly consumers, and children, with producers targeting specialized dietary needs and regional flavor preferences

- These factors, combined with the increasing availability of functional flours across retail and e-commerce platforms, are contributing to the steady growth of this ingredient category across global markets

Which Factor is challenging the Growth of the Functional Flour Market?

- One of the primary challenges in the functional flour market is high product cost and supply inconsistency, particularly for premium raw materials such as teff, quinoa, and amaranth, which can limit large-scale adoption, especially in cost-sensitive regions

- For instance, in October 2024, DairyX developed casein proteins using yeast strains, highlighting the ongoing shift towards sustainable and innovative protein sources—but also underscoring the cost and regulatory hurdles faced by novel ingredients in food applications

- In addition, limited consumer awareness about the health benefits and cooking applications of lesser-known functional flours can hinder their inclusion in household pantries and foodservice menus

- Manufacturers also face technical challenges in processing and formulation, such as ensuring consistency in taste, shelf life, and texture when replacing wheat flour with alternatives such as chickpea, lentil, or rice flours

- Moreover, the lack of standardized regulations or definitions around what constitutes "functional" flour can cause confusion among consumers and producers, impacting transparency and trust

- To overcome these obstacles, the industry must focus on scaling supply chains, educating consumers, and supporting research that demonstrates the health and functional advantages of these innovative flours to encourage broader market penetration

How is the Functional Flour Market Segmented?

The market is segmented on the basis of type, category, source, grade, and application.

• By Type

On the basis of type, the functional flour market is segmented into Specialty Flour and Conventional Flour. The Specialty Flour segment dominated the market with the largest revenue share of 57.3% in 2024, driven by rising consumer preference for nutritionally enriched, gluten-free, and fortified flour types. Specialty flours are widely used in health-conscious food products such as high-fiber bakery goods, protein-rich snacks, and functional beverages.

The Conventional Flour segment is anticipated to register steady growth from 2025 to 2032, supported by its continued use in traditional cooking and large-scale food processing due to cost-effectiveness and wide availability.

• By Category

On the basis of category, the functional flour market is segmented into GMO and Non-GMO. The Non-GMO segment accounted for the largest market share of 64.1% in 2024, fueled by increasing consumer demand for clean-label, organic, and natural food ingredients. Regulatory pressures and growing awareness of food safety are pushing manufacturers toward non-GMO sourcing.

The GMO segment is projected to witness moderate growth, primarily driven by its cost advantages and yield efficiency in large-scale agriculture.

• By Source

On the basis of source, the functional flour market is segmented into Cereals, Legumes, Potato, Tapioca, Chia, and Others. The Cereals segment dominated the market with a revenue share of 38.6% in 2024, owing to the widespread use of wheat, rice, and corn flours in global food applications. These flours are favored for their versatility, affordability, and established consumer acceptance.

The Legumes segment is anticipated to grow at the fastest rate through 2032, driven by its high protein content and rising popularity among plant-based and vegan product developers.

• By Grade

On the basis of grade, the functional flour market is segmented into Food Grade and Feed Grade. The Food Grade segment held the largest market revenue share of 72.8% in 2024, driven by its extensive use in the human food supply chain, including bakery, snacks, baby food, and clinical nutrition.

The Feed Grade segment is expected to grow steadily, supported by increasing livestock production and the need for fortified animal feed solutions.

• By Application

On the basis of application, the functional flour market is segmented into Bakery and Confectionery Products, Convenience Food, Sport Nutrition, Infant Formula, Meat, Poultry and Seafood, Animal Feed, Beverages, Nutritional Bar, Nutritional Supplements, and Dairy Products. The Bakery and Confectionery Products segment dominated the market with a share of 24.9% in 2024, driven by strong demand for improved texture, structure, and shelf life in breads, pastries, and sweets.

The Sport Nutrition segment is anticipated to grow at the highest CAGR from 2025 to 2032, propelled by the fitness boom and rising demand for functional, high-protein, and recovery-enhancing food products among athletes and active consumers.

Which Region Holds the Largest Share of the functional flour Market?

- Germany dominated the European functional flour market with the highest revenue share of 56.36% in 2024 with the largest revenue share, driven by the country’s strong bakery and processed food sectors

- Consumers are increasingly opting for nutritional upgrades to traditional staples, favoring products made from high-protein, low-glycemic flours

- Germany’s reputation for food innovation and its robust distribution infrastructure contribute to the wide availability and trust in Functional Flour products across health-conscious demographics

U.K. Functional Flour Market Insight

U.K. functional flour market is projected to grow at a fastest CAGR through 2032, bolstered by the rising trend of health-forward eating habits and demand for high-protein and allergen-free food solutions. A surge in plant-based diets and interest in functional ingredients is prompting both manufacturers and consumers to explore novel flour types, including legume-based and fiber-rich options. The U.K.’s dynamic foodservice industry and expansion of clean-label product lines support sustained growth in the category.

France Functional Flour Market Insight

France is witnessing steady growth in the functional flour market, underpinned by increasing interest in organic, non-GMO, and artisanal food products. Functional Flours are being integrated into traditional French baked goods and snacks to meet evolving dietary preferences without compromising flavor and texture. Supportive government policies promoting sustainable agriculture and nutrition-focused food innovation also play a key role in driving market momentum.

Which are the Top Companies in Functional Flour Market?

The functional flour industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Roquette Frères (France)

- Ingredion (U.S.)

- AGRANA Beteiligungs-AG (Austria)

- Limagrain - Ingrédients (France)

- Goodmills (Austria)

- EUROGERM SAS (France)

- P&H Milling, Inc. (Canada)

- Associated British Foods plc (U.S.)

- General Mills, Inc. (U.S.)

What are the Recent Developments in Europe Functional Flour Market?

- In April 2023, Cargill's innovative product, SimPure RF, a soluble rice flour alternative to maltodextrin, showcases advancements in the functional flour market. Its high solubility and neutral flavor enhance various foods, meeting consumer demands for healthier options. This aligns with the food industry's trend towards clean label and natural ingredients

- In June 2022, The merger of EUROGERM USA and KB INGREDIENTS into EUROGERM KB LLC marks a significant move in the functional flour market. This consolidation aims to develop innovative, nutritionally enhanced baked goods, addressing the growing demand for healthier options and catering to evolving consumer preferences

- In October 2021, Cargill introduced a rice flour-based maltodextrin substitute, SimPure rice flour, offering a clean label with similar taste, texture, and functionality as maltodextrin. This versatile ingredient serves as a one-to-one replacement, reflecting Cargill's commitment to providing solutions that meet consumer demand for healthier and more natural products

- In July 2021, Ulrick & Short launched fazenda Nutrigel, a functional flour designed to improve viscosity, texture, and structure in gluten-free bakery applications. This addition to their product range addresses specific needs in the market, enhancing moisture, softness, and structure across various bakery products while catering to dietary preferences

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FUNCTIONAL FLOUR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE FUNCTIONAL FLOUR MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE FUNCTIONAL FLOUR MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 SUPPLY CHAIN ANALYSIS

11.1 OVERVIEW

11.2 LOGISTIC COST SCENARIO

11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

12 CLIMATE CHANGE SCENARIO

12.1 ENVIRONMENTAL CONCERNS

12.2 INDUSTRY RESPONSE

12.3 GOVERNMENT’S ROLE

12.4 ANALYST RECOMMENDATIONS

13 EUROPE FUNCTIONAL FLOUR MARKET, BY TYPE, 2018-2032, (USD MILLION) (KILO TONS)

13.1 OVERVIEW

13.2 LEGUMES

13.2.1 BEAN FLOUR

13.2.2 FAVA BEAN FLOUR & FOUR BLENDS

13.2.3 CHICKPEA FLOUR

13.2.4 PEA FLOUR

13.2.5 LENTIL FLOUR

13.2.6 SOY FLOUR

13.2.7 OTHERS

13.3 CEREALS

13.3.1 CORN FLOUR

13.3.2 BARLEY FLOUR

13.3.3 WHEAT FLOUR

13.3.4 BUCHWHEET FLOUR

13.3.5 AMARANTH FLOUR

13.3.6 TEFF FLOUR

13.3.7 RICE FLOUR

13.3.7.1. WHITE

13.3.7.2. BROWN

13.3.8 OAT FLOUR

13.3.9 MAIZE FLOUR

13.3.10 RYE FLOUR

13.3.11 QUINOA FLOUR

13.3.12 SORGHUM FLOUR

13.3.13 OTHERS

13.4 COCONUT FLOUR

13.5 ALMOND FLOUR

13.6 ARROWROOT FLOUR

13.7 TAPIOCA FLOUR

13.8 CASSAVA FLOUR

13.9 GREEN BANANA FLOUR

13.1 GRAPE SEED FLOUR

13.11 BANANA FLOUR

13.12 POTATO FLOUR

13.13 SWEET POTATO FLOUR

13.14 OTHERS

14 EUROPE FUNCTIONAL FLOUR MARKET, BY NATURE, 2018-2032, (USD MILLION)

14.1 OVERVIEW

14.2 ORGANIC

14.2.1 ORGANIC, BY FLOUR TYPE

14.2.1.1. LEGUMES

14.2.1.1.1. BEAN FLOUR

14.2.1.1.2. FAVA BEAN FLOUR & FOUR BLENDS

14.2.1.1.3. CHICKPEA FLOUR

14.2.1.1.4. PEA FLOUR

14.2.1.1.5. LENTIL FLOUR

14.2.1.1.6. SOY FLOUR

14.2.1.1.7. OTHERS

14.2.1.2. CEREALS

14.2.1.2.1. CORN FLOUR

14.2.1.2.2. BARLEY FLOUR

14.2.1.2.3. WHEAT FLOUR

14.2.1.2.4. BUCHWHEET FLOUR

14.2.1.2.5. AMARANTH FLOUR

14.2.1.2.6. TEFF FLOUR

14.2.1.2.7. RICE FLOUR

14.2.1.2.7.1 WHITE

14.2.1.2.7.2 BROWN

14.2.1.2.8. OAT FLOUR

14.2.1.2.9. MAIZE FLOUR

14.2.1.2.10. RYE FLOUR

14.2.1.2.11. QUINOA FLOUR

14.2.1.2.12. SORGHUM FLOUR

14.2.1.2.13. OTHERS

14.2.1.3. COCONUT FLOUR

14.2.1.4. ALMOND FLOUR

14.2.1.5. ARROWROOT FLOUR

14.2.1.6. TAPIOCA FLOUR

14.2.1.7. CASSAVA FLOUR

14.2.1.8. GREEN BANANA FLOUR

14.2.1.9. GRAPE SEED FLOUR

14.2.1.10. BANANA FLOUR

14.2.1.11. POTATO FLOUR

14.2.1.12. SWEET POTATO FLOUR

14.2.1.13. OTHERS

14.3 CONVENTIONAL

14.3.1 CONVENTIONAL, BY FLOUR TYPE

14.3.1.1. LEGUMES

14.3.1.1.1. BEAN FLOUR

14.3.1.1.2. FAVA BEAN FLOUR & FOUR BLENDS

14.3.1.1.3. CHICKPEA FLOUR

14.3.1.1.4. PEA FLOUR

14.3.1.1.5. LENTIL FLOUR

14.3.1.1.6. SOY FLOUR

14.3.1.1.7. OTHERS

14.3.1.2. CEREALS

14.3.1.2.1. CORN FLOUR

14.3.1.2.2. BARLEY FLOUR

14.3.1.2.3. WHEAT FLOUR

14.3.1.2.4. BUCHWHEET FLOUR

14.3.1.2.5. AMARANTH FLOUR

14.3.1.2.6. TEFF FLOUR

14.3.1.2.7. RICE FLOUR

14.3.1.2.7.1 WHITE

14.3.1.2.7.2 BROWN

14.3.1.2.8. OAT FLOUR

14.3.1.2.9. MAIZE FLOUR

14.3.1.2.10. RYE FLOUR

14.3.1.2.11. QUINOA FLOUR

14.3.1.2.12. SORGHUM FLOUR

14.3.1.2.13. OTHERS

14.3.1.3. COCONUT FLOUR

14.3.1.4. ALMOND FLOUR

14.3.1.5. ARROWROOT FLOUR

14.3.1.6. TAPIOCA FLOUR

14.3.1.7. CASSAVA FLOUR

14.3.1.8. GREEN BANANA FLOUR

14.3.1.9. GRAPE SEED FLOUR

14.3.1.10. BANANA FLOUR

14.3.1.11. POTATO FLOUR

14.3.1.12. SWEET POTATO FLOUR

14.3.1.13. OTHERS

15 EUROPE FUNCTIONAL FLOUR MARKET, BY CATEGORY, 2018-2032, (USD MILLION)

15.1 OVERVIEW

15.2 ENZYME TREATED

15.2.1 DIASTATIC

15.2.2 MALTED

15.3 GLUTEN-FREE

15.4 EXTRUDED AND PARTIALLY TRANSFORMED

15.5 PRE-GELATINIZED

15.6 PRE-COOKED

15.7 FORTIFIED

15.8 THERMALLY TREATED

15.9 SPECIALTY FLOUR

15.1 OTHERS

16 EUROPE FUNCTIONAL FLOUR MARKET, BY PROCESSING METHOD, 2018-2032, (USD MILLION)

16.1 OVERVIEW

16.2 WET PROCESSING

16.3 DRY PROCESSING

17 EUROPE FUNCTIONAL FLOUR MARKET, BY FUNCTION, 2018-2032, (USD MILLION)

17.1 OVERVIEW

17.2 THICKENING AGENT

17.3 BINDING AGENT

17.4 NUTRITIONAL ENRICHMENT

17.5 FLAVOR ENHANCEMENT

17.6 GLUTEN-FREE ALTERNATIVES

17.7 STARCH REPLACEMENT

17.8 HYDRATION IMPROVEMENT

17.9 OTHERS

18 EUROPE FUNCTIONAL FLOUR MARKET, BY APPLICATION, 2018-2032, (USD MILLION)

18.1 OVERVIEW

18.2 FOOD

18.2.1 FOOD, BY TYPE

18.2.1.1. DAIRY PRODUCTS

18.2.1.1.1. YOGHURT

18.2.1.1.2. CHEESE

18.2.1.1.3. ICE CREAM

18.2.1.1.4. BUTTER

18.2.1.1.5. OTHERS

18.2.1.2. BAKERY

18.2.1.2.1. COOKIES & BISCUITS

18.2.1.2.2. BREADS & ROLLS

18.2.1.2.3. CAKES & PASTRIES

18.2.1.2.4. DONUTS

18.2.1.2.5. MUFFINS

18.2.1.2.6. OTHERS

18.2.1.3. CONFECTIONERY

18.2.1.3.1. GUMMIES

18.2.1.3.2. HARD CANDIES

18.2.1.3.3. SUGAR CONFECTIONERY

18.2.1.3.4. HARD-BOILED SWEETS

18.2.1.3.5. MINTS

18.2.1.3.6. GUMS & JELLIES

18.2.1.3.7. CHOCOLATE

18.2.1.3.8. CHOCOLATE SYRUPS

18.2.1.3.9. CARAMELS & TOFFEES

18.2.1.3.10. OTHERS

18.2.1.4. PROCESSED FOOD

18.2.1.4.1. PASTA

18.2.1.4.2. NOODLES

18.2.1.4.3. EXTRUDED SNACKS

18.2.1.4.4. SOUPS AND SAUCES

18.2.1.4.5. OTHERS

18.2.1.5. FROZEN DESSERTS

18.2.1.5.1. GELATO

18.2.1.5.2. CUSTARD

18.2.1.5.3. OTHERS

18.2.1.6. BREAKFAST CEREALS

18.2.1.7. INFANT FORMULA

18.2.1.7.1. GROWING UP MILK

18.2.1.7.2. STANDARD INFANT FORMULA

18.2.1.7.3. FOLLOW-ON FORMULA

18.2.1.7.4. SPECIALITY FORMULA

18.2.1.7.5. OTHERS

18.2.1.8. SPORTS NUTRITION

18.2.1.8.1. SPORTS NUTRITION BAR

18.2.1.8.2. SPORTS PROTEIN POWDER

18.2.1.8.3. OTHERS

18.2.1.9. DRESSINGS AND SEASONINGS

18.2.1.10. DAIRY ALTERNATIVE FOOD

18.2.1.11. MEAT & POULTRY PRODUCTS

18.2.1.12. OTHERS

18.2.2 FOOD, BY FLOUR TYPE

18.2.2.1. LEGUMES

18.2.2.1.1. BEAN FLOUR

18.2.2.1.2. FAVA BEAN FLOUR & FOUR BLENDS

18.2.2.1.3. CHICKPEA FLOUR

18.2.2.1.4. PEA FLOUR

18.2.2.1.5. LENTIL FLOUR

18.2.2.1.6. SOY FLOUR

18.2.2.1.7. OTHERS

18.2.2.2. CEREALS

18.2.2.2.1. CORN FLOUR

18.2.2.2.2. BARLEY FLOUR

18.2.2.2.3. WHEAT FLOUR

18.2.2.2.4. BUCHWHEET FLOUR

18.2.2.2.5. AMARANTH FLOUR

18.2.2.2.6. TEFF FLOUR

18.2.2.2.7. RICE FLOUR

18.2.2.2.7.1 WHITE

18.2.2.2.7.2 BROWN

18.2.2.2.8. OAT FLOUR

18.2.2.2.9. MAIZE FLOUR

18.2.2.2.10. RYE FLOUR

18.2.2.2.11. QUINOA FLOUR

18.2.2.2.12. SORGHUM FLOUR

18.2.2.2.13. OTHERS

18.2.2.3. COCONUT FLOUR

18.2.2.4. ALMOND FLOUR

18.2.2.5. ARROWROOT FLOUR

18.2.2.6. TAPIOCA FLOUR

18.2.2.7. CASSAVA FLOUR

18.2.2.8. GREEN BANANA FLOUR

18.2.2.9. GRAPE SEED FLOUR

18.2.2.10. BANANA FLOUR

18.2.2.11. POTATO FLOUR

18.2.2.12. SWEET POTATO FLOUR

18.2.2.13. OTHERS

18.3 BEVERAGES

18.3.1 BEVERAGES, BY TYPE

18.3.1.1. PLANT-BASED YOGURT DRINKS

18.3.1.1.1. SOY

18.3.1.1.2. ALMOND

18.3.1.1.3. CASHEW

18.3.1.1.4. RICE

18.3.1.1.5. COCONUT

18.3.1.1.6. OTHERS

18.3.1.1.7. JUICES

18.3.1.2. SODA DRINKS

18.3.1.3. KOMBUCHA DRINKS

18.3.1.4. PROBIOTIC WATER

18.3.1.5. HEALTH DRINKS

18.3.1.5.1. IMMUNITY BOOSTERS

18.3.1.5.2. GUT SHOTS

18.3.1.5.3. ELECTROLYTE HYDRATION DRINKS

18.3.1.5.4. PROTEIN DRINKS

18.3.1.5.5. OTHERS

18.3.1.6. DAIRY BASED DRINKS

18.3.1.7. OTHERS

18.3.2 BEVERAGES, BY FLOUR TYPE

18.3.2.1. LEGUMES

18.3.2.1.1. BEAN FLOUR

18.3.2.1.2. FAVA BEAN FLOUR & FOUR BLENDS

18.3.2.1.3. CHICKPEA FLOUR

18.3.2.1.4. PEA FLOUR

18.3.2.1.5. LENTIL FLOUR

18.3.2.1.6. SOY FLOUR

18.3.2.1.7. OTHERS

18.3.2.2. CEREALS

18.3.2.2.1. CORN FLOUR

18.3.2.2.2. BARLEY FLOUR

18.3.2.2.3. WHEAT FLOUR

18.3.2.2.4. BUCHWHEET FLOUR

18.3.2.2.5. AMARANTH FLOUR

18.3.2.2.6. TEFF FLOUR

18.3.2.2.7. RICE FLOUR

18.3.2.2.7.1 WHITE

18.3.2.2.7.2 BROWN

18.3.2.2.8. OAT FLOUR

18.3.2.2.9. MAIZE FLOUR

18.3.2.2.10. RYE FLOUR

18.3.2.2.11. QUINOA FLOUR

18.3.2.2.12. SORGHUM FLOUR

18.3.2.2.13. OTHERS

18.3.2.3. COCONUT FLOUR

18.3.2.4. ALMOND FLOUR

18.3.2.5. ARROWROOT FLOUR

18.3.2.6. TAPIOCA FLOUR

18.3.2.7. CASSAVA FLOUR

18.3.2.8. GREEN BANANA FLOUR

18.3.2.9. GRAPE SEED FLOUR

18.3.2.10. BANANA FLOUR

18.3.2.11. POTATO FLOUR

18.3.2.12. SWEET POTATO FLOUR

18.3.2.13. OTHERS

18.4 ANIMAL FEED

18.4.1 ANIMAL FEED, BY TYPE

18.4.1.1. POULTRY

18.4.1.1.1. BROILERS

18.4.1.1.2. LAYERS

18.4.1.1.3. BREEDERS

18.4.1.1.4. CHICKS & POULTS

18.4.1.1.5. OTHERS

18.4.1.2. RUMINANTS

18.4.1.2.1. CALVES

18.4.1.2.2. DAIRY CATTLE

18.4.1.2.3. BEEF CATTLE

18.4.1.2.4. OTHERS

18.4.1.3. SWINE

18.4.1.3.1. STARTER

18.4.1.3.2. GROWER

18.4.1.3.3. SOW

18.4.1.3.4. OTHERS

18.4.1.4. PET

18.4.1.4.1. CAT

18.4.1.4.2. DOG

18.4.1.4.3. RABBIT

18.4.1.4.4. HORSE

18.4.1.4.5. MICE

18.4.1.4.6. OTHERS

18.4.1.5. AQUATIC ANIMAL

18.4.1.5.1. FISH

18.4.1.5.1.1 TILAPIA

18.4.1.5.1.2 SALMON

18.4.1.5.1.3 CARP

18.4.1.5.1.4 TROUT

18.4.1.5.1.5 OTHERS

18.4.1.5.2. CRUSTACEANS

18.4.1.5.2.1 SHRIMP

18.4.1.5.2.2 CRABS

18.4.1.5.2.3 KRILL

18.4.1.5.2.4 OTHERS

18.4.1.5.3. MOLLUSKS

18.4.1.5.3.1 OYSTERS

18.4.1.5.3.2 MUSSELS

18.4.1.5.3.3 OTHERS

18.4.1.5.4. OTHERS

18.4.2 ANIMAL FEED, BY FLOUR TYPE

18.4.2.1. LEGUMES

18.4.2.1.1. BEAN FLOUR

18.4.2.1.2. FAVA BEAN FLOUR & FOUR BLENDS

18.4.2.1.3. CHICKPEA FLOUR

18.4.2.1.4. PEA FLOUR

18.4.2.1.5. LENTIL FLOUR

18.4.2.1.6. SOY FLOUR

18.4.2.1.7. OTHERS

18.4.2.2. CEREALS

18.4.2.2.1. CORN FLOUR

18.4.2.2.2. BARLEY FLOUR

18.4.2.2.3. WHEAT FLOUR

18.4.2.2.4. BUCHWHEET FLOUR

18.4.2.2.5. AMARANTH FLOUR

18.4.2.2.6. TEFF FLOUR

18.4.2.2.7. RICE FLOUR

18.4.2.2.7.1 WHITE

18.4.2.2.7.2 BROWN

18.4.2.2.8. OAT FLOUR

18.4.2.2.9. MAIZE FLOUR

18.4.2.2.10. RYE FLOUR

18.4.2.2.11. QUINOA FLOUR

18.4.2.2.12. SORGHUM FLOUR

18.4.2.2.13. OTHERS

18.4.2.3. COCONUT FLOUR

18.4.2.4. ALMOND FLOUR

18.4.2.5. ARROWROOT FLOUR

18.4.2.6. TAPIOCA FLOUR

18.4.2.7. CASSAVA FLOUR

18.4.2.8. GREEN BANANA FLOUR

18.4.2.9. GRAPE SEED FLOUR

18.4.2.10. BANANA FLOUR

18.4.2.11. POTATO FLOUR

18.4.2.12. SWEET POTATO FLOUR

18.4.2.13. OTHERS

18.5 PERSONAL CARE AND COSMETICS

18.5.1 PERSONAL CARE AND COSMETICS, BY TYPE

18.5.1.1. FACIAL CARE PRODUCTS

18.5.1.1.1. CREAMS & LOTIONS

18.5.1.1.2. SERUMS

18.5.1.1.3. SCRUBS & MASKS

18.5.1.1.4. OTHERS

18.5.1.2. HAIR CARE PRODUCTS

18.5.1.2.1. SHAMPOO

18.5.1.2.2. CONDITIONERS

18.5.1.2.3. OTHERS

18.5.1.3. MAKE-UP PRODUCTS

18.5.1.4. SPRAY PERFUMES

18.5.1.5. BODY CARE PRODUCTS

18.5.1.6. OTHERS

18.5.2 PERSONAL CARE AND COSMETICS, BY FLOUR TYPE

18.5.2.1. LEGUMES

18.5.2.1.1. BEAN FLOUR

18.5.2.1.2. FAVA BEAN FLOUR & FOUR BLENDS

18.5.2.1.3. CHICKPEA FLOUR

18.5.2.1.4. PEA FLOUR

18.5.2.1.5. LENTIL FLOUR

18.5.2.1.6. SOY FLOUR

18.5.2.1.7. OTHERS

18.5.2.2. CEREALS

18.5.2.2.1. CORN FLOUR

18.5.2.2.2. BARLEY FLOUR

18.5.2.2.3. WHEAT FLOUR

18.5.2.2.4. BUCHWHEET FLOUR

18.5.2.2.5. AMARANTH FLOUR

18.5.2.2.6. TEFF FLOUR

18.5.2.2.7. RICE FLOUR

18.5.2.2.7.1 WHITE

18.5.2.2.7.2 BROWN

18.5.2.2.8. OAT FLOUR

18.5.2.2.9. MAIZE FLOUR

18.5.2.2.10. RYE FLOUR

18.5.2.2.11. QUINOA FLOUR

18.5.2.2.12. SORGHUM FLOUR

18.5.2.2.13. OTHERS

18.5.2.3. COCONUT FLOUR

18.5.2.4. ALMOND FLOUR

18.5.2.5. ARROWROOT FLOUR

18.5.2.6. TAPIOCA FLOUR

18.5.2.7. CASSAVA FLOUR

18.5.2.8. GREEN BANANA FLOUR

18.5.2.9. GRAPE SEED FLOUR

18.5.2.10. BANANA FLOUR

18.5.2.11. POTATO FLOUR

18.5.2.12. SWEET POTATO FLOUR

18.5.2.13. OTHERS

18.6 PHARMACEUTICALS

18.6.1 PHARMACEUTICALS, BY TYPE

18.6.1.1. GASTROINTESTINAL HEALTH

18.6.1.2. IMMUNE SYSTEM MODULATION

18.6.1.3. ALLERGY MANAGEMENT

18.6.1.4. METABOLIC DISORDERS

18.6.1.5. MENTAL HEALTH (PSYCHOBIOTICS)

18.6.1.6. CARDIOVASCULAR HEALTH

18.6.1.7. INTESTINAL DISORDERS

18.6.1.8. LACTOSE INTOLERANCE

18.6.1.9. INFLAMMATORY BOWEL DISORDERS

18.6.1.10. RESPIRATORY INFECTIONS

18.6.1.11. OBESITY

18.6.1.12. UROGENITAL INFECTIONS

18.6.1.12.1. TYPE-2 DIABETES

18.6.1.12.2. CANCER

18.6.1.13. ORAL AND DENTAL HEALTH

18.6.1.14. OTHERS

18.6.2 PHARMACEUTICALS, BY PRODUCT FORM

18.6.2.1. TABLETS

18.6.2.2. PROBIOTIC DRINKS

18.6.2.3. POWDERS

18.6.2.4. CAPSULES

18.6.2.5. OTHERS

18.6.3 PHARMACEUTICALS, BY FLOUR TYPE

18.6.3.1. LEGUMES

18.6.3.1.1. BEAN FLOUR

18.6.3.1.2. FAVA BEAN FLOUR & FOUR BLENDS

18.6.3.1.3. CHICKPEA FLOUR

18.6.3.1.4. PEA FLOUR

18.6.3.1.5. LENTIL FLOUR

18.6.3.1.6. SOY FLOUR

18.6.3.1.7. OTHERS

18.6.3.2. CEREALS

18.6.3.2.1. CORN FLOUR

18.6.3.2.2. BARLEY FLOUR

18.6.3.2.3. WHEAT FLOUR

18.6.3.2.4. BUCHWHEET FLOUR

18.6.3.2.5. AMARANTH FLOUR

18.6.3.2.6. TEFF FLOUR

18.6.3.2.7. RICE FLOUR

18.6.3.2.7.1 WHITE

18.6.3.2.7.2 BROWN

18.6.3.2.8. OAT FLOUR

18.6.3.2.9. MAIZE FLOUR

18.6.3.2.10. RYE FLOUR

18.6.3.2.11. QUINOA FLOUR

18.6.3.2.12. SORGHUM FLOUR

18.6.3.2.13. OTHERS

18.6.3.3. COCONUT FLOUR

18.6.3.4. ALMOND FLOUR

18.6.3.5. ARROWROOT FLOUR

18.6.3.6. TAPIOCA FLOUR

18.6.3.7. CASSAVA FLOUR

18.6.3.8. GREEN BANANA FLOUR

18.6.3.9. GRAPE SEED FLOUR

18.6.3.10. BANANA FLOUR

18.6.3.11. POTATO FLOUR

18.6.3.12. SWEET POTATO FLOUR

18.6.3.13. OTHERS

18.7 OTHERS

19 EUROPE FUNCTIONAL FLOUR MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: EUROPE

19.2 MERGERS & ACQUISITIONS

19.3 NEW PRODUCT DEVELOPMENT & APPROVALS

19.4 EXPANSIONS & PARTNERSHIP

19.5 REGULATORY CHANGES

20 EUROPE FUNCTIONAL FLOUR MARKET, BY GEOGRAPHY, 2018-2032, (USD MILLION) (KILO TONS)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

20.1 EUROPE

20.1.1 GERMANY

20.1.2 U.K.

20.1.3 ITALY

20.1.4 FRANCE

20.1.5 SPAIN

20.1.6 SWITZERLAND

20.1.7 NETHERLANDS

20.1.8 LUXEMBOURG

20.1.9 BELGIUM

20.1.10 RUSSIA

20.1.11 TURKEY

20.1.12 NORWAY

20.1.13 SWEDEN

20.1.14 FINLAND

20.1.15 DENMARK

20.1.16 POLAND

20.1.17 REST OF EUROPE

21 EUROPE FUNCTIONAL FLOUR MARKET, SWOT & DBMR ANALYSIS

22 EUROPE FUNCTIONAL FLOUR MARKET, COMPANY PROFILES

22.1 BOBS RED MILLS

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENTS

22.2 EMIGRAIN, INC.

22.2.1 COMPANY OVERVIEW

22.2.2 REVENUE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENTS

22.3 BUHLER GROUP

22.3.1 COMPANY OVERVIEW

22.3.2 REVENUE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 RECENT DEVELOPMENTS

22.4 UNICORN GRAIN SPECIALTIES

22.4.1 COMPANY OVERVIEW

22.4.2 REVENUE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT DEVELOPMENTS

22.5 INGREDION

22.5.1 COMPANY OVERVIEW

22.5.2 REVENUE ANALYSIS

22.5.3 PRODUCT PORTFOLIO

22.5.4 RECENT DEVELOPMENTS

22.6 CAREMOLI SPA

22.6.1 COMPANY OVERVIEW

22.6.2 REVENUE ANALYSIS

22.6.3 PRODUCT PORTFOLIO

22.6.4 RECENT DEVELOPMENTS

22.7 KALIZEA

22.7.1 COMPANY OVERVIEW

22.7.2 REVENUE ANALYSIS

22.7.3 PRODUCT PORTFOLIO

22.7.4 RECENT DEVELOPMENTS

22.8 ABF INGREDIENTS (A SUBSIDIARY OF ASSOCIATED BRITISH FOODS PLC)

22.8.1 COMPANY OVERVIEW

22.8.2 REVENUE ANALYSIS

22.8.3 PRODUCT PORTFOLIO

22.8.4 RECENT DEVELOPMENTS

22.9 AGRANA BETEILIGUNGS-AG

22.9.1 COMPANY OVERVIEW

22.9.2 REVENUE ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENTS

22.1 MÜHLENCHEMIE GMBH & CO.KG

22.10.1 COMPANY OVERVIEW

22.10.2 REVENUE ANALYSIS

22.10.3 PRODUCT PORTFOLIO

22.10.4 RECENT DEVELOPMENTS

22.11 LIMAGRAIN INGREDIENTSINGREDION INCORPORATED

22.11.1 COMPANY OVERVIEW

22.11.2 REVENUE ANALYSIS

22.11.3 PRODUCT PORTFOLIO

22.11.4 RECENT DEVELOPMENTS

22.12 ADM

22.12.1 COMPANY OVERVIEW

22.12.2 REVENUE ANALYSIS

22.12.3 PRODUCT PORTFOLIO

22.12.4 RECENT DEVELOPMENTS

22.13 GENERAL MILLS INC

22.13.1 COMPANY OVERVIEW

22.13.2 REVENUE ANALYSIS

22.13.3 PRODUCT PORTFOLIO

22.13.4 RECENT DEVELOPMENTS

22.14 GOODMILLS INNOVATION GMBH

22.14.1 COMPANY OVERVIEW

22.14.2 REVENUE ANALYSIS

22.14.3 PRODUCT PORTFOLIO

22.14.4 RECENT DEVELOPMENTS

22.15 BAKELS SWEDEN

22.15.1 COMPANY OVERVIEW

22.15.2 REVENUE ANALYSIS

22.15.3 PRODUCT PORTFOLIO

22.15.4 RECENT DEVELOPMENTS

22.16 CARGILL, INCORPORATED

22.16.1 COMPANY OVERVIEW

22.16.2 REVENUE ANALYSIS

22.16.3 PRODUCT PORTFOLIO

22.16.4 RECENT DEVELOPMENTS

22.17 BUNGE LIMITED

22.17.1 COMPANY OVERVIEW

22.17.2 REVENUE ANALYSIS

22.17.3 PRODUCT PORTFOLIO

22.17.4 RECENT DEVELOPMENTS

22.18 DASCA GROUP

22.18.1 COMPANY OVERVIEW

22.18.2 REVENUE ANALYSIS

22.18.3 PRODUCT PORTFOLIO

22.18.4 RECENT DEVELOPMENTS

22.19 SCOULAR COMPANY

22.19.1 COMPANY OVERVIEW

22.19.2 REVENUE ANALYSIS

22.19.3 PRODUCT PORTFOLIO

22.19.4 RECENT DEVELOPMENTS

22.2 THE HAIN CELESTIAL GROUP, INC.

22.20.1 COMPANY OVERVIEW

22.20.2 REVENUE ANALYSIS

22.20.3 PRODUCT PORTFOLIO

22.20.4 RECENT DEVELOPMENTS

22.21 SUNOPTA, INC.

22.21.1 COMPANY OVERVIEW

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 RECENT DEVELOPMENTS

22.22 PARRISH AND HEIMBECKER, LIMITED

22.22.1 COMPANY OVERVIEW

22.22.2 REVENUE ANALYSIS

22.22.3 PRODUCT PORTFOLIO

22.22.4 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23 RELATED REPORTS

24 CONCLUSION

25 QUESTIONNAIRE

26 ABOUT DATA BRIDGE MARKET RESEARCH

Europe Functional Flour Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Functional Flour Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Functional Flour Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.