Global Flavored Camel Milk Market

Market Size in USD Billion

CAGR :

%

USD

1.82 Billion

USD

3.57 Billion

2024

2032

USD

1.82 Billion

USD

3.57 Billion

2024

2032

| 2025 –2032 | |

| USD 1.82 Billion | |

| USD 3.57 Billion | |

|

|

|

|

Flavored Camel Milk Market Analysis

The flavored camel milk market is experiencing significant growth due to increasing consumer demand for nutritious and unique dairy alternatives. Camel milk, known for its rich nutrient profile and easy digestibility, is gaining traction among health-conscious individuals and those with lactose intolerance. The introduction of flavored variants such as milk chocolate, vanilla, and strawberry enhances its appeal, especially among children and younger demographics. Rising awareness of camel milk's health benefits, including its role in managing diabetes and boosting immunity, further drives market expansion. Key players are innovating with new flavors and convenient packaging to meet evolving consumer preferences. Recent developments include partnerships with specialty stores and the launch of online sales platforms to expand reach. Growing interest in natural and functional beverages is expected to propel the flavored camel milk market, making it a promising segment in the dairy industry.

Flavored Camel Milk Market Size

The global flavored camel milk market size was valued at USD 1.82 billion in 2024 and is projected to reach USD 3.57 billion by 2032, with a CAGR of 8.80% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Flavored Camel Milk Market Trends

“Rise of Functional Beverages”

The flavored camel milk market is witnessing growing popularity as consumers seek healthier and unique dairy alternatives. Camel milk is increasingly favored by health-conscious individuals and those with lactose intolerance. Innovations in flavor offerings, such as chocolate, vanilla, and exotic fruits, are driving its appeal among younger demographics and expanding its consumer base. A key trend shaping the market is the rise of functional beverages, with flavored camel milk being positioned as a natural and nutrient-rich option. Enhanced by attractive packaging and increased availability through online channels, the market is poised for steady growth, reflecting the global shift toward health-focused and premium dairy products.

Report Scope and Flavored Camel Milk Market Segmentation

|

Attributes |

Flavored Camel Milk Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Camelicious (UAE), Desert Farms, Inc. (U.S.), Tiviski pvt Ltd. (Mauritania), Aadvik Foods (India), Kamelenmelk (Netherlands), QCamel (Australia), The Camel Milk Co. Australia Pty Ltd. (Australia), UK Camel Milk Ltd. (U.K.) Shiva Dairy Pvt Ltd (India), Desert Farms, Inc. (U.S.), Al Ain Farms (U.A.E.), Queensland Camel Milk (Australia), and Almarai (Saudi Arabia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Flavored Camel Milk Market Definition

Flavored camel milk is a dairy product derived from camel milk, infused with various flavors such as chocolate, vanilla, strawberry, or other natural and artificial additives to enhance its taste. It retains the nutritional benefits of camel milk, including its high vitamin, mineral, and protein content, while catering to diverse consumer preferences. Flavored camel milk is marketed as a healthier alternative to traditional flavored dairy products, appealing to individuals with lactose intolerance, health-conscious consumers, and those seeking unique beverage options. This product is available in various forms, including ready-to-drink beverages, powders, and frozen options, making it versatile for different consumption needs.

Flavored Camel Milk Market Dynamics

Drivers

- Rising Health Consciousness

Growing consumer awareness about the health benefits of camel milk is significantly driving the flavored camel milk market. Camel milk is rich in essential nutrients, including vitamins, minerals, and proteins, making it a healthier alternative to traditional frozen dairy products. Its easy digestibility and low lactose content make it suitable for individuals with lactose intolerance, further expanding its appeal among health-conscious consumers. In addition, camel milk’s potential benefits in managing diabetes, boosting immunity, and promoting gut health are increasingly recognized, creating a strong demand for flavored variants. This rising awareness supports the adoption of flavored camel milk as a nutritious and functional beverage choice, boosting market growth.

- Growing Popularity of Alternative Dairy

The growing demand for unique and sustainable dairy alternatives is driving the flavored camel milk market. As consumers seek healthier and more eco-friendly options, camel milk has gained attention due to its distinctive composition, which offers superior nutritional benefits compared to cow's milk. It is rich in vitamins, minerals, and antioxidants, while being lower in fat and lactose. In addition, camel milk is considered more sustainable than traditional dairy farming, as camels are more resilient to harsh environments and require fewer resources. This eco-friendly aspect, coupled with its health benefits, is propelling the rise in flavored camel milk adoption, further driving market growth.

Opportunities

- Innovation in Flavor and Product Varieties

The introduction of flavored camel milk, such as chocolate, vanilla, and fruit-infused versions, is significantly enhancing its appeal among consumers, particularly younger demographics and those seeking more exciting, innovative dairy alternatives. These flavored varieties provide a novel option for those who may not traditionally prefer the taste of plain camel milk, thus expanding its consumer base. As more individuals shift toward non-dairy and functional foods, flavored camel milk offers an opportunity to cater to this growing demand for healthier, exotic, and enjoyable beverages. This trend presents a key market opportunity, boosting sales potential and driving the overall growth of the flavored camel milk market.

- Expansion of E-commerce Platforms

The availability of flavored camel milk through online retail channels is significantly expanding its market reach, especially in regions where access to traditional brick-and-mortar stores may be limited. E-commerce platforms provide a convenient and accessible way for consumers to explore and purchase flavored camel milk, even in remote or underserved areas. This shift to online retail is particularly advantageous in regions with growing interest in alternative dairy products but limited physical retail options. As more consumers turn to online shopping for convenience, this trend presents a major market opportunity for flavored camel milk brands to tap into previously inaccessible consumer segments and boost sales globally.

Restraints/Challenges

- Limited Availability and Infrastructure

The production of camel milk is geographically limited, primarily to regions such as the Middle East, Africa, and parts of Asia, where camels are more commonly raised. This restricted production base poses a challenge for expanding the flavored camel milk market globally. The lack of widespread dairy infrastructure for camel milk in regions outside these areas complicates the supply chain and distribution network, leading to higher transportation costs and logistical challenges. These barriers can hinder market growth in areas where demand for alternative dairy products is rising but access to camel milk is limited, presenting a significant challenge to broader market expansion.

- High Production Costs

Camel milk is more expensive to produce than cow milk due to several factors, including the lower milk yield per camel and the specialized farming practices required for their care. Unlike cows, camels are less common in dairy farming, and their milk production is more resource-intensive, leading to higher operational costs. These elevated production costs are often passed on to consumers, making flavored camel milk significantly more expensive than traditional dairy products. As a result, price-sensitive consumers may be discouraged from purchasing flavored camel milk, particularly in regions where cow's milk remains the more affordable and familiar option, limiting market accessibility.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Flavored Camel Milk Market Scope

The market is segmented on the basis of packaging, type, application, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Packaging

- Cartons

- Bottles

- Jars

- Cans

Type

- Raw Camel Milk

- Frozen Raw Camel Milk

- Powder Camel Milk

- Camel Milk Handmade Soaps

- Camel Milk Flakes

- Others

Application

- Daily Foods

- Health Care

- Daily Necessities

Distribution Channel

- Supermarket

- Specialty Stores

- Online Stores

- Hypermarket

- Others

Flavored Camel Milk Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, packaging, type, application, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E., Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

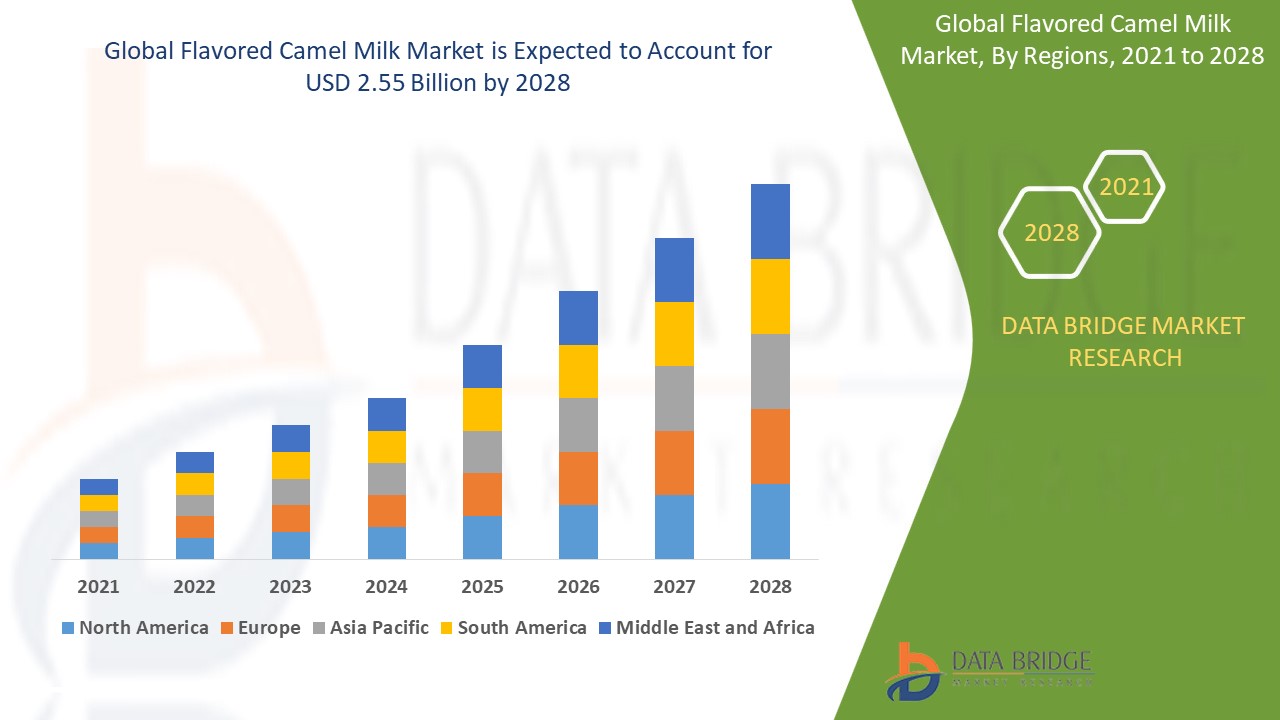

The Middle East and Africa dominate the flavored camel milk market, driven by their high per capita consumption rates. In these regions, camel milk is a traditional beverage, and its flavored variants are gaining popularity. As a result, the market in these areas is experiencing strong growth and demand.

North America is projected to experience substantial growth from 2025 to 2032, driven by the rising adoption of camel milk among diabetic consumers in the U.S. and Canada. Camel milk’s low sugar content makes it an appealing option for individuals managing blood sugar levels. As awareness of its health benefits grows, more consumers are turning to camel milk as a preferred alternative.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Flavored Camel Milk Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Flavored Camel Milk Market Leaders Operating in the Market Are:

- Camelicious (UAE)

- Desert Farms, Inc. (U.S.)

- Tiviski pvt Ltd. (Mauritania)

- Aadvik Foods (India)

- Kamelenmelk (Netherlands)

- QCamel (Australia)

- The Camel Milk Co. Australia Pty Ltd. (Australia)

- UK Camel Milk Ltd. (U.K.)

- Shiva Dairy Pvt Ltd (India)

- Desert Farms, Inc. (U.S.)

- Al Ain Farms (U.A.E.)

- Queensland Camel Milk (Australia)

- Almarai (Saudi Arabia)

Latest Developments in Flavored Camel Milk Market

- In March 2023, Camel Milk Co Australia introduced a freeze-dried camel milk powder packaged in a resealable stand-up pouch. The powder is made from 100% camel milk and is processed through a unique freeze-drying method, which preserves the taste, texture, and nutrients better than traditional hot spray drying. This innovative process also extends the shelf life of the product, offering a convenient and long-lasting alternative to fresh camel milk

- In December 2022, Amul expanded its camel dairy product offerings with the launch of camel milk ice cream and camel milk powder. The company highlighted that its new ice cream is made with 100% camel milk, showcasing a unique flavor without any added flavorings or colorings. This move further diversifies Amul’s camel milk range, catering to consumers seeking natural and distinctive dairy alternatives

- In 2022, Al Ain Farms, part of Al Ain Dairy, revealed plans to launch UHT camel milk in the European market in 2023. The ultra-high temperature (UHT) processing will enhance the product's shelf life, extending it to six months and making it more convenient for transportation. This expansion aims to introduce camel milk to a broader European audience, offering a longer-lasting and easily distributable alternative

- In October 2022, Al Ain Farms introduced a new range of lactose-free dairy products in the UAE. This product launch caters to the growing demand for lactose-free alternatives among consumers in the region. The expanded offering reflects Al Ain Farms' commitment to providing healthier and more inclusive dairy options for a diverse customer base

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flavored Camel Milk Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flavored Camel Milk Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flavored Camel Milk Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.