Global Propolis Market

Market Size in USD Million

CAGR :

%

USD

996.31 Million

USD

1,625.51 Million

2024

2032

USD

996.31 Million

USD

1,625.51 Million

2024

2032

| 2025 –2032 | |

| USD 996.31 Million | |

| USD 1,625.51 Million | |

|

|

|

|

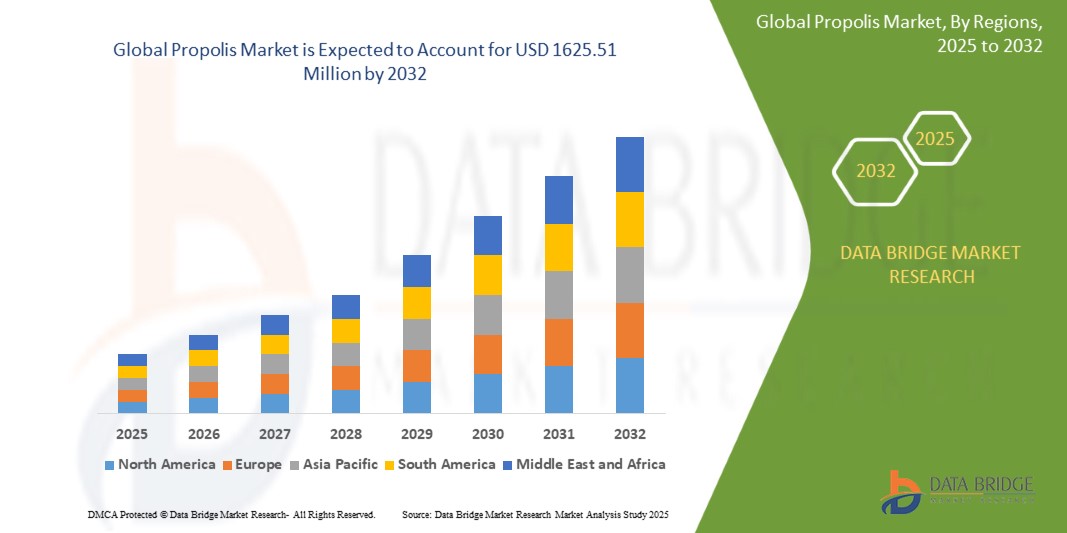

What is the Global Propolis Market Size and Growth Rate?

- The global Propolis market size was valued at USD 996.31 million in 2024 and is expected to reach USD 1625.51 million by 2032, at a CAGR of6.31% during the forecast period

- The global propolis market is experiencing significant growth, driven by its diverse applications across various sectors, including pharmaceuticals, cosmetics, and food and beverages. Propolis, a natural resinous substance produced by bees, is renowned for its antibacterial, anti-inflammatory, and antioxidant properties

- Research indicates that these bioactive compounds enhance immune function and possess therapeutic potential against various ailments, fostering increased consumer interest. In addition, rising awareness of natural and organic products has bolstered demand, particularly in health and wellness. The market is further supported by innovations in extraction methods, improving the quality and efficacy of propolis products

What are the Major Takeaways of Propolis Market?

- The rising awareness of the health benefits associated with propolis is significantly fueling demand for this natural product, as consumers increasingly recognize its potential therapeutic properties

- Propolis is known for its anti-inflammatory, antioxidant, and antimicrobial effects, making it an attractive ingredient for a variety of applications, including dietary supplements, cosmetics, and functional foods. For instance, a study published in the Journal of Agricultural and Food Chemistry highlighted that propolis extracts exhibited strong antioxidant activity, which can help combat oxidative stress and support overall health

- This increasing incorporation of propolis into health and beauty products underscores its growing acceptance and demand in the marketplace, establishing it as a key driver for the propolis market

- Asia-Pacific dominated the propolis market with the largest revenue share of 41.12% in 2024, attributed to the widespread use of natural remedies, growing adoption of functional foods, and strong beekeeping traditions in countries such as China, India, and Japan

- North America is projected to grow at the fastest CAGR of 13.24% from 2025 to 2032, fueled by heightened demand for clean-label, plant-based supplements and the rising popularity of alternative medicine in daily wellness routines

- The Extract segment dominated the market with the largest revenue share of 38.7% in 2024, driven by its wide usage in nutraceuticals, cosmetics, and functional beverages

Report Scope and Propolis Market Segmentation

|

Attributes |

Propolis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Propolis Market?

“Growing Application in Functional and Nutraceutical Foods”

- A major trend in the Propolis market is its increasing incorporation into functional foods and nutraceutical products due to its rich concentration of bioactive compounds such as flavonoids, phenolic acids, and antioxidants

- With consumer interest shifting toward natural immunity boosters and anti-inflammatory ingredients, food and beverage manufacturers are infusing Propolis into supplements, gummies, herbal teas, and fortified snacks

- In January 2024, Juice Works, a nutraceutical company, launched a new line of Propolis extract immunity shots aimed at promoting cardiovascular health and anti-aging benefits

- This trend aligns with the clean-label and plant-based movement, as Propolis is viewed as a natural, non-GMO, chemical-free alternative to synthetic additives

- As awareness grows around its therapeutic value, Propolis is expected to emerge as a staple ingredient in the global functional food ecosystem, bridging nutrition and natural medicine

What are the Key Drivers of Propolis Market?

- Health and wellness awareness continues to drive demand for Propolis due to its antiviral, antifungal, antibacterial, and anti-inflammatory properties that support immunity, oral care, skin repair, and gut health

- In March 2024, NOW Foods introduced Propolis-infused lozenges marketed for throat relief and immune support during cold and flu season, targeting health-conscious consumers

- The rising demand for natural and sustainable personal care products is fueling the use of Propolis in skincare, dental hygiene, and anti-aging formulations

- Technological advancements in microencapsulation and solvent-free extraction methods have improved bioavailability and stability, expanding its usability in pharma and food applications

- In addition, wider availability via e-commerce platforms and specialty health retailers is enhancing market penetration, especially across North America, Europe, and East Asia, where demand for holistic remedies is growing

Which Factor is challenging the Growth of the Propolis Market?

- A key restraint is the limited standardization and quality control across global Propolis products, which affects consumer trust and regulatory approvals for pharmaceutical-grade applications

- For instance, a 2023 study by the European Food Safety Authority (EFSA) emphasized the need for compositional consistency in Propolis-based supplements before broader health claims can be legally marketed

- Sourcing challenges also impact market stability—Propolis is collected by bees in small quantities, and its composition can vary depending on regional flora, affecting supply chain uniformity

- In addition, high production costs, particularly for organic and sustainably harvested Propolis, make it less accessible for cost-sensitive consumers and SMEs

- To overcome these hurdles, investment in bee farming best practices, regional quality certifications, and consumer education on Propolis' health benefits will be crucial to scale adoption globally

How is the Propolis Market Segmented?

The market is segmented on the basis of distribution channel, nutritional content, and end-user industry.

• By Product Type

On the basis of product type, the Propolis market is segmented into Capsules and Tablets, Spray, Extract, and Others. The Extract segment dominated the market with the largest revenue share of 38.7% in 2024, driven by its wide usage in nutraceuticals, cosmetics, and functional beverages. Extracts offer high concentration and purity, making them ideal for direct consumption and incorporation in product formulations.

The Capsules and Tablets segment is projected to witness the fastest CAGR from 2025 to 2032, supported by growing demand for convenient dosage formats in natural supplements. These products are gaining traction among consumers looking for immune support, antioxidant benefits, and chronic disease prevention.

• By Category

On the basis of category, the market is segmented into Alcohol-Based and Alcohol-Free. The Alcohol-Free segment held the largest revenue share of 56.2% in 2024, driven by consumer preference for non-irritant, clean-label alternatives suitable for children, sensitive individuals, and religious groups. These formulations are popular in both oral and topical uses.

The Alcohol-Based segment is anticipated to grow steadily, especially in pharmaceutical and clinical-grade applications where alcohol improves extraction efficiency and bioavailability.

• By Distribution Channel

On the basis of distribution channel, the Propolis market is segmented into Store-Based and Non-Store-Based. The Store-Based segment accounted for the largest market revenue share of 61.8% in 2024, as health food stores, pharmacies, and wellness centers remain primary touchpoints for consumer purchases. These channels support product trials, guidance from in-store nutritionists, and localized marketing.

The Non-Store-Based segment (primarily online retail) is projected to grow at the fastest CAGR during the forecast period, fueled by increasing e-commerce platforms, rising digital health awareness, and the popularity of subscription-based natural supplement delivery services.

• By Application

On the basis of application, the Propolis market is segmented into Food and Beverages, Healthcare, Personal Care and Cosmetics, and Other. The Healthcare segment led the market with the highest revenue share of 42.5% in 2024, supported by rising usage of Propolis in immunity boosters, wound care, dental hygiene, and anti-inflammatory drugs.

The Personal Care and Cosmetics segment is expected to grow at the fastest CAGR, driven by increased demand for natural skincare and anti-aging products. Propolis's antibacterial, anti-acne, and skin-soothing properties make it ideal for premium and organic cosmetic lines.

• By Type

On the basis of type, the market is segmented into Supercritical Extraction CO₂ (SFE), Ethanol Extracted Propolis (EEP), Glycol Extracted Propolis (GEP), and Other. The Ethanol Extracted Propolis (EEP) segment dominated with the largest revenue share of 46.1% in 2024, due to its widespread use in dietary supplements, tinctures, and mouth sprays. Ethanol extraction ensures high potency and active compound preservation.

The Supercritical Extraction CO₂ (SFE) segment is expected to witness the fastest CAGR, owing to its cleaner, solvent-free profile, making it highly desirable for clean-label and pharmaceutical applications.

Which Region Holds the Largest Share of the Propolis Market?

- Asia-Pacific dominated the Propolis market with the largest revenue share of 41.12% in 2024, attributed to the widespread use of natural remedies, growing adoption of functional foods, and strong beekeeping traditions in countries such as China, India, and Japan

- The region benefits from abundant raw material availability, low production costs, and rising government support for traditional and alternative medicine integration in healthcare and wellness sectors

- Rapid urbanization, increasing health awareness, and a strong herbal supplement market are key drivers of demand across pharmaceutical, nutraceutical, and cosmetic applications

China Propolis Market Insight

China held the largest revenue share within Asia-Pacific in 2024, fueled by its robust traditional medicine ecosystem and significant export volumes of Propolis derivatives. The presence of leading manufacturers, combined with advanced extraction techniques, supports market expansion across skincare, dental care, and over-the-counter wellness products.

India Propolis Market Insight

India is poised to witness the fastest growth rate in the region, driven by Ayurvedic innovation, rising middle-class spending, and the increasing popularity of natural immunity boosters. With a growing number of startups and FMCG brands leveraging Propolis in supplements and health drinks, the domestic market is rapidly scaling.

Japan Propolis Market Insight

Japan shows steady growth, supported by a health-conscious aging population and high demand for premium anti-aging and anti-inflammatory products. Japanese companies are focusing on Propolis-based solutions in functional foods and high-end cosmetics, maintaining consistent market performance.

Which Region is the Fastest Growing in the Propolis Market?

North America is projected to grow at the fastest CAGR of 13.24% from 2025 to 2032, fueled by heightened demand for clean-label, plant-based supplements and the rising popularity of alternative medicine in daily wellness routines. The expansion of e-commerce, coupled with strong R&D investment in dietary supplements, is enabling wider consumer access and innovative product development across the region.

U.S. Propolis Market Insight

The U.S. dominated the North American market in 2024, driven by a well-established supplement industry, increasing use of Propolis in oral care and wound healing products, and widespread adoption of organic and non-GMO certifications. Consumer preference for science-backed natural products continues to shape product launches and marketing strategies.

Canada Propolis Market Insight

Canada is projected to experience robust growth, supported by a proactive health-conscious population, favorable natural health product regulations, and growing usage of Propolis in functional snacks, herbal tinctures, and topical solutions. The country is increasingly recognized for its emphasis on sustainability and product transparency.

Which are the Top Companies in Propolis Market?

The Propolis industry is primarily led by well-established companies, including:

- Apis Flora (Brazil)

- Bee Health Limited (U.K.)

- Comvita Limited and its subsidiaries (New Zealand)

- Laprell's Beehive Products, Inc. (Canada)

- Manuka Health New Zealand Ltd (New Zealand)

- Polenectar (Brazil)

- SUNYATA PON LEE (Brazil)

- Wax Green (Brazil)

- zhifengtang (China)

What are the Recent Developments in Global Propolis Market?

- In July 2024, ApiotiX Technologies, a biotech leader, has introduced a standardized polyphenolic acid polymer extract (PAPE) sourced from propolis, which has been clinically validated to provide the same benefits as retinol. This innovative extract also shows comparable efficacy to the popular alternative bakuchiol and is noted as the first natural retinol substitute with similar purity levels

- In August 2023, Comvita Ltd, a reputable source for genuine Mānuka honey, announced the launch of Immune Bee Propolis, which features twice the active ingredients in a single daily dose

- In September 2021 Comvita Ltd revealed a strategic partnership with Caravan, a joint venture with the entertainment and sports agency Creative Artists Agency (CAA). This collaboration aims to raise consumer awareness about the benefits of Mānuka honey and propolis by creating a celebrity-backed lifestyle brand that highlights the natural healing properties of these products for topical use

- In March 2021 Innovations in Nutrition + Wellness (INW) announced its acquisition of Bee Health, the leading developer and manufacturer of nutritional supplements in the United Kingdom. This acquisition aims to enhance the services provided to brand partners through the complementary product capabilities and geographic reach of both companies

- In March 2021 Bee Health, a supplement manufacturer, was acquired by Innovations in Nutrition + Wellness (INW), a leader in custom research and development, to expand its presence in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Propolis Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Propolis Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Propolis Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.