Cancer is the second major cause of death in the world and is a major worldwide public health problem. Early detection and appropriate therapy are crucial for cancer patients to enhance their prognosis and enhance their chances of survival. As tumors are sometimes hard to detect early, it is difficult to use tissue biopsies to accurately detect tumors at an early stage in the diseases. Compared with tissue biopsy, liquid biopsy has many advantages in the diagnosis and treatment of various types of cancer, including non-invasive, quickly and so on. Currently, the application of liquid biopsy in tumor detection has received widely attention. It is now undergoing rapid progress, and it holds significant potential for future applications

National Cancer Institute estimated that 2,041,910 new cases of cancer will be diagnosed in the U.S. and 618,120 people will die from the disease. The rate of new cases of cancer (cancer incidence) is 445.8 per 100,000 men and women per year (based on 2018–2022 cases). The most common cancers (listed in descending order according to estimated new cases in 2025) are breast cancer, prostate cancer, lung and bronchus cancer, colon and rectum cancer, melanoma of the skin, bladder cancer, kidney and renal pelvis cancer, non-Hodgkin lymphoma, uterine corpus cancer, pancreatic cancer, leukemia, thyroid cancer, and liver and intrahepatic bile duct cancer.

According to WHO Over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022. The rapidly growing global cancer burden reflects both population ageing and growth, as well as changes to people’s exposure to risk factors, several of which are associated with socioeconomic development. Tobacco, alcohol and obesity are key factors behind the increasing incidence of cancer, with air pollution still a key driver of environmental risk factors.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-liquid-biopsy-market

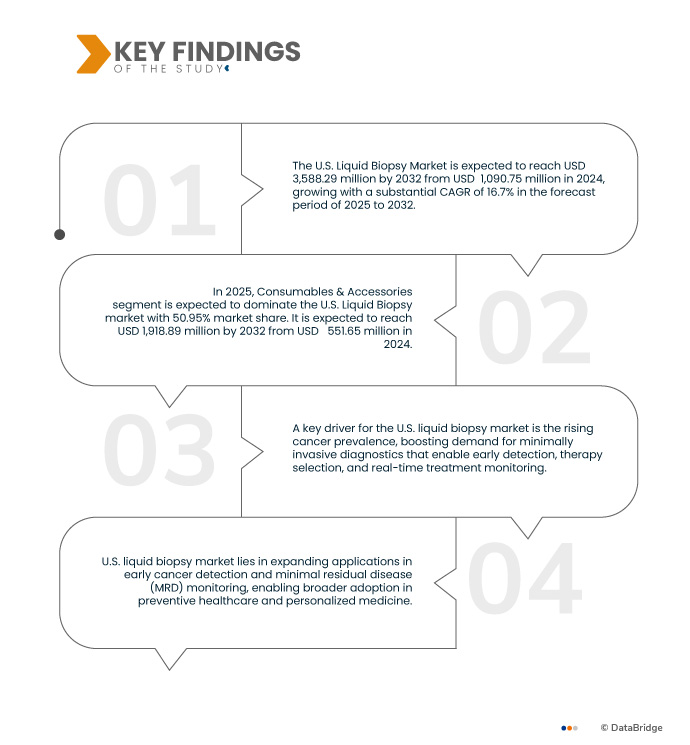

Data Bridge market research analyzes that The U.S. Liquid Biopsy Market is expected to reach USD 3,588,298.98 thousand by 2032 from USD 1,090,756.62 thousand in 2024, growing with a substantial CAGR of 16.7% in the forecast period of 2025 to 2032.

Key Findings of the Study

Advancements in NGS and CTDNA Analysis

The U.S. liquid biopsy market is witnessing rapid innovation driven by significant advancements in molecular diagnostics, particularly in next-generation sequencing (NGS), circulating tumor DNA (ctDNA) detection, and digital PCR technologies. These developments are enhancing the analytical sensitivity, specificity, and clinical applicability of liquid biopsy platforms across various stages of cancer management—from early detection and minimal residual disease (MRD) monitoring to treatment selection and real-time disease surveillance. Leading industry stakeholders such as Natera, Illumina, Agilent, and Guardant Health, along with advancements in digital PCR platforms, are collectively reshaping the precision oncology landscape and driving broader adoption of non-invasive cancer testing solutions.

Report Scope and U.S. Liquid Biopsy Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD thousand

|

|

Segments Covered

|

By Product (Consumables & Accessories, Instruments and Services & Software), Biomarker Type (Circulating Tumor Cells (CTCs), Circulating Cell-Free DNA (cfDNA), Cell-Free RNA, Exosomes, Extracellular Vesicles and Others), By Sample Type (Blood Sample-Based, Urine Sample-Based, Saliva Fluid,Cerebrospinal Fluid (CSF), Pleural Fluid, Tissue Fluid and Others), Analytical Type (Molecular, Proteomic and Histology/Imaging), Application (Cancer Applications and Non-Cancer Applications), Clinical Aapplication (Routine Screening, Therapy Selection, Treatment Monitoring, Recurrence Monitoring, Patient Work-Up and Others), Technology (Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR)-Based, Immunoassays & Mass Spectrometry, Microfluidics-Based, Nanotechnology and Microarrays), End User (Hospitals, Reference Laboratories, Diagnostics Centers, Research Centres and Academic Institutes, Clinics and Others), Distribution Channel (Direct Tender, Third Party Distributor and Others)

|

|

Countries Covered

|

U.S.

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The U.S. liquid biopsy market is segmented into nine segments based on product, biomarker type, sample type, analytical type, application, clinical application, technology, end user and distribution channel.

- On the basis of product, the market is segmented into consumables & accessories, instruments and services & software.

In 2025, the Consumables & Accessories segment is expected to dominate the market with a market share of 50.95% due to their recurring demand, wide usage across all testing platforms, and essential role in ensuring assay accuracy and reproducibility.

- On the basis of biomarker type, the market is segmented into Circulating Tumor Cells (CTCs), Circulating Cell-Free DNA (cfDNA), Cell-Free RNA, Exosomes, Extracellular Vesicles, Others.

In 2025, the Circulating Tumor Cells (CTCs) segment is expected to dominate the market

In 2025, the Circulating Tumor Cells (CTCs) segment is expected to dominate the market with a market share of 51.27% due to their increasing clinical utility in cancer diagnostics, prognostics, and real-time monitoring of treatment effectiveness.

- On the basis of sample type, the market is segmented into Blood Sample-Based, Urine Sample-Based, Saliva Fluid, Cerebrospinal Fluid (CSF), Pleural Fluid, Tissue Fluid, Others.

In 2025, the Blood Sample-Based segment is expected to dominate the market

In 2025, the Blood Sample-Based segment is expected to dominate the market with a market share of 53.12% due to the minimally invasive nature of blood draws, higher patient compliance, and availability of validated testing protocols.

- On the basis of analytical type, the market is segmented into Molecular, Proteomic and Histology/Imaging.

In 2025, the Molecular segment is expected to dominate the market

In 2025, the Molecular segment is expected to dominate the market with a market share of 54.98% due to its high sensitivity, specificity, and ability to provide detailed genetic and molecular insights for precision medicine.

- On the basis of application, the market is segmented into Cancer Applications and Non-Cancer Applications.

In 2025, the Cancer Applications segment is expected to dominate the market

In 2025, the Cancer Applications segment is expected to dominate the market with a market share of 76.77% due to the rising global cancer burden, demand for early detection, and adoption of liquid biopsy for non-invasive tumor profiling.

- On the basis of clinical application, the market is segmented into Routine Screening, Therapy Selection, Treatment Monitoring, Recurrence Monitoring, Patient Work-Up, Others.

In 2025, the Routine Screening for alcohol segment are expected to dominate the market

In 2025, the Routine Screening segment is expected to dominate the market with a market share of 39.74% due to increasing awareness of preventive healthcare, emphasis on early disease detection, and rising integration of liquid biopsy into population health programs.

- On the basis of technology, the market is segmented into Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR)-Based, Immunoassays & Mass Spectrometry, Microfluidics-Based, Nanotechnology, Microarrays.

In 2025, the Next-Generation Sequencing (NGS) segment is expected to dominate the market

In 2025, the Next-Generation Sequencing (NGS) segment is expected to dominate the market with a market share of 45.05% due to its capability to detect a wide range of biomarkers simultaneously with high accuracy, scalability, and declining sequencing costs.

- On the basis of end user, the market is segmented into Hospitals, Reference Laboratories, Diagnostics Centers, Research Centres and Academic Institutes, Clinics, Others

In 2025, the Hospitals segment is expected to dominate the market

In 2025, the Hospitals segment is expected to dominate the market with a market share of 52.83% due to the availability of advanced infrastructure, integration of multidisciplinary care, and higher patient inflow for diagnostic and treatment monitoring services.

- On the basis of distribution channel, the market is segmented into Direct Tender, Third Party Distributor and Others.

In 2025, the Direct Tender segment is expected to dominate the market

In 2025, the Direct Tender segment is expected to dominate the market with a market share of 65.18% due to bulk procurement practices by hospitals and laboratories, cost benefits in large-scale purchases, and preference for direct supplier agreements.

Major Players

F. Hoffmann-La Roche Ltd (Foundation Medicine) (U.S.), Guardant Health) (U.S.), Exact Sciences Corporation) (U.S.), Labcorp) (U.S.) and among others.

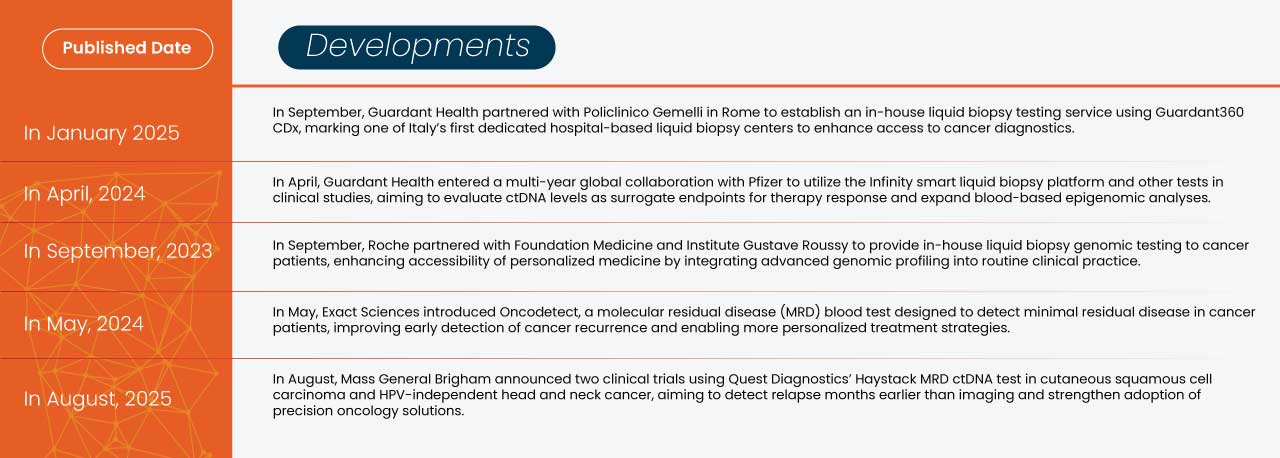

Market Developments

- In September 2024, Guardant Health partnered with Policlinico Gemelli in Rome to establish an in-house liquid biopsy testing service. This facility utilizes Guardant360 CDx, a comprehensive liquid biopsy test, to aid in therapy selection for advanced cancer patients. This collaboration marks one of Italy's first dedicated liquid biopsy testing centers within a hospital system, aiming to enhance access to innovative cancer diagnostics.

- In April 2025, Guardant Health entered a multi-year global collaboration with Pfizer to support the development and commercialization of new cancer therapies. The partnership focuses on utilizing Guardant's Infinity smart liquid biopsy platform and other liquid biopsy tests in Pfizer's clinical studies. The aim is to evaluate the clinical utility of circulating tumor DNA (ctDNA) levels as a surrogate endpoint to monitor therapy response and to assess related blood-based epigenomic analyses.

- In September 2023, Roche partnered with Foundation Medicine and the Institute Gustave Roussy to provide in-house liquid biopsy genomic testing to cancer patients. This collaboration aims to enhance the accessibility of personalized medicine by integrating advanced genomic profiling into routine clinical practice.

- In May 2025, Exact Sciences introduced Oncodetect, a molecular residual disease (MRD) blood test designed to detect minimal residual disease in cancer patients. The test aims to improve early detection of cancer recurrence, enhancing personalized treatment strategies

- In August, Mass General Brigham announced two clinical trials using Quest Diagnostics’ Haystack MRD ctDNA test to guide post-surgical treatment in cutaneous squamous cell carcinoma and HPV-independent head and neck cancer. The trials aim to demonstrate the test’s ability to detect relapse months earlier than imaging, enabling more timely and tailored treatment decisions. For Quest, this advancement strengthens clinical adoption of its ctDNA platform and reinforces its position in advancing precision oncology solutions.

As per Data Bridge Market Research analysis:

For more detailed information about the U.S. Liquid biopsy Market report, click here – https://www.databridgemarketresearch.com/reports/us-liquid-biopsy-market