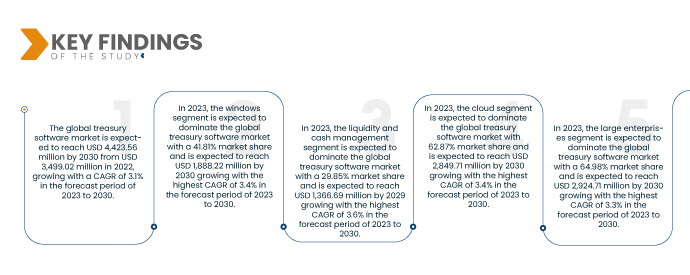

تشير تحليلات Data Bridge Market Research إلى أن سوق برمجيات الخزانة العالمية من المتوقع أن ينمو بمعدل نمو سنوي مركب قدره 3.1٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 4،423.56 مليون دولار أمريكي بحلول عام 2030. تستثمر الشركات في أدوات إدارة الدفع الإلكتروني الذكية وتتبناها لتصبح أكثر مرونة من أجل بقائها لدفع نمو السوق.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/global-treasury-software-market

برنامج الخزانة هو تطبيق يُؤتمت الأنشطة المالية للشركة، مثل التدفقات النقدية والأصول والاستثمارات. يوفر نظامًا لإدارة الخزانة يتتبع قدرة الشركة على تحويل الأصول إلى نقد للوفاء بالالتزامات المالية. يستخدم المديرون الماليون والحسابات برنامج إدارة الخزانة لمراقبة السيولة والقدرة على تحويل الأصول إلى نقد للوفاء بالالتزامات المالية. يُؤتمت البرنامج ويُبسط وظائف إدارة الخزانة، مما يُقلل من المخاطر المالية ومخاطر السمعة، ويُوفر التكاليف، ويُحسّن الكفاءة والفعالية التشغيلية. تُحسّن الرؤية والتحليلات والتنبؤات التي يوفرها نظام إدارة الخزانة عملية اتخاذ القرارات، وتُساعد في وضع الاستراتيجيات المالية للمؤسسة.

تزايد اعتماد أدوات إدارة الدفع الإلكتروني الذكية

الجهاز الإلكتروني الذكي هو أداة إلكترونية تتيح لنا مشاركة المعلومات والبيانات والتفاعل مع مستخدميها والأجهزة الذكية الأخرى. في الآونة الأخيرة، اكتسبت الهواتف الذكية وغيرها من الأجهزة الذكية شعبية هائلة بين المستهلكين، وأصبحت جزءًا لا يتجزأ من نمط حياة الإنسان.

وفقًا لموقع TechJury.net، شهد عام ٢٠٢٠ انتشارًا واسعًا للأجهزة الإلكترونية الذكية بين المستهلكين. يمتلك حوالي ٦١٪ من سكان العالم أجهزة ذكية. يُمكّن هذا المستهلكين والمستخدمين من إجراء المعاملات المالية والمدفوعات وغيرها من أي مكان.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

سنة الأساس

|

2022

|

فترة التنبؤ

|

2023 - 2030

|

السنوات التاريخية

|

2021 (قابلة للتخصيص حتى 2020-2016)

|

الوحدات الكمية

|

الإيرادات بالألف دولار أمريكي، التسعير بالدولار الأمريكي

|

القطاعات المغطاة

|

نظام التشغيل (ويندوز، لينكس، آي أو إس، أندرويد، ماك)، التطبيق (إدارة السيولة والنقد، إدارة الاستثمار، إدارة الديون، إدارة المخاطر المالية ، إدارة الامتثال، التخطيط الضريبي، وغيرها)، وضع النشر (محلي، سحابي)، حجم المؤسسة (الشركات الكبيرة والصغيرة والمتوسطة)، القطاع الرأسي (الخدمات المصرفية، الخدمات المالية والتأمين، الحكومة ، التصنيع، الرعاية الصحية، السلع الاستهلاكية، المواد الكيميائية ، الطاقة، وغيرها)

|

الدول المغطاة

|

الولايات المتحدة وكندا والمكسيك وألمانيا وفرنسا والمملكة المتحدة وإيطاليا وإسبانيا وهولندا وبلجيكا وروسيا وسويسرا وتركيا وبقية دول أوروبا والصين والهند واليابان وكوريا الجنوبية وأستراليا وإندونيسيا وماليزيا وتايلاند وسنغافورة والفلبين وبقية دول آسيا والمحيط الهادئ والمملكة العربية السعودية وجنوب أفريقيا والإمارات العربية المتحدة ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا

|

الجهات الفاعلة في السوق المغطاة

|

فيناسترا، زين تريسوري المحدودة، إمفاسيس سوفتوير، إس إس آند سي تكنولوجيز، كابيكس، أدينزا، كوبا سوفتوير، داتا لوج فاينانس، إف آي إس، أكسس سيستمز (المملكة المتحدة) المحدودة، تريجري سوفتوير كورب، موركس إس إيه إس، إيدج فيرف سيستمز المحدودة (شركة تابعة مملوكة بالكامل لشركة إنفوسيس)، فاينانشال ساينسز كورب، برودريدج فاينانشال سوليوشنز، كاش أناليتكس، أوراكل، فيسيرف، أيون، إس إيه بي، سولومون سوفتوير المحدودة، إيه بي إم كلاود، نومينتيا، إرنست آند يونغ، وتريجري إنتليجنس سوليوشنز جي إم بي إتش، وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء وعلم الأوبئة للمرضى وتحليل خطوط الأنابيب وتحليل التسعير والإطار التنظيمي.

|

تحليل القطاعات:

يتم تقسيم سوق برمجيات الخزانة العالمية إلى خمسة قطاعات بارزة بناءً على نظام التشغيل والتطبيق ونموذج النشر وحجم المنظمة والقطاع الرأسي.

- في عام 2023، من المتوقع أن تهيمن شريحة Windows على سوق برامج الخزانة العالمية بحصة سوقية تبلغ 41.81%

من المتوقع أن تهيمن شريحة Windows على سوق برامج الخزانة العالمية في عام 2023 مع التقدم التكنولوجي وتطورات البرامج المختلفة المتعلقة بالوصول إلى برامج الخزانة وربطها بأنظمة تشغيل Windows.

- في عام 2023، من المتوقع أن يهيمن قطاع إدارة السيولة والنقد على سوق برامج الخزانة العالمية، بحصة سوقية تبلغ 29.85%

من المتوقع أن تهيمن شريحة إدارة السيولة والنقد على سوق برمجيات الخزانة العالمية في عام 2023، حيث يساعد الاختراق العالي للخزانة في إدارة السيولة والنقد على تقليل عمليات الإدخال اليدوي وأخطاء الحساب.

- من المتوقع أن تهيمن شريحة الحوسبة السحابية على سوق برمجيات الخزانة العالمية في عام 2023، حيث توفر كفاءة التكلفة وخصائص المرونة في الحلول لتكنولوجيا الحوسبة السحابية بنية تحتية ثابتة بأقصى قدر من الإنتاج لمنظمات خدمات برمجيات الخزانة.

- من المتوقع أن تهيمن شريحة الشركات الكبيرة على برامج الخزانة العالمية في عام 2023، حيث تقدم الشركات الصغيرة والمتوسطة الحجم (SMES) تكنولوجيا وخدمات برامج الخزانة الفعالة من حيث التكلفة للمطورين للعمل على مشاريعهم.

- من المتوقع أن تهيمن شريحة الخدمات المصرفية والمالية والتأمين (BFSI) على سوق برامج الخزانة العالمية في عام 2023، حيث أصبح ظهور الأنظمة المدعومة بالذكاء الاصطناعي في قطاع الخدمات المصرفية والمالية والتأمين بمثابة تغيير جذري لأن أنظمة الذكاء الاصطناعي هذه تزيد من الحاجة إلى حلول برامج الخزانة.

من بين أبرز الشركات العاملة في سوق برمجيات الخزانة العالمية: Finastra (لندن، المملكة المتحدة)، وZenTreasury Ltd (إسبو، فنلندا)، وEmphasys Software (فلوريدا، الولايات المتحدة)، وSS&C Technologies, Inc. (كونيتيكت، الولايات المتحدة)، وCAPIX (ملبورن، أستراليا)، وAdenza (كاليفورنيا، الولايات المتحدة)، وCoupa Software Inc. (كاليفورنيا، الولايات المتحدة)، وDataLog Finance (باريس، فرنسا)، وFIS (فلوريدا، الولايات المتحدة)، وAccess Systems (UK) Limited (مانشستر، المملكة المتحدة)، وTreasure Software Corp. (فيرجينيا، الولايات المتحدة)، وMUREX SAS (باريس، فرنسا)، وEdgeVerve Systems Limited (شركة تابعة مملوكة بالكامل لشركة Infosys) (كارناتاكا، الهند)، وFinancial Sciences Corp. (نيويورك، الولايات المتحدة)، وBroadridge Financial Solutions, Inc. (نيويورك، الولايات المتحدة)، وCashAnalytics (دبلن، أيرلندا)، وOracle (كاليفورنيا، الولايات المتحدة)، وFiserv, Inc (ويسكونسن، الولايات المتحدة)، وION. (تكساس، الولايات المتحدة)، وSAP (فالدورف، ألمانيا)، وSolomon Software Ltd. (إنجلترا، المملكة المتحدة)، وABM CLOUD (هارجوما، إستونيا)، وNomentia (فنلندا، أوروبا)، وErnst & Young (إنجلترا، المملكة المتحدة)، وTreasure Intelligence Solutions (ماساتشوستس، الولايات المتحدة) وغيرها.

اللاعبون الرئيسيون

تعترف شركة Data Bridge Market Research بالشركات التالية باعتبارها سوق البرمجيات الخزانة العالمية الرئيسية Finastra وZenTreasury Ltd وEmphasys Software وSS&C Technologies, Inc. وCAPIX وAdenza وCoupa Software Inc. وDataLog Finance وFIS وAccess Systems (UK) Limited وTreasure Software Corp. وMUREX SAS وEdgeVerve Systems Limited (شركة تابعة مملوكة بالكامل لشركة Infosys) وFinancial Sciences Corp. وBroadridge Financial Solutions, Inc. وCashAnalytics وOracle وFiserv, Inc وION وSAP وSolomon Software Ltd. وABM CLOUD وNomentia وErnst & Young وTreasure Intelligence Solutions GmbH وغيرها.

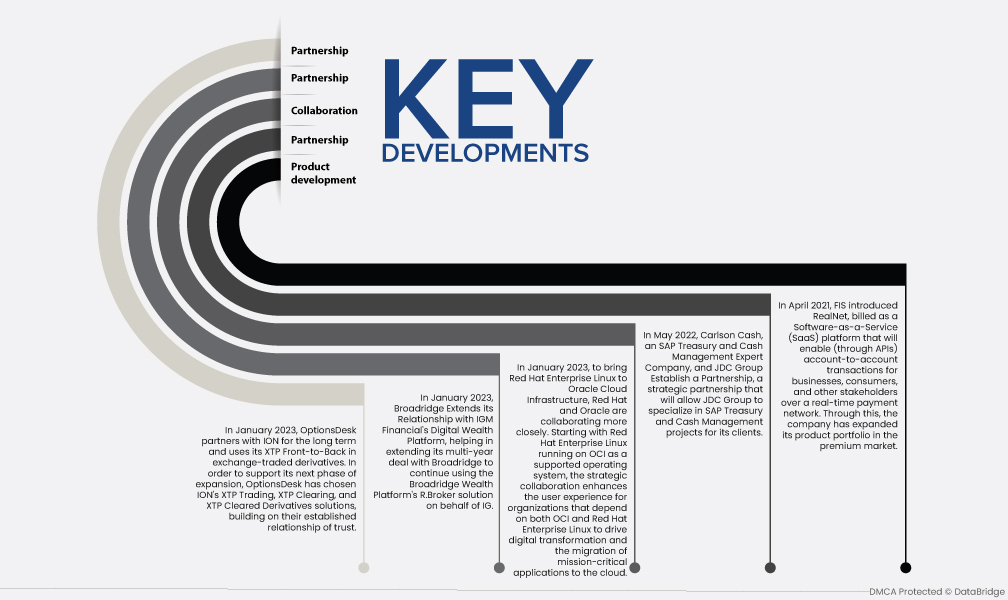

تطورات السوق

- في يناير 2023، دخلت OptionsDesk في شراكة طويلة الأجل مع ION، وتستخدم نظام XTP Front-to-Back في المشتقات المتداولة في البورصة. لدعم مرحلتها التوسعية التالية، اختارت OptionsDesk حلول ION لتداول XTP، ومقاصة XTP، ومشتقات XTP Cleared، مستفيدةً من علاقة الثقة الراسخة بينهما.

- في يناير 2023، قامت شركة Broadridge بتوسيع علاقتها مع منصة الثروة الرقمية التابعة لشركة IGM Financial، مما ساعد في تمديد صفقتها متعددة السنوات مع Broadridge لمواصلة استخدام حل R.Broker التابع لمنصة الثروة الرقمية التابعة لشركة Broadridge نيابة عن IG

- في يناير 2023، ولدمج Red Hat Enterprise Linux مع Oracle Cloud Infrastructure، تتعاون Red Hat وOracle بشكل أوثق. بدءًا من Red Hat Enterprise Linux الذي يعمل على OCI كنظام تشغيل مدعوم، يُحسّن هذا التعاون الاستراتيجي تجربة المستخدم للمؤسسات التي تعتمد على كلٍّ من OCI وRed Hat Enterprise Linux لدفع عجلة التحول الرقمي ونقل التطبيقات المهمة إلى السحابة.

- في مايو 2022، أقامت شركة Carlson Cash، وهي شركة متخصصة في إدارة الخزانة والنقد من SAP، ومجموعة JDC شراكة، وهي شراكة استراتيجية تسمح لمجموعة JDC بالتخصص في مشاريع إدارة الخزانة والنقد من SAP لعملائها

- في أبريل 2021، أطلقت شركة FIS منصة RealNet، وهي منصة برمجيات كخدمة (SaaS)، تُمكّن (عبر واجهات برمجة التطبيقات) من إجراء معاملات بين الحسابات للشركات والمستهلكين وغيرهم من أصحاب المصلحة عبر شبكة دفع آنية. ومن خلال هذه المنصة، وسّعت الشركة محفظة منتجاتها في سوق المنتجات المتميزة.

التحليل الإقليمي

من الناحية الجغرافية، البلدان التي يغطيها تقرير سوق برامج الخزانة العالمية هي الولايات المتحدة وكندا والمكسيك وألمانيا وفرنسا والمملكة المتحدة وإيطاليا وإسبانيا وهولندا وبلجيكا وروسيا وسويسرا وتركيا وبقية أوروبا والصين والهند واليابان وكوريا الجنوبية وأستراليا وإندونيسيا وماليزيا وتايلاند وسنغافورة والفلبين وبقية دول آسيا والمحيط الهادئ والمملكة العربية السعودية وجنوب إفريقيا والإمارات العربية المتحدة ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

وفقًا لتحليل Data Bridge Market Research في عام 2023، من المتوقع أن تهيمن منطقة أمريكا الشمالية على سوق برمجيات الخزانة العالمية حيث تتمتع المنطقة بأقصى استثمار في سوق تطوير البرمجيات، مما يؤدي إلى نمو أعلى للمنطقة وغيرها للفترة المتوقعة 2023-2030.

لمزيد من المعلومات التفصيلية حول تقرير سوق برمجيات الخزانة العالمية ، انقر هنا - https://www.databridgemarketresearch.com/reports/global-treasury-software-market