В США инновации рынка ореховых и снэковых батончиков во вкусах и ингредиентах отражают растущий потребительский спрос на разнообразные и более полезные варианты закусок. Уделяя повышенное внимание здоровью и питанию, компании представляют уникальные комбинации орехов, фруктов и других полезных ингредиентов, чтобы удовлетворить различные вкусы и диетические предпочтения. Это нововведение улучшает сенсорные ощущения потребителей и соответствует растущему акценту на натуральных, питательных и функциональных продуктах . Развивающийся ландшафт вкусов и текстур ореховых и снэковых батончиков отвечает динамичному образу жизни потребителей в США, предлагая удобные, но сытные альтернативы традиционным вариантам закусок.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/us-nuts-and-snacks-bar-market

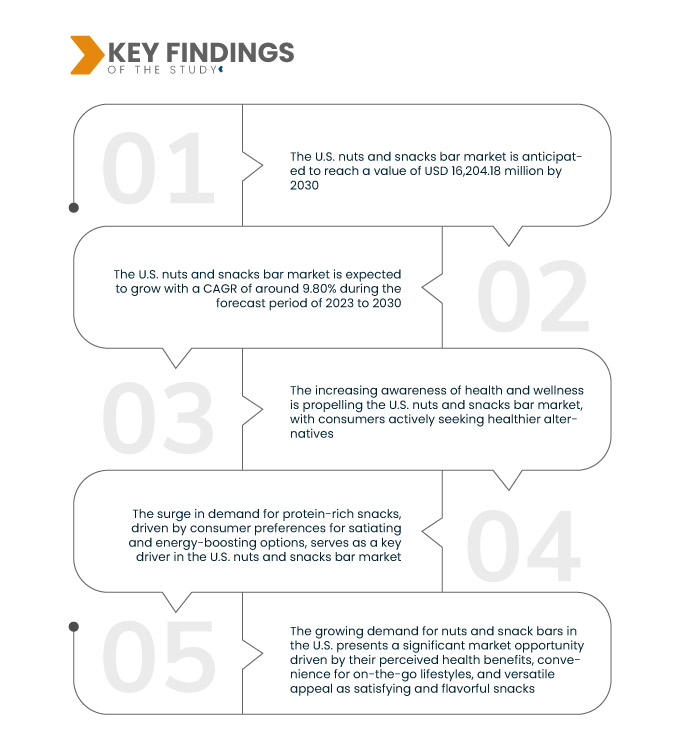

Data Bridge Market Research анализирует рынок ореховых и снэковых батончиков в США, который, как ожидается, достигнет 16 204,18 млн долларов США к 2030 году, что составляет 7 670,23 млн долларов США в 2022 году, регистрируя среднегодовой темп роста 9,80% в прогнозируемый период с 2023 по 2030 год. Спрос на ореховые и снэковые батончики в США можно объяснить удобством и образом жизни на ходу. Рост безглютеновых, веганских и палеодиетических предпочтений способствовал созданию нишевых продуктов на рынке ореховых и снэковых батончиков в США.

Основные выводы исследования

Ожидается, что растущие маркетинговые и брендинговые стратегии будут способствовать темпам роста рынка.

На рынке ореховых и снэковых батончиков США растущие маркетинговые и брендинговые стратегии играют решающую роль в формировании восприятия и предпочтений потребителей. Стратегическое партнерство с влиятельными лицами, знаменитостями или другими брендами, наряду с эффективными рекомендациями, способствуют укреплению авторитета и доверия. Продуманные рекламные кампании помогают повысить осведомленность и подчеркнуть преимущества продукта, влияя на выбор потребителей. В конкурентной среде бренды часто дифференцируются с помощью эффективного повествования и позиционирования бренда, укрепляя связь с заботящимися о своем здоровье и активными потребителями. Успешные маркетинговые инициативы повышают узнаваемость, привлекая внимание к уникальным функциям и вкусам, в конечном итоге стимулируя продажи на рынке, где выбор потребителей в значительной степени зависит от имиджа и сообщений бренда.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2023-2030

|

Базовый год

|

2022

|

Исторические годы

|

2021 (Можно настроить на 2015-2020)

|

Количественные единицы

|

Доход в млн. долл. США, объемы в единицах, цены в долл. США

|

Охваченные сегменты

|

Тип продукта (энергетические батончики, протеиновые батончики, злаковые батончики , ореховые батончики), калорийность (обычные, низкокалорийные, без сахара), вкус (обычные, со вкусом), природа (органические, обычные), размер (от 1,5 до 2,5 унций, от 2,6 до 3,5 унций, от 3,6 до 5,5 унций, 5,5 унций и выше), канал сбыта (супермаркеты/гипермаркеты, магазины шаговой доступности, специализированные магазины, интернет-магазины, другие)

|

Охваченные участники рынка

|

Kellogg Co. (США), General Mills Inc. (США), KIND (США), Clif Bar & Company (США), Hormel Foods (США), THE HERSHEY COMPANY (США), The Simply Good Foods Company (США), Mars, Incorporated (США), Premier Nutrition Company, LLC (США), Abbott (США)

|

Данные, отраженные в отчете

|

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса.

|

Анализ сегмента:

Рынок ореховых и снэковых батончиков в США сегментирован по типу продукта, калорийности, вкусу, природе, размеру и каналу сбыта.

- По типу продукта рынок ореховых и снэковых батончиков в США сегментируется на энергетические батончики, протеиновые батончики, злаковые батончики и ореховые батончики.

- По калорийности рынок ореховых и снэковых батончиков в США сегментируется на обычные, низкокалорийные и без сахара.

- По вкусовым качествам рынок ореховых и снэковых батончиков в США сегментируется на обычные и вкусовые.

- По признаку натуральности рынок орехов и закусочных батончиков в США сегментируется на органические и традиционные.

- В зависимости от размера рынок ореховых и снэковых батончиков в США сегментируется на 1,5–2,5 унции, 2,6–3,5 унции, 3,6–5,5 унции, 5,5 унции и более.

- По каналам сбыта рынок ореховых и снэковых батончиков в США сегментируется на супермаркеты/гипермаркеты, магазины у дома, специализированные магазины, интернет-магазины и т. д.

Основные игроки

По данным Data Bridge Market Research, основными игроками на рынке ореховых и снэковых батончиков в США являются следующие компании: Kellogg Co. (США), General Mills Inc. (США), KIND (США), Clif Bar & Company (США), Hormel Foods (США), THE HERSHEY COMPANY (США) и The Simply Good Foods Company (США).

Развитие рынка

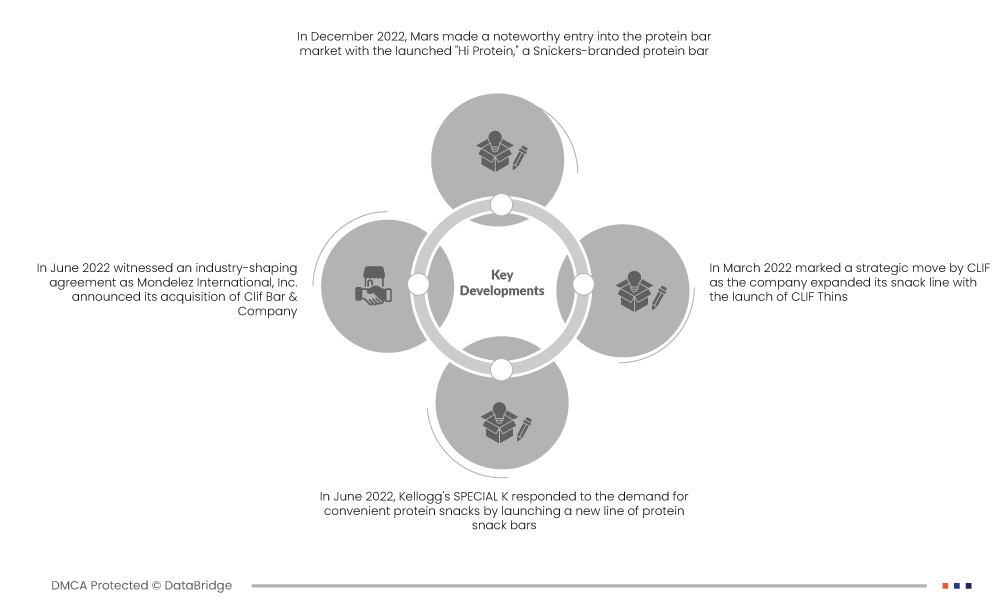

- В декабре 2022 года компания Mars сделала заметный выход на рынок протеиновых батончиков с «Hi Protein», протеиновым батончиком под брендом Snickers. Каждый батончик может похвастаться существенными 20 граммами белка, ориентированными на потребителей, ищущих перекус, богатый белком. Примечательно, что Mars сбалансировала содержание белка с относительно низким содержанием сахара, каждый батончик содержал всего четыре грамма сахара

- В июне 2022 года Mondelez International, Inc. объявила о приобретении Clif Bar & Company. Приобретение Clif Bar & Company, известной производством питательных энергетических батончиков с органическими ингредиентами, оценивается в значительные 2,9 млрд долларов США, включая дополнительные условные выплаты. Этот стратегический шаг Mondelez отражает растущий спрос на органические и ориентированные на питание продукты на рынке

- В июне 2022 года компания Kellogg's SPECIAL K отреагировала на спрос на удобные белковые закуски, выпустив новую линейку протеиновых батончиков. Каждый батончик содержит 6 граммов белка и 90 калорий, обеспечивая баланс между содержанием белка и количеством калорий. Благодаря таким вкусам, как ягодная ваниль и шоколадный брауни-сандей, эти батончики предназначены для потребителей, которые ищут вкусный и удобный способ включить высококачественный белок в свой образ жизни на ходу

- Март 2022 года ознаменовался стратегическим шагом CLIF, поскольку компания расширила свою линейку закусок, выпустив CLIF Thins. Эта хрустящая вариация оригинального батончика CLIF BAR разработана для удовлетворения потребностей людей, находящихся в движении, занятых семей и пассажиров. Доступные в трех заманчивых вкусах — шоколадная крошка, шоколадный арахисовый брауни и белый шоколад с орехом макадамия — CLIF Thins предлагают вкусный и удобный вариант перекуса для тех, кто ведет активный образ жизни

Более подробную информацию об отчете по рынку ореховых и снэковых батончиков в США можно получить здесь – https://www.databridgemarketresearch.com/reports/us-nuts-and-snacks-bar-market