Global Diet And Nutrition Apps Market

Market Size in USD Billion

CAGR :

%

USD

11.35 Billion

USD

41.57 Billion

2024

2032

USD

11.35 Billion

USD

41.57 Billion

2024

2032

| 2025 –2032 | |

| USD 11.35 Billion | |

| USD 41.57 Billion | |

|

|

|

|

Diet and Nutrition Apps Market Size

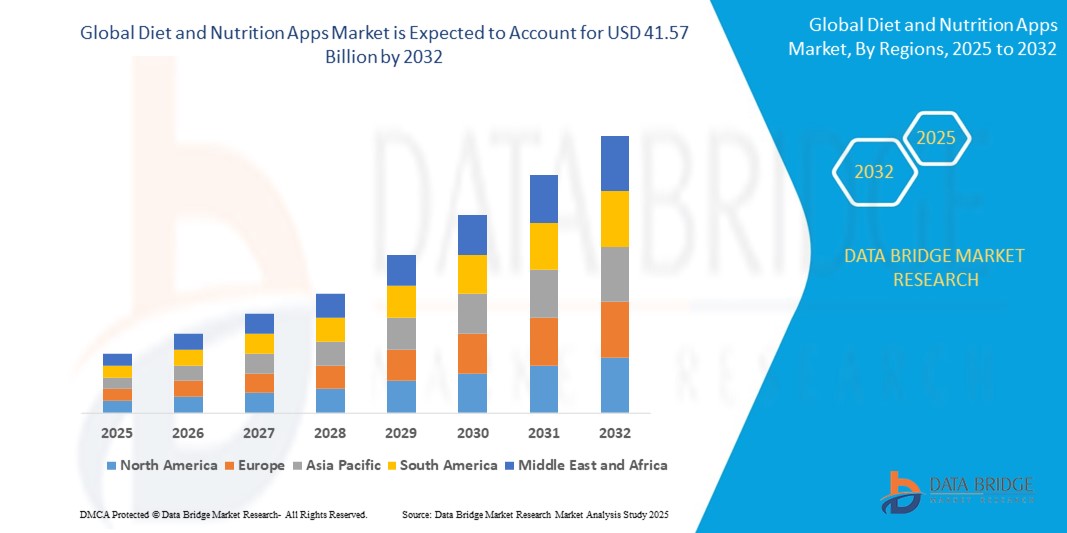

- The global diet and nutrition apps market was valued at USD 11.35 billion in 2024 and is expected to reach USD 41.57 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 17.61% primarily driven by the increasing consumer awareness and demand for personalized health and wellness solutions

- This growth is driven by factors such as the rising prevalence of lifestyle-related diseases, growing smartphone penetration, and increased adoption of digital health platforms

Diet and Nutrition Apps Market Analysis

- The diet and nutrition apps market are currently witnessing strong growth, with apps such as MyFitnessPal surpassing 200 million users globally as of 2024, offering features such as barcode scanning, calorie tracking, and personalized nutrition goals

- Platforms such as Noom, which reported over 45 million downloads, are being widely adopted for their psychology-based approach to weight loss and structured meal planning, making them popular among individuals seeking sustainable health changes

- Real-time syncing with wearable devices such as Fitbit, Garmin, and Apple Watch is becoming a standard feature, allowing users to track food intake, physical activity, heart rate, and sleep patterns all in one ecosystem, enhancing the app's utility and user retention

- Subscription-based models are on the rise, with apps such as Cronometer and Yazio reporting a significant increase in premium subscribers who access customized meal plans, macronutrient analysis, and expert guidance

- For instance, Cronometer reported a 30 percent rise in paid users in 2023 due to growing interest in detailed nutrition tracking

- The market is evolving with cutting-edge innovations such as artificial intelligence and machine learning

- For instance, Lifesum uses AI to generate meal suggestions based on eating habits, and for instance, HealthifyMe features an AI assistant named Ria that offers real-time diet and fitness recommendations to users

Report Scope and Diet and Nutrition Apps Market Segmentation

|

Attributes |

Diet and Nutrition Apps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Diet and Nutrition Apps Market Trends

“Integration of Smart Features”

- The integration of smart features in diet and nutrition apps is enhancing user experience by enabling real-time tracking of calories, macronutrients, and hydration

- For instance, MyFitnessPal allows users to log meals using barcode scanners and photo-based food recognition

- Voice-enabled logging and smart notifications are becoming increasingly popular, helping users maintain consistency in their health routines

- For instance, Lifesum offers reminders for water intake and meal tracking, tailored to user behavior

- Personalization is at the core of this trend, with many apps using data analytics and machine learning to recommend meal plans based on dietary preferences, activity levels, and fitness goals

- For instance, Yazio creates adaptive meal suggestions based on a user's progress

- Integration with wearable devices such as Apple Watch, Fitbit, and Garmin allows users to sync their nutrition data with physical activity, sleep, and heart rate, creating a holistic view of wellness in one app

- Gamification and user-friendly interfaces are being adopted to make smart features more engaging; for instance, HealthifyMe includes daily challenges and progress streaks that motivate users while providing AI-powered insights through its virtual assistant Ria

Diet and Nutrition Apps Market Dynamics

Driver

“Increasing Health Awareness and Preventive Lifestyle Adoption”

- The rising demand for diet and nutrition apps is largely driven by growing awareness around preventive healthcare and maintaining a balanced lifestyle, especially among millennials and Gen Z who prefer digital solutions for health management

- The global surge in lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions has pushed consumers to become more conscious of their eating habits and seek tools to monitor and manage their nutrition

- For instance, MyFitnessPal and Noom have seen consistent growth in downloads and active users, thanks to features such as real-time calorie tracking, meal planning, and integration with wearable devices

- The influence of social media health influencers and online fitness challenges is encouraging more people to adopt diet apps

- For instance, platforms such as Instagram and TikTok are filled with content creators demonstrating how they use apps to achieve fitness goals

- Public health campaigns promoting healthy eating and the accessibility of mobile technology have made it easier for users to track their progress, stay accountable, and take control of their health without relying solely on clinics or professionals

Opportunity

“Expansion into Personalized Nutrition and AI-Powered Recommendations”

- A major opportunity in the diet and nutrition apps market lies in the rise of personalized nutrition services powered by artificial intelligence and machine learning, which allow users to receive tailored recommendations based on their unique body metrics and lifestyle goals

- Modern consumers now expect more than basic calorie counting, and apps are responding by integrating smart features that analyze biometric data, fitness levels, and dietary restrictions to provide real-time, dynamic meal and health suggestions

- For instance, HealthifyMe uses its AI assistant “Ria” to deliver personalized meal plans, suggest local Indian food options, and adapt fitness advice based on user behavior, enhancing engagement and daily usage

- Integration with wearable devices such as Fitbit, Apple Watch, or glucose monitors opens up new possibilities, allowing apps to provide real-time health feedback and track metrics such as heart rate, sleep, or blood sugar for better wellness outcomes

- For instance, Lifesum has integrated with Apple HealthKit and Google Fit to personalize user recommendations by analyzing steps, hydration levels, and workout patterns, turning the app into a holistic wellness partner and opening avenues for partnerships with food brands, gyms, and virtual care platforms

Restraint/Challenge

“Data Privacy and User Trust Concerns”

- One of the biggest challenges in the diet and nutrition apps market is the rising concern around data privacy, as these platforms collect highly sensitive personal information including food habits, fitness routines, and in some cases, medical and biometric details

- If not properly secured, this data is vulnerable to cyber breaches and unauthorized access, which could result in serious consequences for users and erode trust in digital health solutions

- For instance, the health tracking app Strava faced backlash in the past when its global heat map revealed sensitive military base locations, highlighting how location and activity data can be misused if not protected properly

- Not all apps maintain clear privacy policies or user consent mechanisms, and some have been reported to sell anonymized data to advertisers or insurers without full disclosure

- For instance, a report by the Norwegian Consumer Council found that several health apps shared user data with third parties without proper consent

- These concerns, coupled with inconsistent global enforcement of data protection regulations such as the General Data Protection Regulation, create hesitation among new users and threaten retention, making it crucial for developers to ensure strong data governance and user transparency to sustain long-term growth

Diet and Nutrition Apps Market Scope

The market is segmented on the basis of type, products, gender, age, platform, and end-user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Products |

|

|

By Gender |

|

|

By Age |

|

|

By Platform |

|

|

By End-User |

|

Diet and Nutrition Apps Market Regional Analysis

“North America is the Dominant Region in the Diet and Nutrition Apps Market”

- North America is the dominating region in the global diet and nutrition apps market due to its strong digital infrastructure and widespread health awareness among consumers

- The region shows high adoption of fitness and nutrition technology, supported by widespread smartphone usage and a cultural focus on preventive healthcare

- Consumers actively use digital tools to maintain a balanced lifestyle and achieve personalized health goals through features such as calorie tracking, meal planning, and fitness monitoring

- The presence of well-established app developers, innovative health-tech startups, and integrated wellness platforms strengthens the region’s market leadership

- Collaborations between healthcare providers and tech companies have improved the reliability and accessibility of nutrition tracking apps, further solidifying North America’s dominant position in the market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is the fastest-growing region in the diet and nutrition apps market, fueled by rising health awareness and changing lifestyle habits among urban populations

- There is a noticeable increase in digital adoption across the region, especially among younger users who prefer mobile apps for tracking wellness and nutrition

- Cultural shifts toward healthy eating and regular fitness practices are contributing to the popularity of these apps in daily routines

- Many apps are now being customized to align with local dietary patterns, languages, and preferences, enhancing their relevance and usability

- A growing number of local startups and expanding global brands are actively entering the market, making Asia-Pacific a dynamic and rapidly evolving space for diet and nutrition app growth

Diet and Nutrition Apps Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- MyFitnessPal, Inc. (U.S.)

- Noom, Inc (U.S.)

- Lifesum AB (Sweden)

- FitNow, Inc. (U.S.)

- MyNetDiary Inc. (U.S.)

- Innit International SCA (U.S.)

- Kroger (U.S.)

- Fatsecret (Australia)

- Fitocracy (U.S.)

- Wombat Apps LLC (U.S.)

- Syndigo LLC (U.S.)

- foodvisor.io (France)

- Eat This Much Inc. (U.S.)

- asken Inc. (Japan)

- Leaf Group (U.S.)

- Avatar Nutrition LLC. (U.S.)

Latest Developments in Global Diet and Nutrition Apps Market

- In October 2023, MyFitnessPal, Inc. released the Wear OS app. This app development enables seamless integration with Wear OS devices, allowing users to track their physical activities and nutrition directly from their smartwatches. It provides real-time tracking of calories burned, steps taken, and workouts completed, as well as easy access to nutrition data. The benefit is that it enhances user convenience, allowing them to manage their health data on-the-go without needing to access their phone. This development impacts the market by catering to the growing demand for more integrated, wearable fitness solutions and is likely to attract a broader audience, especially those who prefer using wearable technology for health management

- In March 2023, Zoe raised USD 2.5 million from Flight Fund. This development focuses on advancing its personalized nutrition and health platform, which uses microbiome analysis to provide users with tailored dietary advice. The investment aims to enhance Zoe's data-driven approach to nutrition, improving accuracy and customization for individual users. The benefit is that it allows Zoe to offer more personalized and scientifically-backed insights into diet and health, empowering users to make better decisions based on their unique biology. This move impacts the market by pushing the boundaries of personalized nutrition, creating a stronger competitive edge in the rapidly growing health tech space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Diet And Nutrition Apps Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Diet And Nutrition Apps Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Diet And Nutrition Apps Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.