North America Bioinformatics Market

Market Size in USD Billion

CAGR :

%

| 2015 –0 | |

|

|

|

|

|

|

|

Supply Chain Ecosystem Analysis now part of DBMR Reports

Market Size in USD Billion

| 2015 –0 | |

|

|

|

|

|

|

|

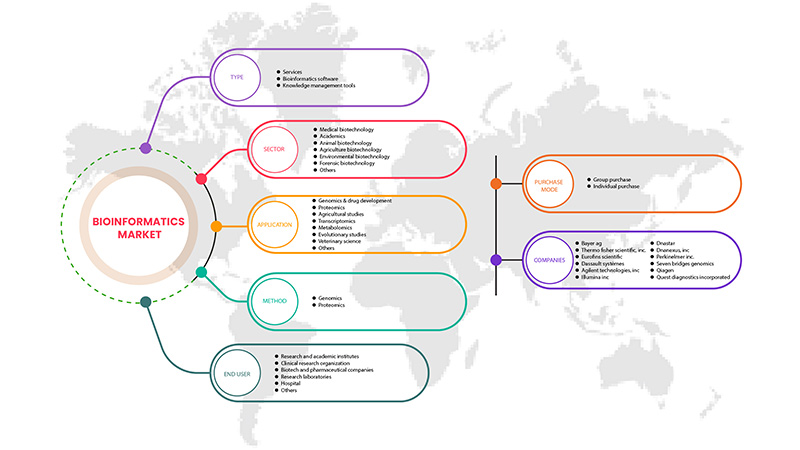

North America Bioinformatics Market, By Type (Knowledge Management Tools, Bioinformatics Software and Services), Sector (Medical Biotechnology, Academics, Animal Biotechnology, Agricultural Biotechnology, Environmental Biotechnology, Forensic Biotechnology and Others), Application (Genomics & Drug Development, Proteomics, Evolutionary Studies, Agricultural Studies, Veterinary Science, Metabolomics, Transcriptomics and Others), Purchase Mode (Group Purchase and Individual Purchase), Method (Genomics and Proteomics) End-User, (Research and Academic Institutes, Clinical Research Organization, Biotech and Pharmaceutical Companies, Research Laboratories, Hospital and Others) - Industry Trends and Forecast to 2029.

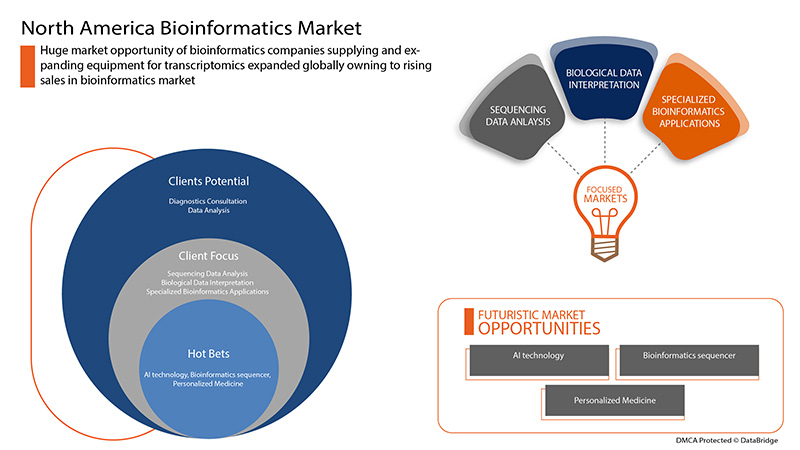

The drivers responsible for the growth of the bioinformatics market are the less cost of genetic sequencing per base, growing need for bioinformatics, wide product portfolio offered by major market players and use of bioinformatics in personalized medicine and increased public-private sector funding for bioinformatics. However, factors expected to restrain the market growth are the rise in the cost of instrumentation, difficulty in clinical bioinformatics analysis and cyber security in bioinformatics.

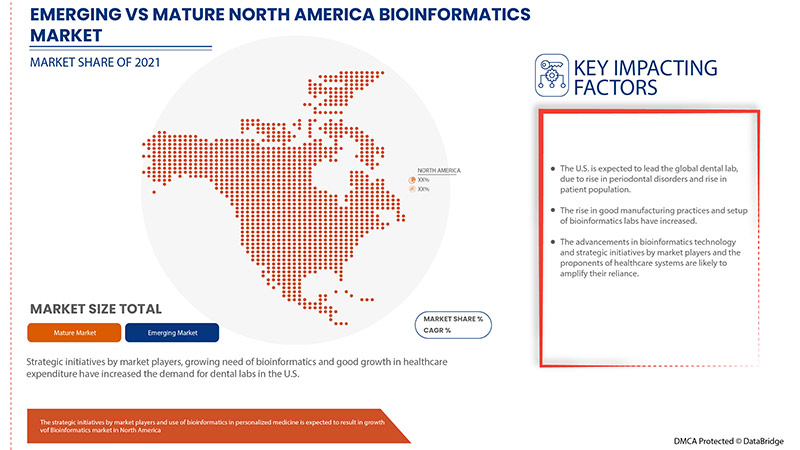

On the other hand, strategic initiatives by market players, product development, advancements in bioinformatics technology and a rise in healthcare expenditure may act as an opportunity for the growth of the bioinformatics market. However, the need for skilled expertise, challenges in implementing bioinformatics technology in clinical laboratories and regulatory approval may create challenges for the bioinformatics market. There are recent developments related to the worldwide bioinformatics market.

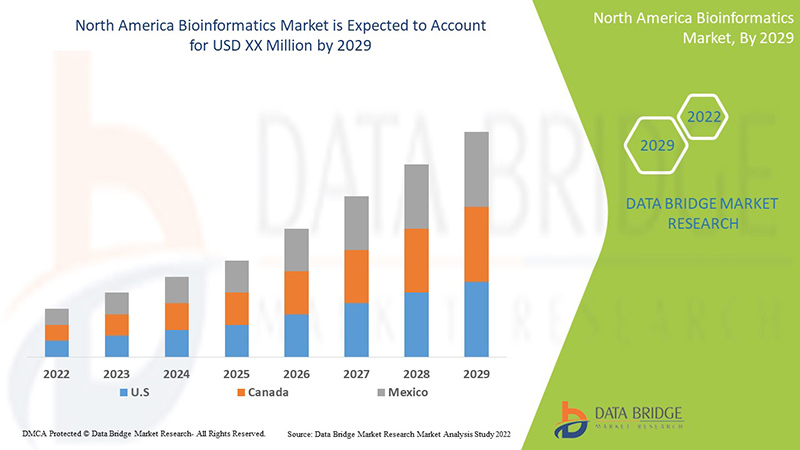

The rising demand for use of bioinformatics in drug development and design is expected to drive the market growth in North America. Data Bridge Market Research analyzes that the North America Bioinformatics market will grow at a CAGR of 21.8% during the forecast period of 2022 to 2029.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million, Pricing in USD

|

|

Segments Covered

|

By Type (Knowledge Management Tools, Bioinformatics Software and Services), Sector (Medical Biotechnology, Academics, Animal Biotechnology, Agricultural Biotechnology, Environmental Biotechnology, Forensic Biotechnology and Others), Application (Genomics & Drug Development, Proteomics, Evolutionary Studies, Agricultural Studies, Veterinary Science, Metabolomics, Transcriptomics and Others), Purchase Mode (Group Purchase and Individual Purchase), Method (Genomics and Proteomics) End-User, (Research and Academic Institutes, Clinical Research Organization, Biotech and Pharmaceutical Companies, Research Laboratories, Hospital and Others)

|

|

Countries Covered

|

The U.S., Canada, and Mexico

|

|

Market Players Covered

|

Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Water Corporation, Partek Incorporated, DNASTAR, Dassault Systèmes, Bayer AG, DNANEXUS, INC., PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam, GenoFAB, Inc. Among others

|

Market Definition

Bioinformatics combines computer programming, big data, and Molecular Biology, which enables scientists to understand and identify patterns in biological data. It is particularly useful in studying genomes and DNA sequencing, as it allows scientists to organize large amounts of data.

From genetics to toxicology to mycology and radiobiology, there are scores of branches of Biology to specialize in. And out of the many, Bioinformatics is one of the intriguing fields which enables you to identify, evaluate, store, and retrieve biological information. Being an interdisciplinary field of study, it incorporates various applications of Computer Science, Statistics, and Biology to develop software applications for understanding biological data like DNA sequencing, protein analysis, evolutionary genetics, etc.

In the coming future, important decisions related to bioinformatics on drug discovery will be made by individuals who not only understand the biology but can also use the bioinformatics tools and the knowledge they release to develop hypotheses and identify quality targets

Drivers

Oral health is one of the most important aspects of maintaining the health of gums, teeth and the oral-facial system, which allows for speaking, chewing and smiling. According to World Health Organization's report on March 25th, 2020, around 2.3 billion people worldwide are suffering from caries of a permanent tooth, among which around 530 million children suffer from caries of the primary tooth. In North America, periodontal disease has a high prevalence among all age groups. Thereby due to rising periodontal dental disorders, the availability and usage of intraoral scanners are anticipated to boost the market's growth.

As genomics-focused pharmacology continues to play a greater role in the treatment of various chronic diseases, especially cancer, next-generation sequencing (NGS) is evolving as a powerful tool for providing a deeper and more precise insight into the molecular underpinnings of individual tumors and specific receptors. Informatics is essential in biological research involving biologists who learn programming, computer programmers, mathematicians, or database managers who learn the foundations of biology.

Opportunities

The growth curve for bioinformatics market clinical applications is following an upward trend as established applications are gaining momentum and new ones are finding a foothold. Product development in the past years has helped the market size to grow. This also shows the support of the regulatory agency for allowing these products in the market.

For instance-

The product development in recent years has shown the potential of these technologies and the companies working in this market are trying to get the more advanced product in the market, which is expected to create a lucrative opportunity for market growth in the forecast period.

The demand for bioinformatics is increasing in the market owing to the increased levels of research and development along with the growth of the bioinformatics services market aided by the desire for innovative medications. Thus, the top market players have implemented a new strategy by developing new products and collaborating with other market players to improve business operations and profitability.

For instance-

These strategic initiatives by the market players, including acquisition, conferences and focused segment product launches, are helping them grow and improve the company's product portfolio, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players may be expected to as an opportunity that is expected to drive market growth.

Restraints/Challenges

The largely untapped potential of big data analytics is a feed buzz that has been exacerbated by the production of many next-generation data sets that seek to answer long-standing questions about the biology of human diseases. Although these approaches are likely to be a powerful means of unveiling new biological insights, several significant challenges currently hinder efforts to harness the power of big data. Typical challenges include the effective assessment of analytical software tools, the speeding up of the overall process using hybrid parallel computing (HPC) parallelization and acceleration technology, the advancement of automation strategies, data storage alternatives, and, finally, the development of new methods for the full utilization of results across multiple experimental conditions.

Bioinformatics technologies can perform massively complicated biological data analysis. This capacity simultaneously facilitates the computational tools for the organization and analysis of biological data, which helps improve diagnostic screening. The application of these powerful technologies in a clinical laboratory poses a challenge because of the data's scope, quantity and medico-technical consequences.

Various challenges of implementing next-generation sequencing in the clinical laboratory are as follows-

During the pandemic, the North Bioinformatics sector is one that focuses on using a combination of biology and information technology. At the heart of the industry is biological data, which is analyzed and transformed using IT techniques. Bioinformatics has always had huge potential in providing essential support to many areas of scientific research. The tools that Bioinformatics can provide allow scientists to get to grips with larger data sets and to mine and analyze them to discover crucial information that could lead to key discoveries. Genetics and genomes have been the primary focus of Bioinformatics in recent years, including comparative genomics, DNA microarrays, and functional genomics.

Recent Developments

North America bioinformatics market is segmented on the basis of six segments: type, sector, application, purchase mode, genomics, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

On the basis of type, the North America bioinformatics market is segmented into knowledge management tools, bioinformatics software, and services.

Sector

On the basis of sector, the North America bioinformatics market is segmented into medical biotechnology, academics, animal biotechnology, agricultural biotechnology, environmental biotechnology, forensic biotechnology, and others.

Application

On the basis of application, the North America bioinformatics market is segmented into genomics and drug development, proteomics, evolutionary studies, agricultural studies, veterinary science, metabolomics, transcriptomics, and others.

Purchase Mode

On the basis of purchase mode, the North America bioinformatics market is segmented into group purchases and individual purchases.

Method

On the basis of method, the North America bioinformatics market is segmented into genomics and proteomics.

End User

On the basis of end-user, the North America Bioinformatics market is segmented into research and academic institutes, clinical research organizations, biotech and pharmaceutical companies, research laboratories, hospitals, and others.

Pipeline Analysis

North America bioinformatics market is analyzed, and market size insights and trends are provided by regions, type, sector, application, purchase mode, genomics, and end-user. as referenced above.

The countries covered in the North America bioinformatics market report are the U.S., Canada, and New Mexico. The U.S. is expected to dominate the market due to a rise in the incidence of periodontal diseases, a rise in medical tourism, a growth of technological innovations in bioinformatics, and a rise in research and development activity.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands impact on sales channels are considered while providing forecast analysis of the country data.

North America bioinformatics market competitive landscape provides details on the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, the North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the North America Bioinformatics market.

Some of the major players operating in the North America Bioinformatics market are Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Water Corporation, Partek Incorporated, DNASTAR, Dassault Systèmes, Bayer AG, DNANEXUS, INC., PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam, GenoFAB, Inc. among others.

SKU-

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA BIOINFORMATICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 TYPE SEGMENT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 THE CATEGORY VS TIME GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 REGULATIONS OF THE NORTH AMERICA BIOINFORMATICS MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 DECREASE IN THE COST OF GENETIC SEQUENCING PER BASE

6.1.2 GROWING NEED FOR BIOINFORMATICS

6.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY MAJOR PLAYERS

6.1.4 USE OF BIOINFORMATICS IN PERSONALIZED MEDICINE

6.1.5 INCREASING PUBLIC-PRIVATE SECTOR FUNDING FOR BIOINFORMATICS

6.2 RESTRAINTS

6.2.1 HIGH COST OF INSTRUMENTATION

6.2.2 DIFFICULTY IN CLINICAL BIOINFORMATICS ANALYSIS

6.2.3 CYBER SECURITY CONCERNS IN BIOINFORMATICS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

6.3.2 PRODUCT DEVELOPMENT IN RECENT YEARS

6.3.3 ADVANCEMENT IN BIOINFORMATICS TECHNOLOGY

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM BIOINFORMATICS TECHNOLOGY

6.4.2 CHALLENGES TO IMPLEMENTING BIOINFORMATICS TECHNOLOGY IN THE CLINICAL LABS

7 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 SERVICES

7.2.1 DIAGNOSTICS CONSULTATION

7.2.2 DATA ANALYSIS

7.2.2.1 STRUCTURAL

7.2.2.2 FUNCTIONAL

7.3 BIOINFORMATICS SOFTWARE

7.3.1 INFORMATICS INFRASTRUCTURE AND PIPELINE SETUP

7.3.2 SAMPLE AND EXPERIMENT MANAGEMENT

7.3.3 SEQUENCING DATA ANALYSIS

7.3.3.1 SEQUENCE ANALYSIS PLATFORM

7.3.3.2 SEQUENCE ALIGNMENT PLATFORM

7.3.3.3 SEQUENCE MANIPULATION PLATFORM

7.3.3.4 STRUCTURAL ANALYSIS PLATFORM

7.3.3.5 OTHERS

7.3.4 BIOLOGICAL DATA INTERPRETATION

7.3.5 SPECIALIZED BIOINFORMATICS APPLICATIONS

7.3.5.1 SINGLE CELL GENE EXPRESSION

7.3.5.2 GENE EXPRESSION

7.3.5.3 VARIANT DETECTION

7.3.5.4 CNV ANALYSIS

7.3.5.5 METAGENOMICS

7.3.5.6 METHYLATION

7.3.5.7 CHIP-SEQ

7.3.5.8 NON-CODING RNA EXPRESSION

7.3.5.9 OTHERS

7.3.6 OTHERS

7.4 KNOWLEDGE MANAGEMENT TOOLS

7.4.1 GENERALIZED KNOWLEDGE MANAGEMENT TOOLS

7.4.2 SPECIALIZED KNOWLEDGE MANAGEMENT TOOLS

8 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR

8.1 OVERVIEW

8.2 MEDICAL BIOTECHNOLOGY

8.3 ACADEMICS

8.4 ANIMAL BIOTECHNOLOGY

8.5 AGRICULTURAL BIOTECHNOLOGY

8.6 ENVIRONMENTAL BIOTECHNOLOGY

8.7 FORENSIC BIOTECHNOLOGY

8.8 OTHERS

9 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENOMICS & DRUG DEVELOPMENT

9.2.1 SERVICES

9.2.2 SEQUENCING PLATFORMS

9.2.3 KNOWLEDGE MANAGEMENT TOOLS

9.2.4 GENOMICS & DRUG DEVELOPMENT BY TYPE

9.2.4.1 PREVENTIVE MEDICINE

9.2.4.2 MOLECULAR MEDICINE

9.2.4.3 PERSONALIZED MEDICINE

9.2.4.4 CHEMOINFORMATICS AND DRUG DESIGN

9.2.4.5 ANTIBIOTIC RESISTANCE

9.3 PROTEOMICS

9.3.1 SERVICES

9.3.2 SERVICES SEQUENCING PLATFORMS

9.3.3 KNOWLEDGE MANAGEMENT TOOLS

9.4 AGRICULTURAL STUDIES

9.4.1 SERVICES

9.4.2 SERVICES SEQUENCING PLATFORMS

9.4.3 KNOWLEDGE MANAGEMENT TOOLS

9.5 TRANSCRIPTOMICS

9.5.1 SERVICES

9.5.2 SERVICES SEQUENCING PLATFORMS

9.5.3 KNOWLEDGE MANAGEMENT TOOLS

9.6 METABOLOMICS

9.6.1 SERVICES

9.6.2 SERVICES SEQUENCING PLATFORMS

9.6.3 KNOWLEDGE MANAGEMENT TOOLS

9.7 EVOLUTIONARY STUDIES

9.7.1 SERVICES

9.7.2 SERVICES SEQUENCING PLATFORMS

9.7.3 KNOWLEDGE MANAGEMENT TOOLS

9.8 VETERINARY SCIENCE

9.8.1 SERVICES

9.8.2 SERVICES SEQUENCING PLATFORMS

9.8.3 KNOWLEDGE MANAGEMENT TOOLS

9.9 OTHERS

9.9.1 SERVICES

9.9.2 SERVICES SEQUENCING PLATFORMS

9.9.3 KNOWLEDGE MANAGEMENT TOOLS

10 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE

10.1 OVERVIEW

10.2 GROUP PURCHASE

10.3 INDIVIDUAL PURCHASE

11 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD

11.1 OVERVIEW

11.2 GENOMICS

11.2.1 DNA

11.2.2 RNA

11.3 PROTEOMICS

12 NORTH AMERICA BIOINFORMATICS MARKET, BY END USER

12.1 OVERVIEW

12.2 RESEARCH AND ACADEMIC INSTITUTES

12.3 CLINICAL RESEARCH ORGANIZATION

12.4 BIOTECH AND PHARMACEUTICAL COMPANIES

12.5 RESEARCH LABORATORIES

12.6 HOSPITALS

12.7 OTHERS

13 NORTH AMERICA BIOINFORMATICS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA BIOINFORMATICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BAYER AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 EUROFINS SCIENTIFIC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 DASSAULT SYSTÈMES

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 AGILENT TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASTRIDBIO TECHNOLOGIES INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BGI (A SUBSIDIARY OF BGI GROUP)

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BIOBAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 DNANEXUS INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DNASTAR

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENOFAB, INC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 ILLUMINA, INC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 PARTEK INCORPORATED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 PERKINELMER INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 QIAGEN

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 QUEST DIAGNOSTICS INCORPORATED (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SEVEN BRIDGES GENOMICS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SOPHIA GENETICS

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 STRAND LIFE SCIENCES

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 WATERS CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

TABLE 1 BIOINFORMATICSCOST PER SAMPLE

TABLE 2 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MEDICAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ACADEMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ANIMAL TECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA AGRICULTURAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ENVIRONMENTAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FORENSIC BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA GROUP PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA INDIVIDUAL PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA RESEARCH AND ACADEMIC INSTITUTES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CLINICAL RESEARCH ORGANIZATION IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA BIOTECH AND PHARMACEUTICAL COMPANIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA RESEARCH LABORATORIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HOSPITALS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BIOINFORMATICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA. BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 U.S. BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 83 U.S. BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.S. GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 U.S. GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 U.S. PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 U.S. AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 U.S. METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 U.S. EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 U.S. VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 U.S. OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 U.S. BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 94 U.S. BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 95 U.S GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 96 U.S. BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 97 CANADA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 CANADA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 CANADA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 105 CANADA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 CANADA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 CANADA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 CANADA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 CANADA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 CANADA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 CANADA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 CANADA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 CANADA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 CANADA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 CANADA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 116 CANADA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 117 CANADA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 118 CANADA BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 MEXICO BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 127 MEXICO BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 MEXICO GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 MEXICO GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 MEXICO PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 MEXICO AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 MEXICO TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 MEXICO METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 MEXICO EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 MEXICO VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 MEXICO OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 MEXICO BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 139 MEXICO GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 140 MEXICO BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

FIGURE 1 NORTH AMERICA BIOINFORMATICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BIOINFORMATICS MARKET: GEOGRAPHIC SCOPE

FIGURE 3 NORTH AMERICA BIOINFORMATICS MARKET: DATA TRIANGULATION

FIGURE 4 NORTH AMERICA BIOINFORMATICS MARKET: SNAPSHOT

FIGURE 5 NORTH AMERICA BIOINFORMATICS MARKET: BOTTOM-UP APPROACH

FIGURE 6 NORTH AMERICA BIOINFORMATICS MARKET: TOP-DOWN APPROACH

FIGURE 7 NORTH AMERICA BIOINFORMATICS MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 NORTH AMERICA BIOINFORMATICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA BIOINFORMATICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BIOINFORMATICS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA BIOINFORMATICS MARKET: THE CATEGORY VS TIME GRID

FIGURE 12 NORTH AMERICA BIOINFORMATICS MARKET SEGMENTATION

FIGURE 13 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA DENTAL LABMARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 GROWING APPLICATIONS OF BIOINFORMATICS AND LOW COST OF BIOINFORMATICS SEQUENCING ARE EXPECTED TO DRIVE THE MARKET FOR NORTH AMERICA BIOINFORMATICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SERVICES SEGMENT ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BIOINFORMATICS MARKET IN 2019 & 2026

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BIOINFORMATICS MARKET

FIGURE 17 DECREASE IN COST OF PER BASE SEQUENCING

FIGURE 18 GROWING NEED FOR BIOINFORMATICS IN VITAL APPLICATIONS

FIGURE 19 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, 2021

FIGURE 24 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, LIFELINE CURVE

FIGURE 27 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, 2021

FIGURE 28 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, 2021

FIGURE 32 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, 2021

FIGURE 36 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, LIFELINE CURVE

FIGURE 39 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, 2021

FIGURE 40 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 41 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 42 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 43 NORTH AMERICA BIOINFORMATICS MARKET: SNAPSHOT (2021)

FIGURE 44 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2021)

FIGURE 45 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE (2022-2029)

FIGURE 48 NORTH AMERICA BIOINFORMATICS MARKET: COMPANY SHARE 2021 (%)

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.